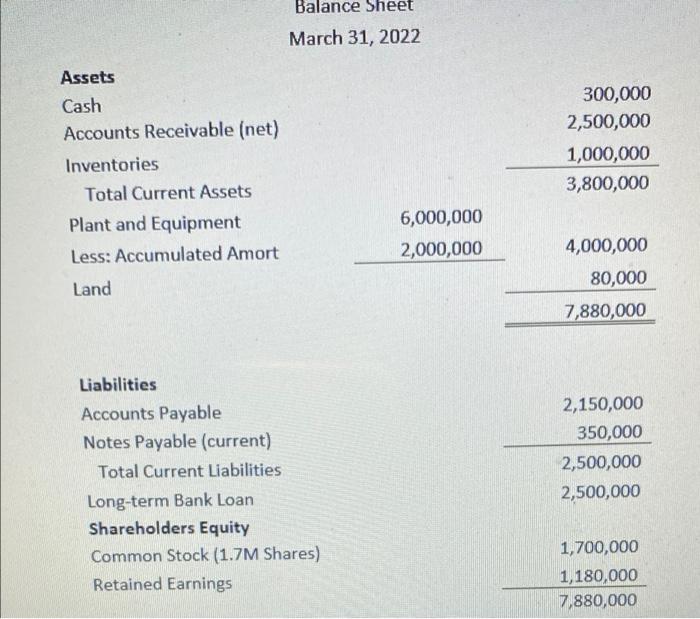

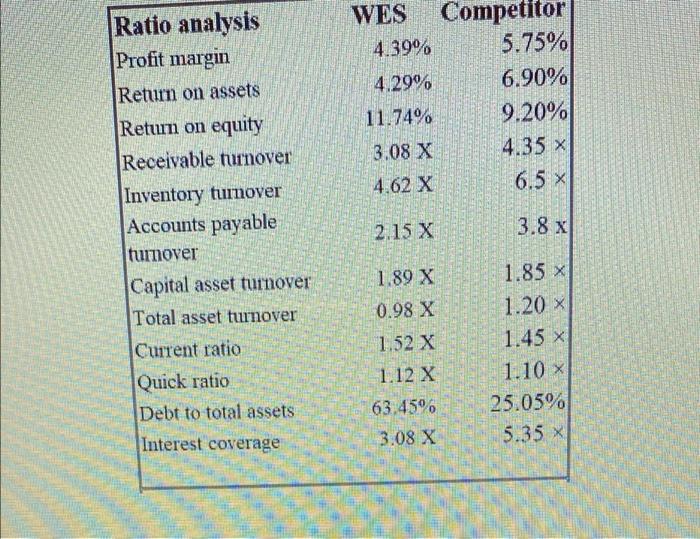

Taylor has always waited until the vendors start calling the company before making any payments. Actually, the vendors usually call several times before a payment is made and sometimes WES are charged interest Taylor explains that WES has never taken advantage of the 1% discount that all their suppliers offer if they pay on day 10, as cash has been tight. In the windmill industry, the invoices are usually 1/10 net 45. Now, that WES is looking at consolidating the short-term debt based on your recommended financing decision, it plans to get back on track" and pay all their vendors on day 45 Advise Taylor on their approach to Accounts Payable discount, and if they should take advantage of the discount or not. Balance Sheet March 31, 2022 Assets Cash Accounts Receivable (net) Inventories Total Current Assets Plant and Equipment Less: Accumulated Amort Land 300,000 2,500,000 1,000,000 3,800,000 6,000,000 2,000,000 4,000,000 80,000 7,880,000 Liabilities Accounts Payable Notes Payable (current) Total Current Liabilities Long-term Bank Loan Shareholders Equity Common Stock (1.7M Shares) Retained Earnings 2,150,000 350,000 2,500,000 2,500,000 1,700,000 1,180,000 7,880,000 WES 4.39% 4.29% 11.74% 3.08 X 4.62 X Competitor 5.75% 6.90% 9.20% 4.35 x 6.5 x Ratio analysis Profit margin Return on assets Return on equity Receivable turnover Inventory turnover Accounts payable turnover Capital asset turnover Total asset turnover Current ratio Quick ratio Debt to total assets 2.15 X 3.8 x 1.89 X 0.98 X 1.52 x 1.12 X 1.85 x 1.20 x 1.45 x 1.10 x 25.05% 5.35 x 63.45 3:08 X Interest coverage Since your last communication Taylor, has been busy meeting with the several banks. WES is looking to consolidate all the existing short-term debt plus some additional funds to ensure smooth operations over the next quarter. The lending arrangements that were discussed WES would have a loan of $3.0 million and pay $270,000 in interest. All the loans look similar to Taylor, and Taylor provides you with the information below. Taylor is looking for your advice on which one is best Option 1: A discounted interest loan, paid back in 270 days Option 2. A simple interest loan, paid back in 270 days