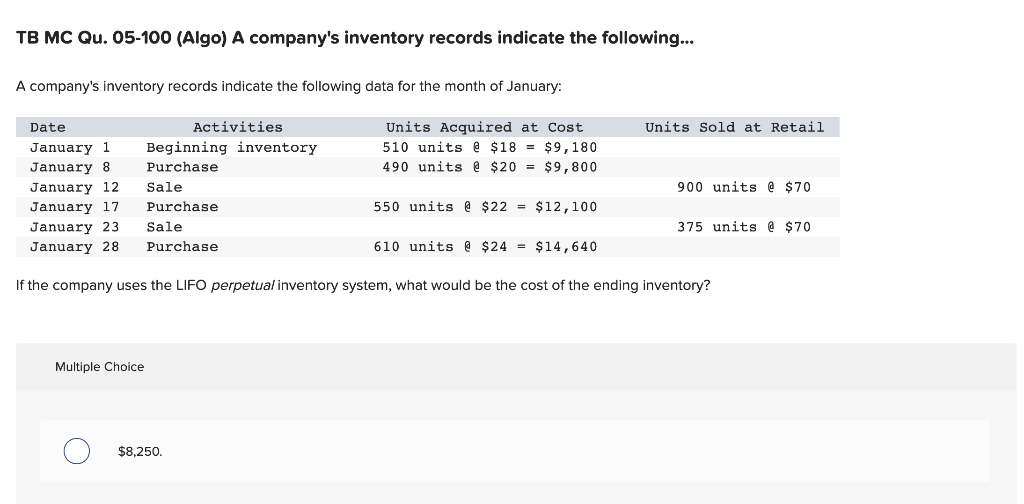

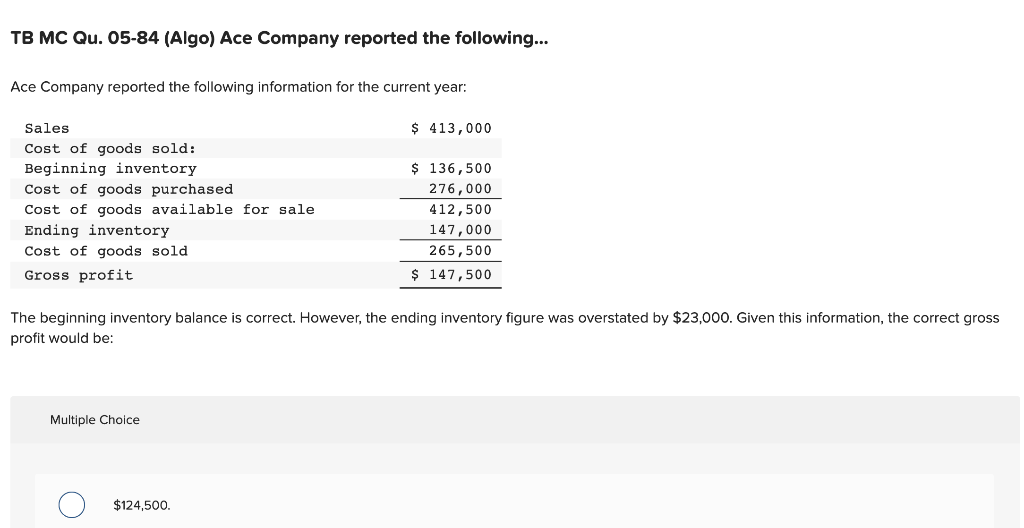

