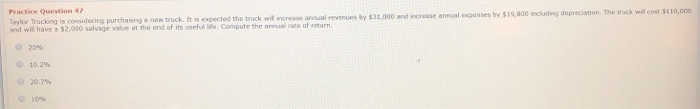

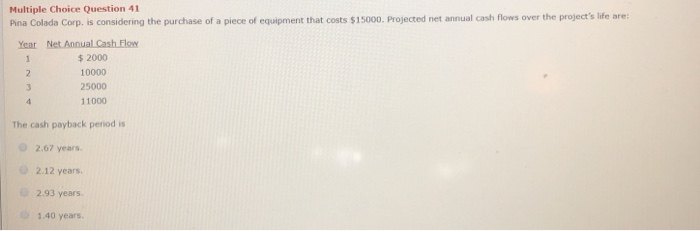

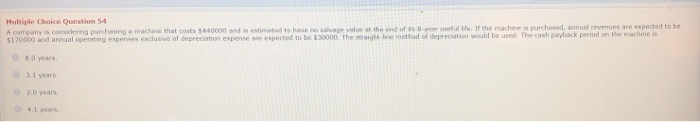

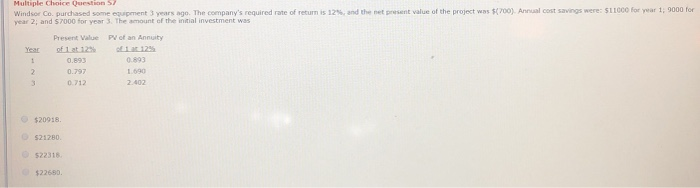

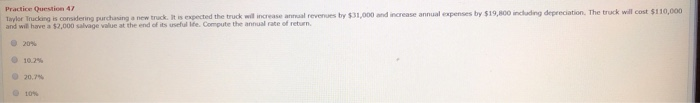

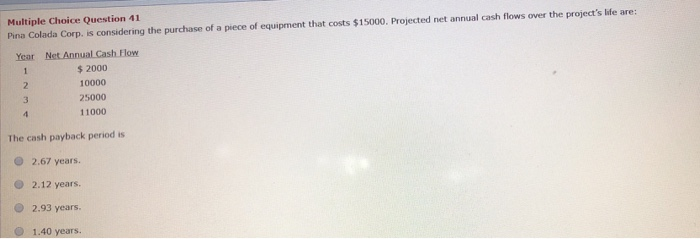

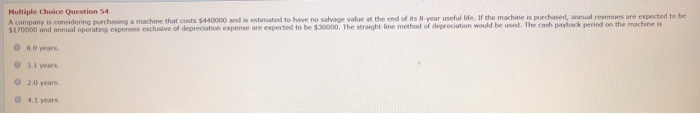

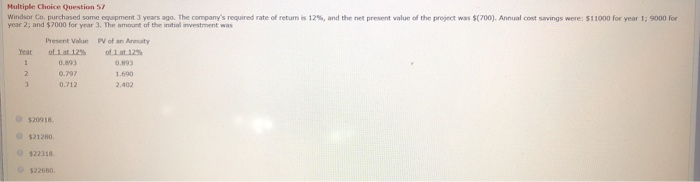

Taylor Trucking is considerirg purchasing a new truck. It is expected the truck wil increase anoual revenues by $31,000 and increase anual expenses by $19,800 includng depreciation. The track will cost $110,000 and will havea $2,000 salvage value at the end of ts useful e. Compute the annual rate of return Practice Quaestion 47 20% 10.2% O20.7% O10% Multiple Choice Question 41 Pina Colada Corp. is considering the purchase of a piece of equipment that costs $15000. Projected net annual cash flows over the project's life are: Year Net Annual Cash Flow $ 2000 10000 7 25000 3 11000 4 The cash payback period is 2.67 years 2.12 years 2.93 years 1.40 years Multiple Choice Question 54 purchased, aonual revenues are expected to be A company is considening parchasing machine that costs $440000 nd is estimated to have no salvage vnloe at the end of as -yesr sneful Me. 1f the $170000 and annual operabng experses exclusive of depreciation expense are expected to be $30000 The straight-ine method of depreciation would be used. The cash payback period on the machine i nachine 80 years 3.1 years 2.0 years 4.1 vears Multiple Choice Question S7 Windsor Co. purchased some equipment 3 years ago. The company's required rate of returm is 12 % , and the net present value of the project was $(700). Annual cost savings were: $11000 for year 1, 9000 for year 2; and $7000 for year 3. The amount of the initial investment was Present Value PV of an Annuity of 1 at 12% of 1 at 12% Year 0.893 1 0.893 27 0.797 1690 2.402 0.712 $20918 $21280, $22318. $22680. Practice Ouestion 47 Taylor Trucking is considering purchasing a new truck. It is expected the truck will increase annual revenues by $31,000 and increase annual expenses by $19,800 including depreciation, The truck will cost $110,000 and will hae a $2.000 salvage value at the end of its useful de. Compute the annual rate of return 20% O 10.2% 20,7 % 10% Multiple Choice Question 41 Pina Colada Corp. is considering the purchase of a piece of equipment that costs $15000. Projected net annual cash flows over the project's life are: Year Net Annual Cash Flow $ 2000 1 10000 2 25000 11000 The cash payback period is 2.67 years. O2.12 years. 2.93 years. O 1.40 years. Multiple Choice Question S4 A company is considering purchasing a machine that costs $440000 and is estimated to have no salvage value at the end of its 8-year useful lide, 1f the machine is purchased, aneual reveues are expected to be $170000 and annual operating expenses excusive of depreciation expense are expected to be $30000, The straight line method of deprociation would be used. The cash payback period on the machne isa 8.0 years 3.1 years 2.0 years 4.1 years Multiple Choice Question 5r Windsor Co. purchased some equipment 3 years ago. The company's required rate of retum is 12 %, and the net present value of the project was $(700). Annual cost savings were: $11000 for year 1; 9000 for year 2; and $7000 for year 3. The amount of the initial investment was Present Value PV of an Areaty of 1 at 12% Year of 1 at 12% 0.8934 0.893 0.797 1.690 0.712 2,402 O$20918. G $21280. $22318 $22680