Question

Taylor Swift Corporation sells unique T-Swift merch for swifties. Taylor Swift Corporation has income and expenses for its current fiscal year with a calendar year

Taylor Swift Corporation sells unique T-Swift merch for swifties. Taylor Swift Corporation has income and expenses for its current fiscal year with a calendar year end December 31, 2022, recorded under GAAP, as shown in the following schedule. In addition, a review of Taylor Swifts books and records reveals the following information:

- Taylor Swift expensed, for book purposes, meals totaling $30,000 and entertainment totaling $50,000. Further detail shows that $20,000 of the meals were provided by a restaurant and the remaining $10,000 were not provided by a restaurant. These costs were incurred by Taylor Swifts sales personnel, are reasonable in amount, and are documented in company records.

- During January of the current year, Taylor Swift was sued by one of its employees because of a work-related accident. The suit has not yet gone to court. However, Taylor Swifts auditors required the company to record a contingent liability (and related book expense) for $60,000, reflecting the companys likely liability from the suit.

- Taylor Swift recorded federal income tax expense for book purposes of $80,000.

- Taylor Swift used the reserve method for calculating bad debt expenses for book purposes. Its book income statement reflects bad debt expense of $25,000, calculated as 2% of net sales revenue. Actual write-offs of accounts receivable during the year totaled $18,000.

- MACRS depreciation for the year totals $90,000.

- Taylor Swift received dividend income of $20,000 from Lana Del Rey Corporation, of which they own 10%. They also received dividend income of $100,000 from Phoebe Bridgers Corporation, of which they own 70%.

- Corporate tax rate is 21% and the company made no estimated tax payments.

- Taylor Swift Corporation uses the accrual method of accounting.

- There are over 100 shareholders that all own equal parts and have been the shareholders since December 13, 1989.

Prepare the following schedules:

Schedule 1120 (pages 1-6)