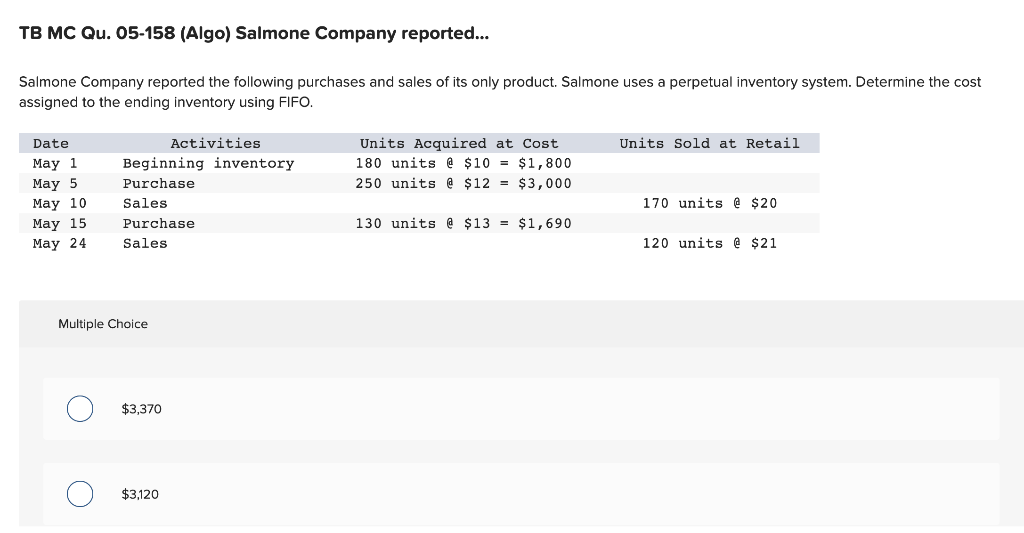

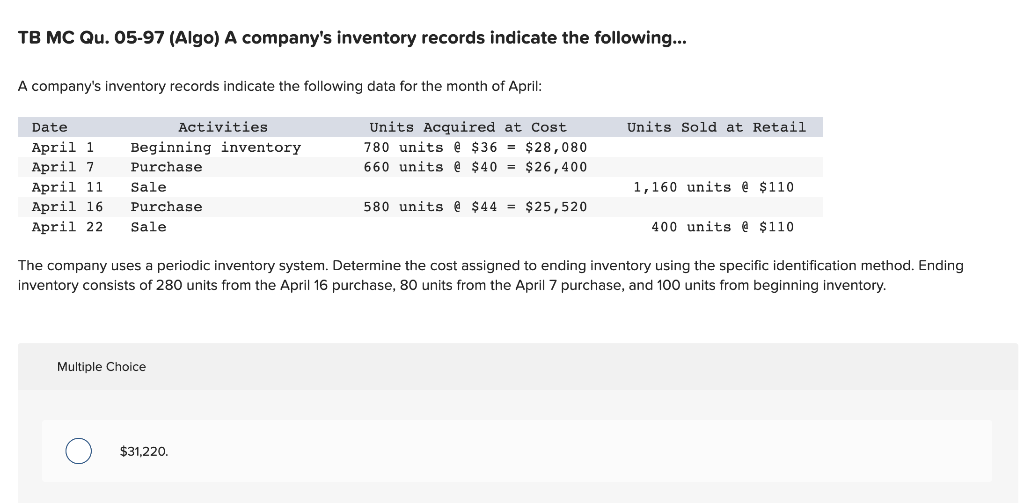

