Answered step by step

Verified Expert Solution

Question

1 Approved Answer

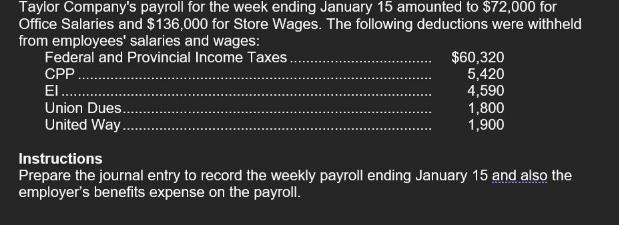

Taylor Company's payroll for the week ending January 15 amounted to $72,000 for Office Salaries and $136,000 for Store Wages. The following deductions were

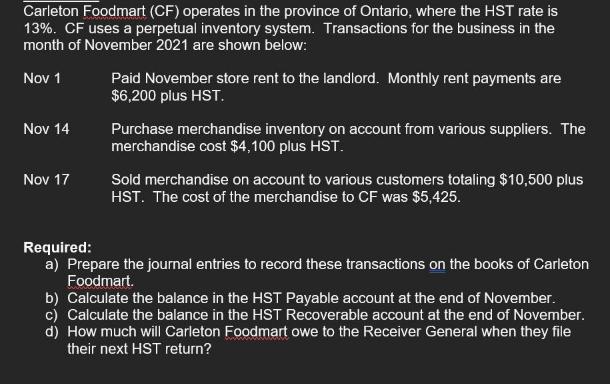

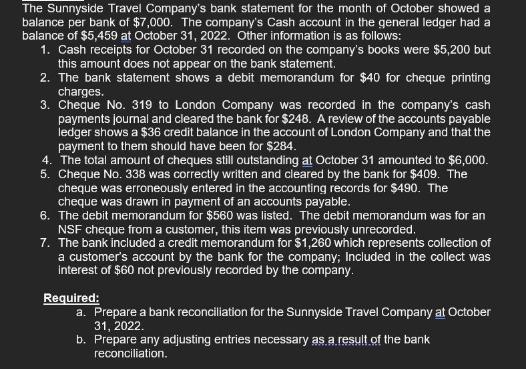

Taylor Company's payroll for the week ending January 15 amounted to $72,000 for Office Salaries and $136,000 for Store Wages. The following deductions were withheld from employees' salaries and wages: Federal and Provincial Income Taxes. CPP . Union Dues. United Way.. $60,320 5,420 4,590 1,800 1,900 Instructions Prepare the journal entry to record the weekly payroll ending January 15 and also the employer's benefits expense on the payroll. Carleton Foodmart (CF) operates in the province of Ontario, where the HST rate is 13%. CF uses a perpetual inventory system. Transactions for the business in the month of November 2021 are shown below: Nov 1 Nov 14 Nov 17 Paid November store rent to the landlord. Monthly rent payments are $6,200 plus HST. Purchase merchandise inventory on account from various suppliers. The merchandise cost $4,100 plus HST. Sold merchandise on account to various customers totaling $10,500 plus HST. The cost of the merchandise to CF was $5,425. Required: a) Prepare the journal entries to record these transactions on the books of Carleton Foodmart. b) Calculate the balance in the HST Payable account at the end of November. c) Calculate the balance in the HST Recoverable account at the end of November. d) How much will Carleton Foodmart owe to the Receiver General when they file their next HST return? The Sunnyside Travel Company's bank statement for the month of October showed a balance per bank of $7,000. The company's Cash account in the general ledger had a balance of $5,459 at October 31, 2022. Other information is as follows: 1. Cash receipts for October 31 recorded on the company's books were $5,200 but this amount does not appear on the bank statement. 2. The bank statement shows a debit memorandum for $40 for cheque printing charges. 3. Cheque No. 319 to London Company was recorded in the company's cash payments journal and cleared the bank for $248. A review of the accounts payable ledger shows a $36 credit balance in the account of London Company and that the payment to them should have been for $284. 4. The total amount of cheques still outstanding at October 31 amounted to $6,000. 5. Cheque No. 338 was correctly written and cleared by the bank for $409. The cheque was erroneously entered in the accounting records for $490. The cheque was drawn in payment of an accounts payable. 6. The debit memorandum for $560 was listed. The debit memorandum was for an NSF cheque from a customer, this item was previously unrecorded. 7. The bank included a credit memorandum for $1,260 which represents collection of a customer's account by the bank for the company; Included in the collect was interest of $60 not previously recorded by the company. Required: a. Prepare a bank reconciliation for the Sunnyside Travel Company at October 31, 2022. b. Prepare any adjusting entries necessary as a result of the bank reconciliation.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries and Calculations Taylor Company Payroll Journal Entry 1 Debit Office Salaries Expens...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started