Schedule C

Schedule K

Schedule M-1

Schedule 4562

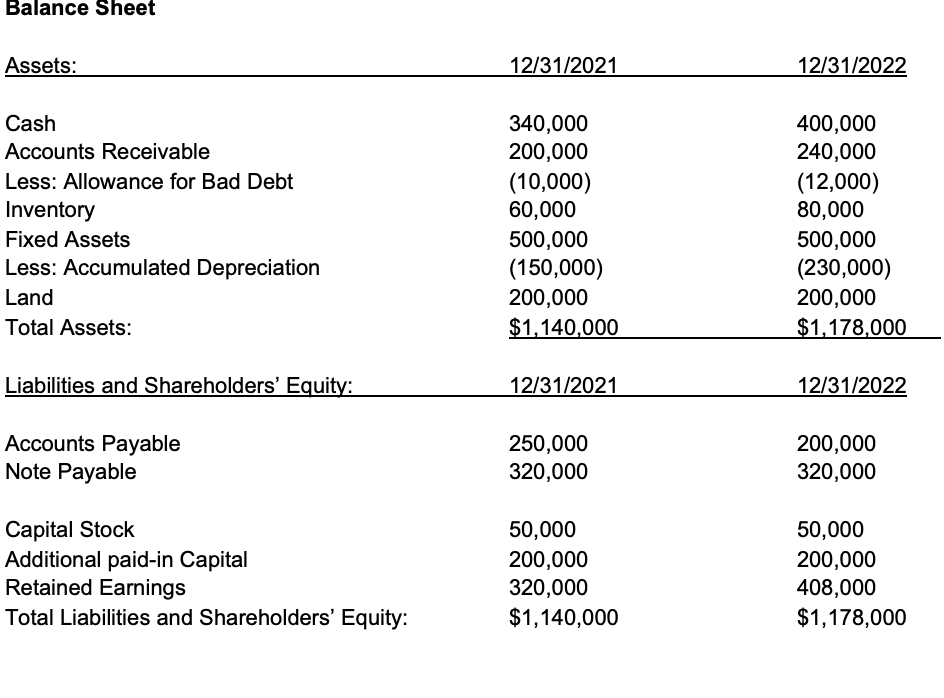

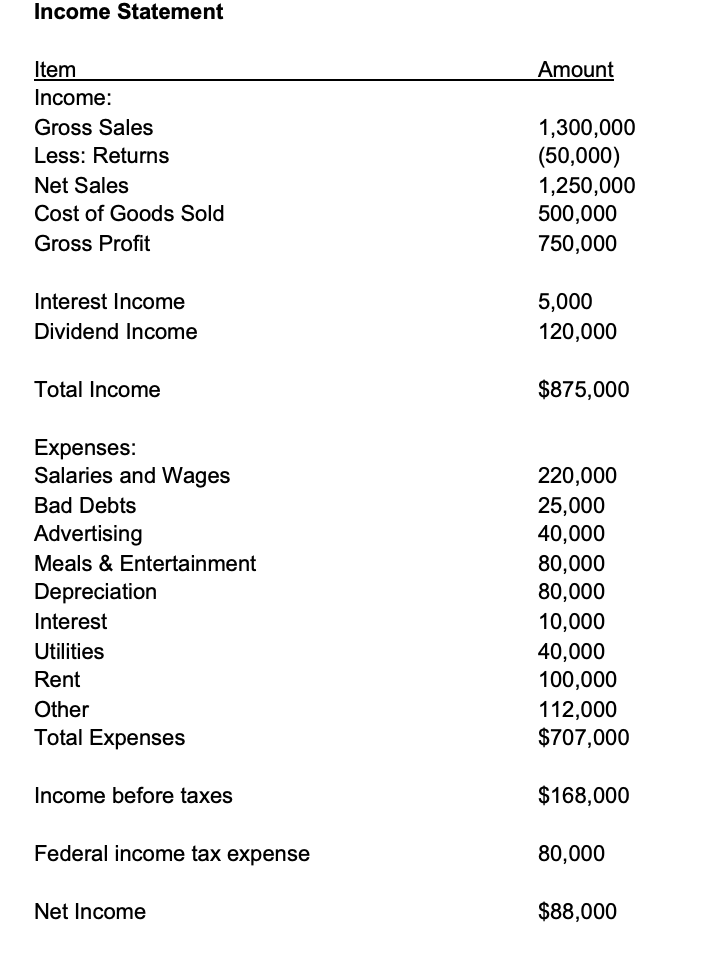

Balance Sheet Assets: 12/31/2021 12/31/2022 Cash Accounts Receivable Less: Allowance for Bad Debt Inventory Fixed Assets Less: Accumulated Depreciation Land Total Assets: \begin{tabular}{ll} 340,000 & 400,000 \\ 200,000 & 240,000 \\ (10,000) & (12,000) \\ 60,000 & 80,000 \\ 500,000 & 500,000 \\ (150,000) & (230,000) \\ 200,000 & 200,000 \\ $1,140,000 & $1,178,000 \\ \hline \end{tabular} Liabilities and Shareholders' Equity: 12/31/2021 12/31/2022 Accounts Payable Note Payable 250,000320,000200,000320,000 Capital Stock 50,000 Additional paid-in Capital Retained Earnings 50,000 200,000 320,000 $1,140,000 200,000 Total Liabilities and Shareholders' Equity: $1,140,000$1,178,000 Income Statement Item Amount Income: Gross Sales 1,300,000 Less: Returns (50,000) Net Sales 1,250,000 Cost of Goods Sold 500,000 Gross Profit 750,000 Interest Income 5,000 Dividend Income 120,000 Total Income $875,000 Expenses: Salaries and Wages 220,000 Bad Debts 25,000 Advertising 40,000 Meals \& Entertainment 80,000 Depreciation 80,000 Interest 10,000 Utilities 40,000 Rent 100,000 Other 112,000 Total Expenses $707,000 Income before taxes $168,000 Federal income tax expense 80,000 Net Income $88,000 Balance Sheet Assets: 12/31/2021 12/31/2022 Cash Accounts Receivable Less: Allowance for Bad Debt Inventory Fixed Assets Less: Accumulated Depreciation Land Total Assets: \begin{tabular}{ll} 340,000 & 400,000 \\ 200,000 & 240,000 \\ (10,000) & (12,000) \\ 60,000 & 80,000 \\ 500,000 & 500,000 \\ (150,000) & (230,000) \\ 200,000 & 200,000 \\ $1,140,000 & $1,178,000 \\ \hline \end{tabular} Liabilities and Shareholders' Equity: 12/31/2021 12/31/2022 Accounts Payable Note Payable 250,000320,000200,000320,000 Capital Stock 50,000 Additional paid-in Capital Retained Earnings 50,000 200,000 320,000 $1,140,000 200,000 Total Liabilities and Shareholders' Equity: $1,140,000$1,178,000 Income Statement Item Amount Income: Gross Sales 1,300,000 Less: Returns (50,000) Net Sales 1,250,000 Cost of Goods Sold 500,000 Gross Profit 750,000 Interest Income 5,000 Dividend Income 120,000 Total Income $875,000 Expenses: Salaries and Wages 220,000 Bad Debts 25,000 Advertising 40,000 Meals \& Entertainment 80,000 Depreciation 80,000 Interest 10,000 Utilities 40,000 Rent 100,000 Other 112,000 Total Expenses $707,000 Income before taxes $168,000 Federal income tax expense 80,000 Net Income $88,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started