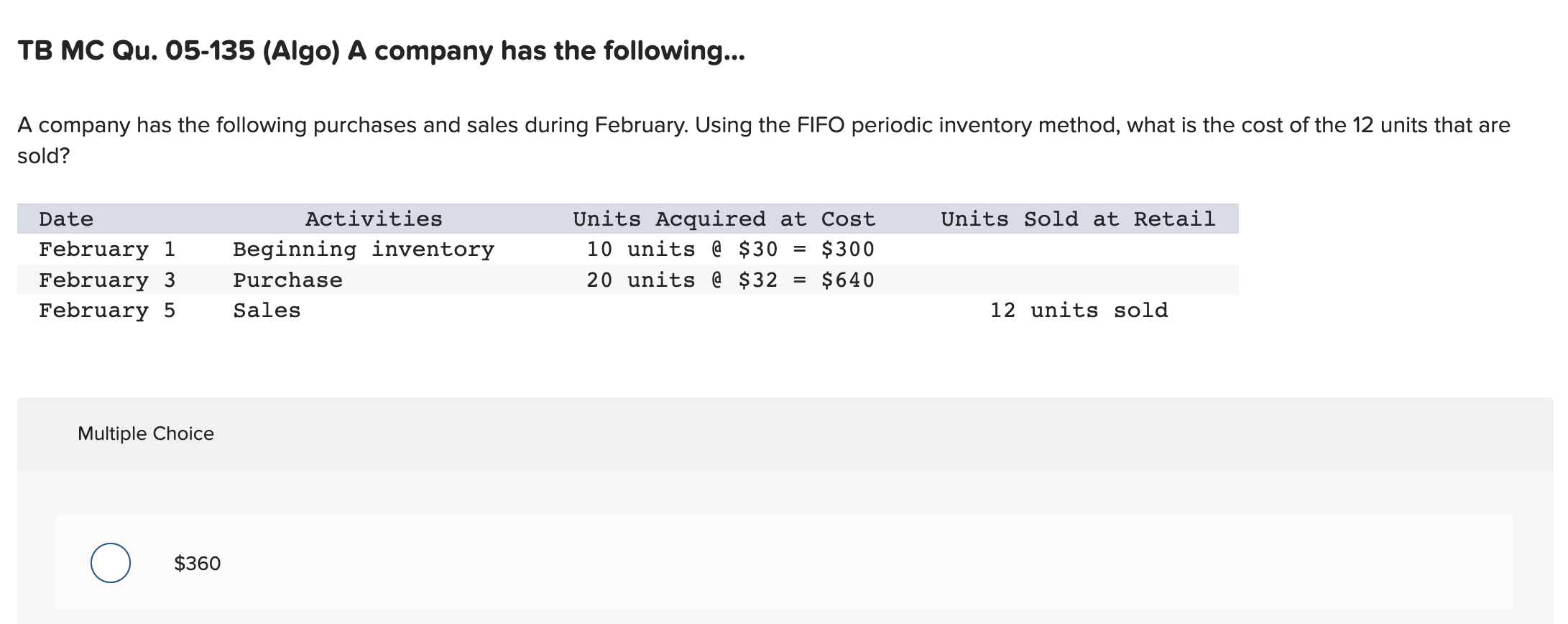

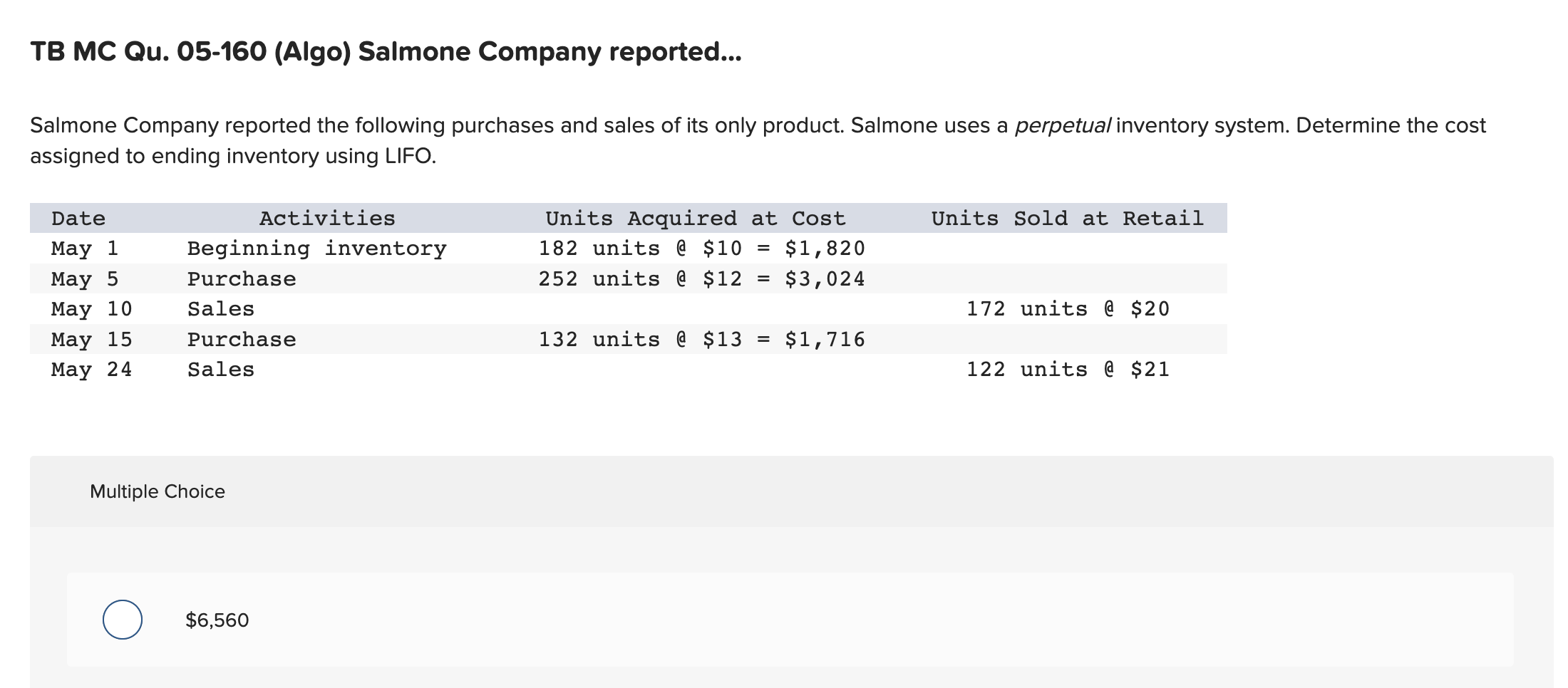

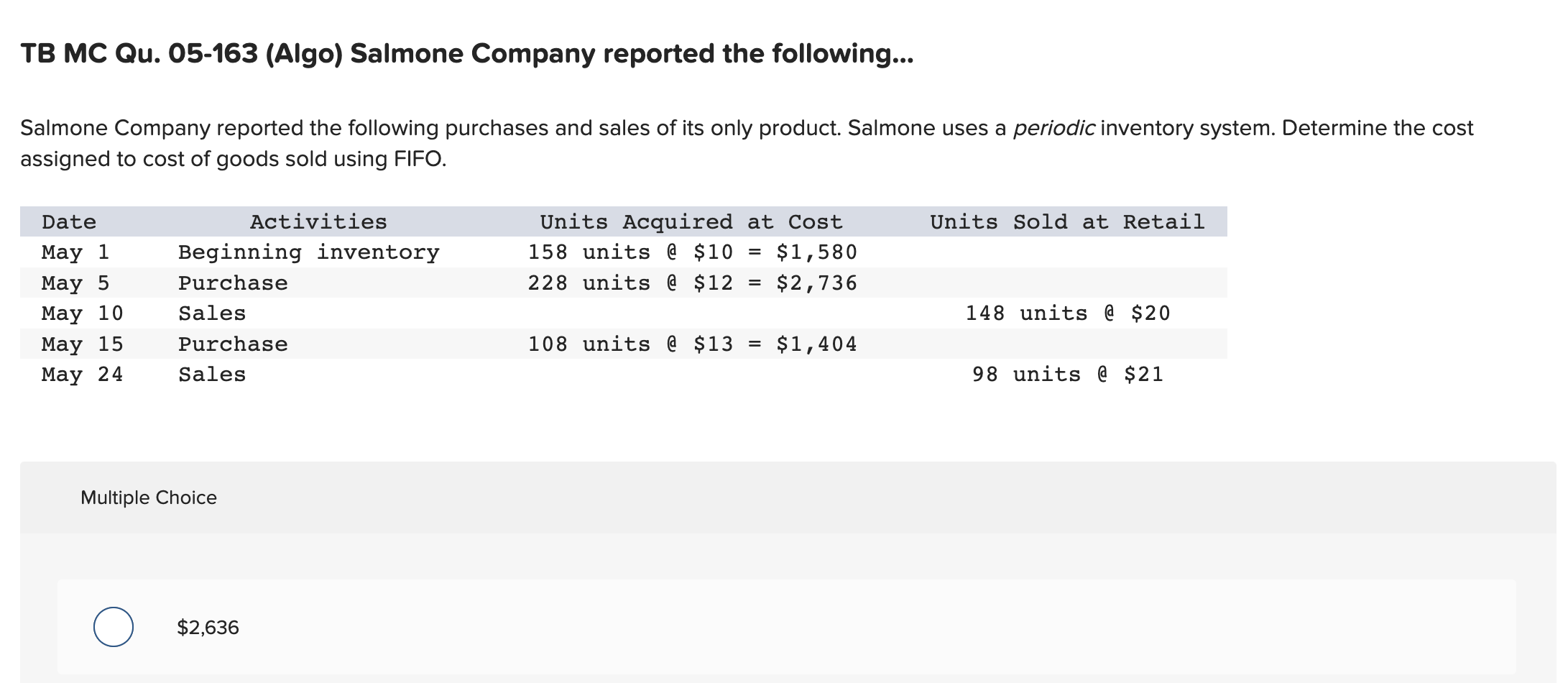

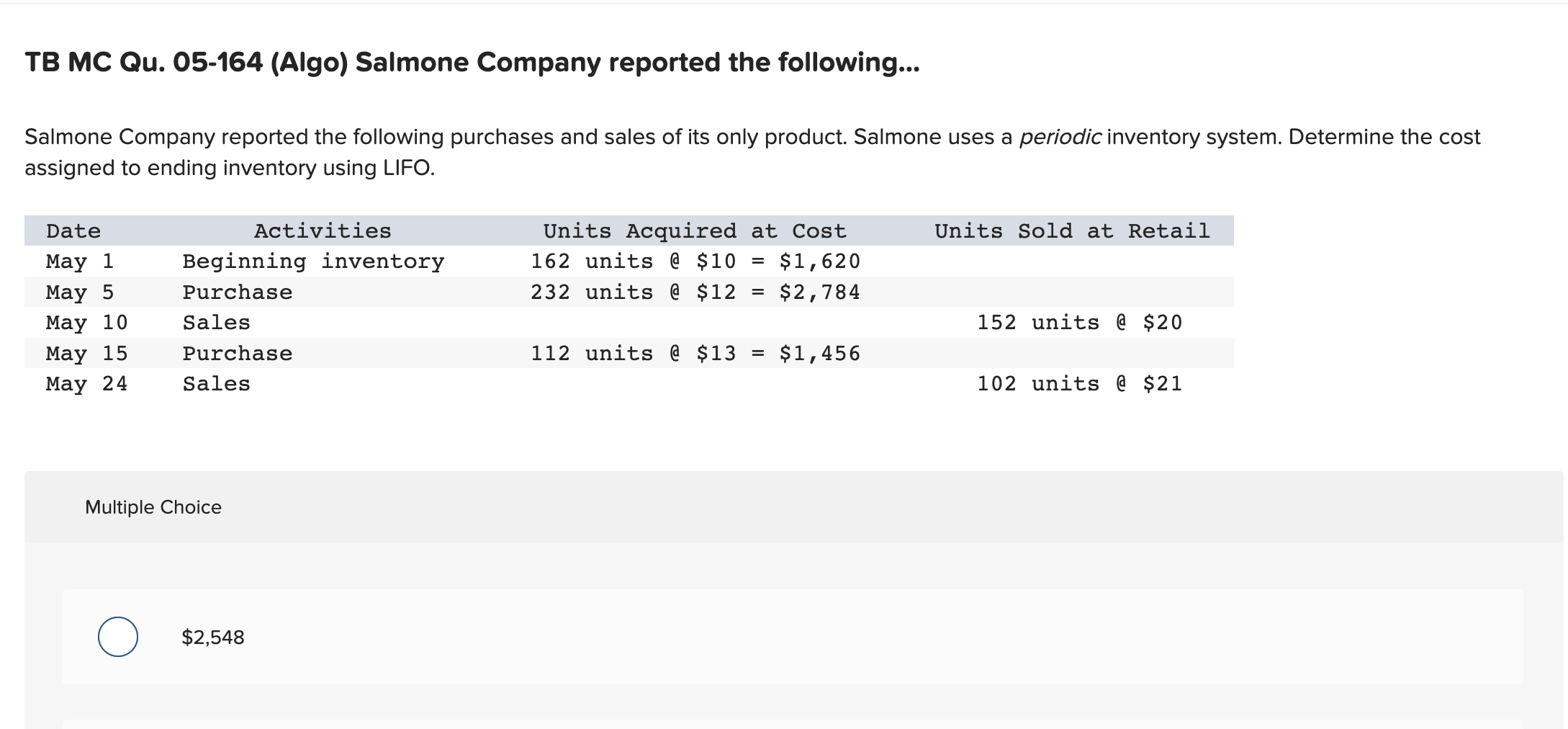

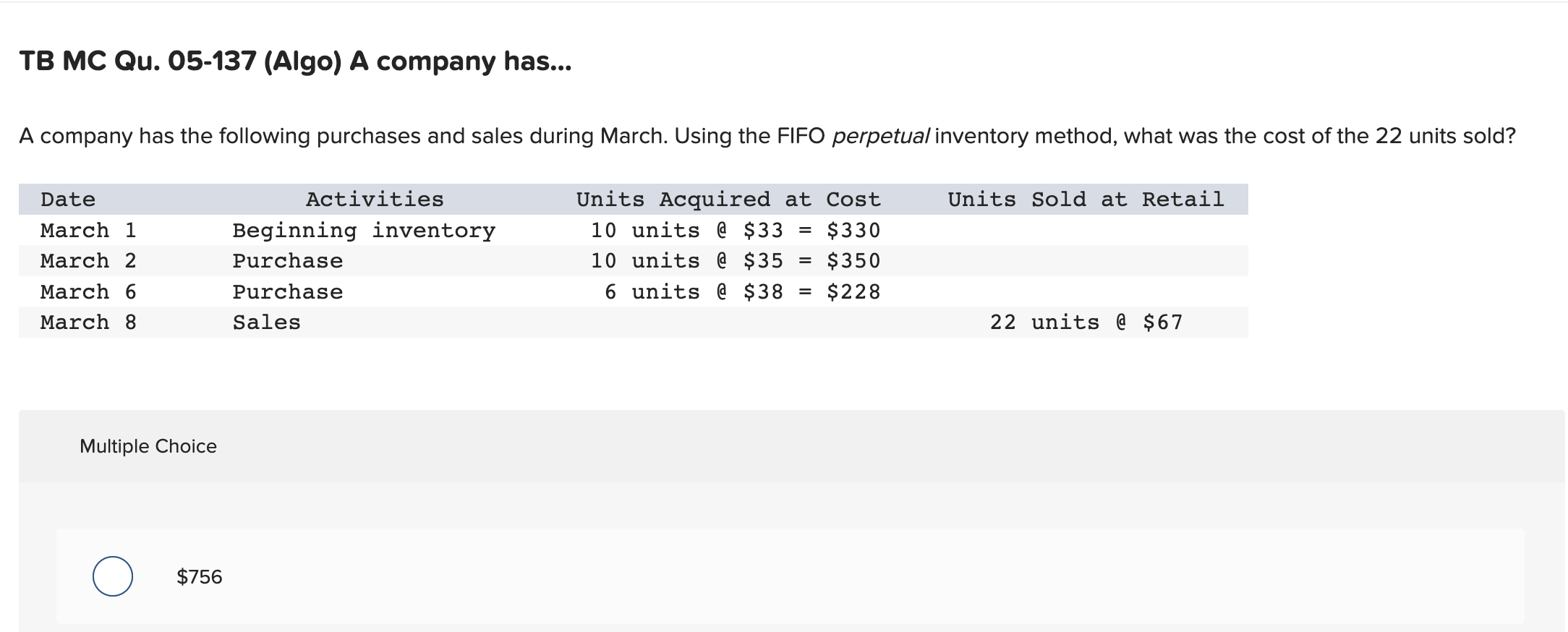

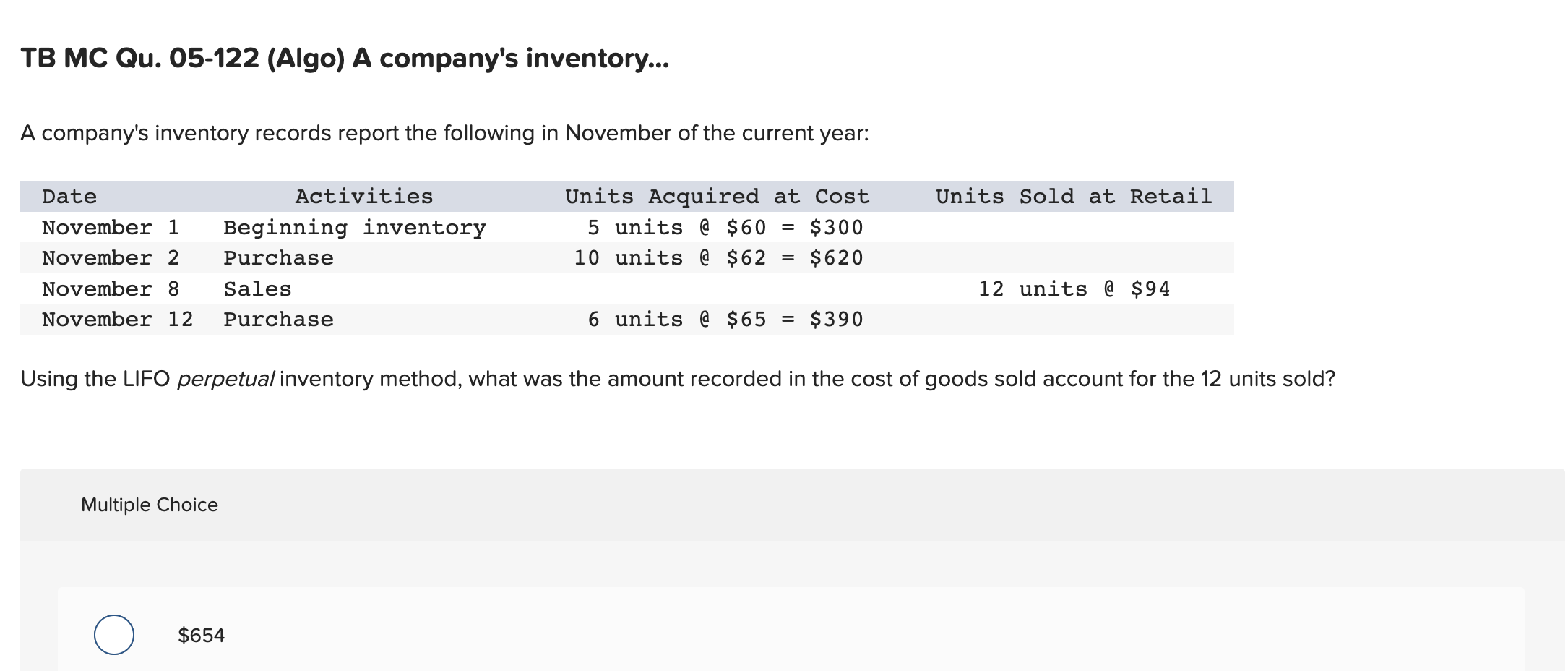

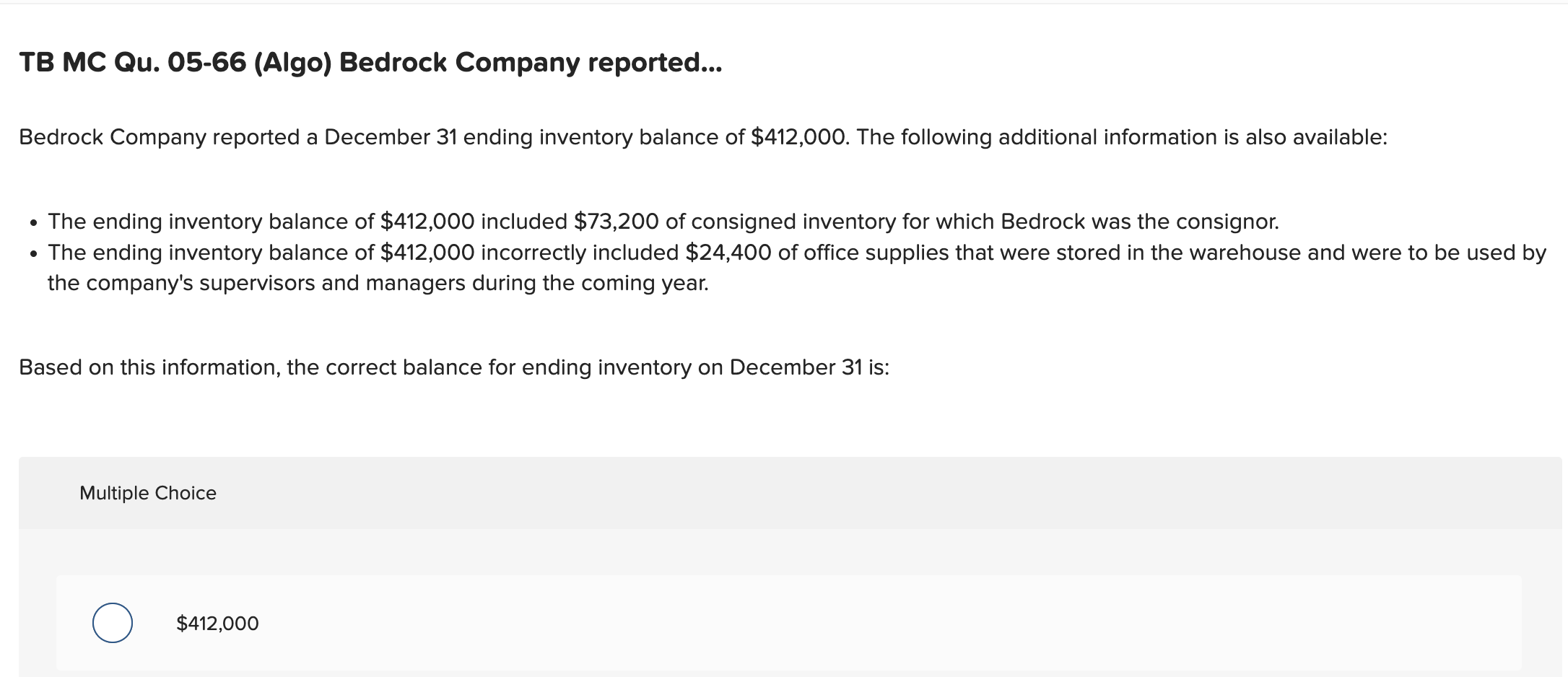

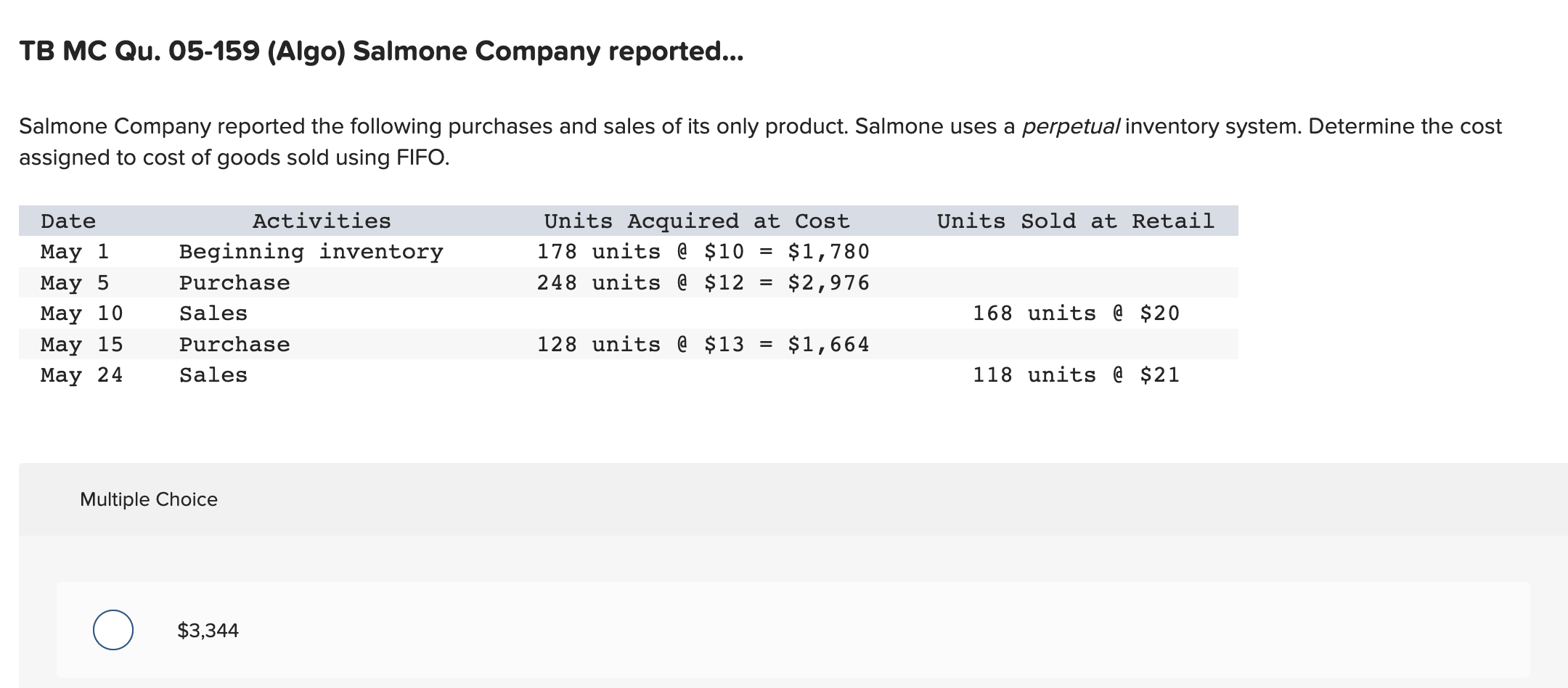

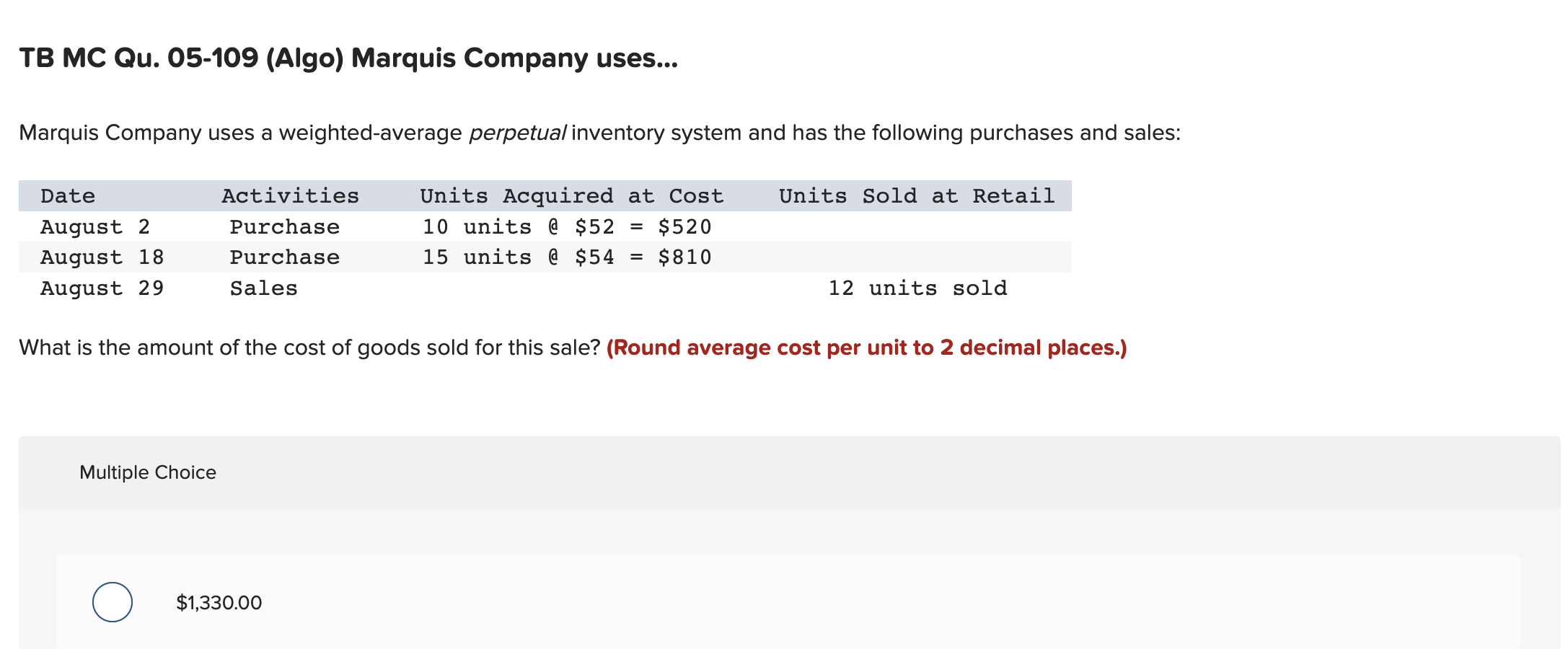

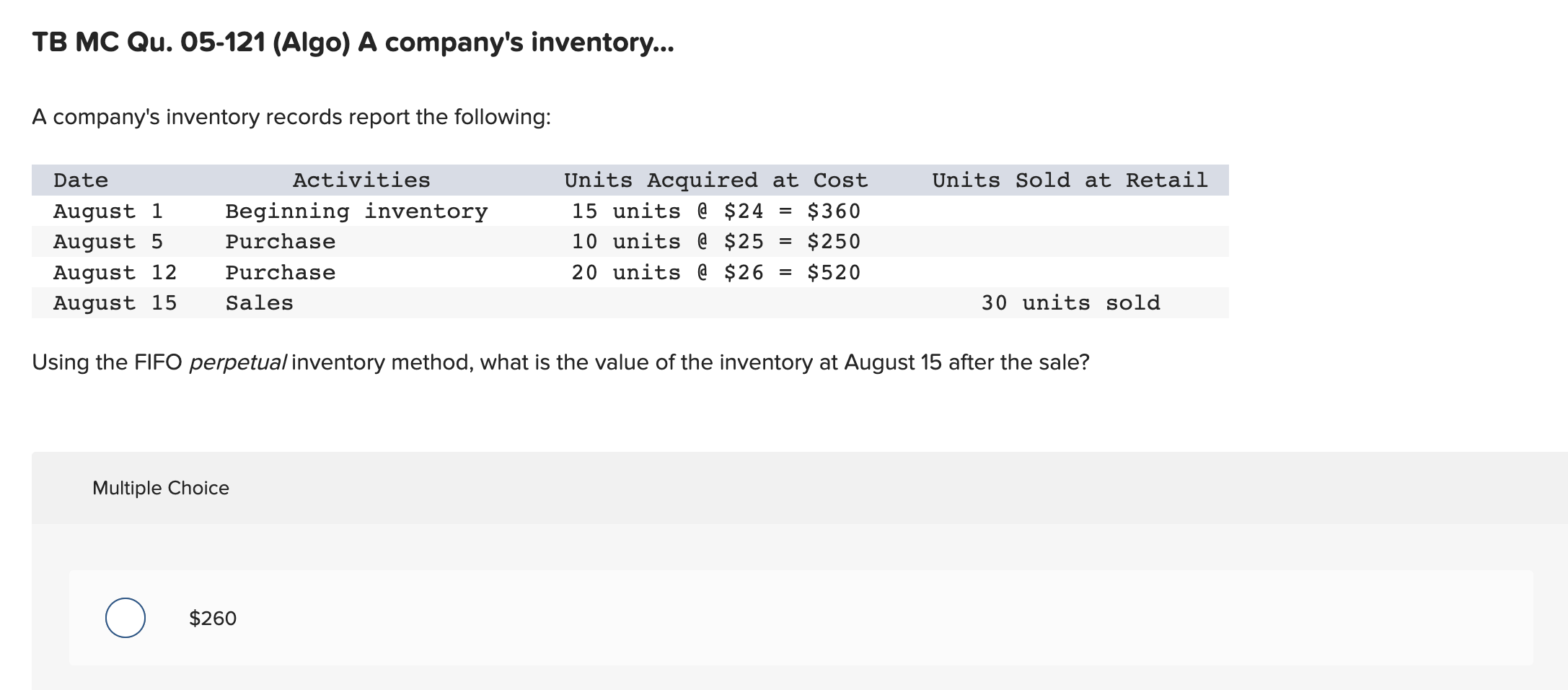

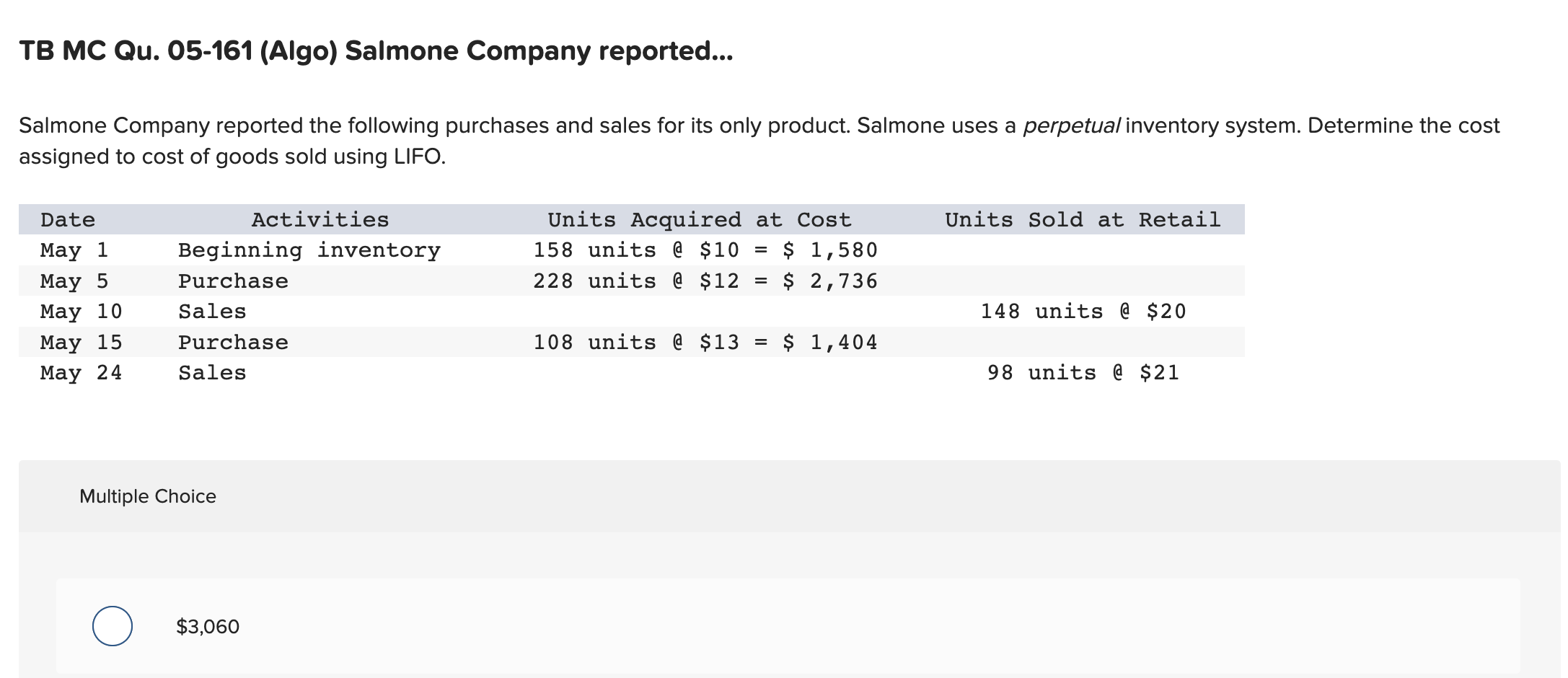

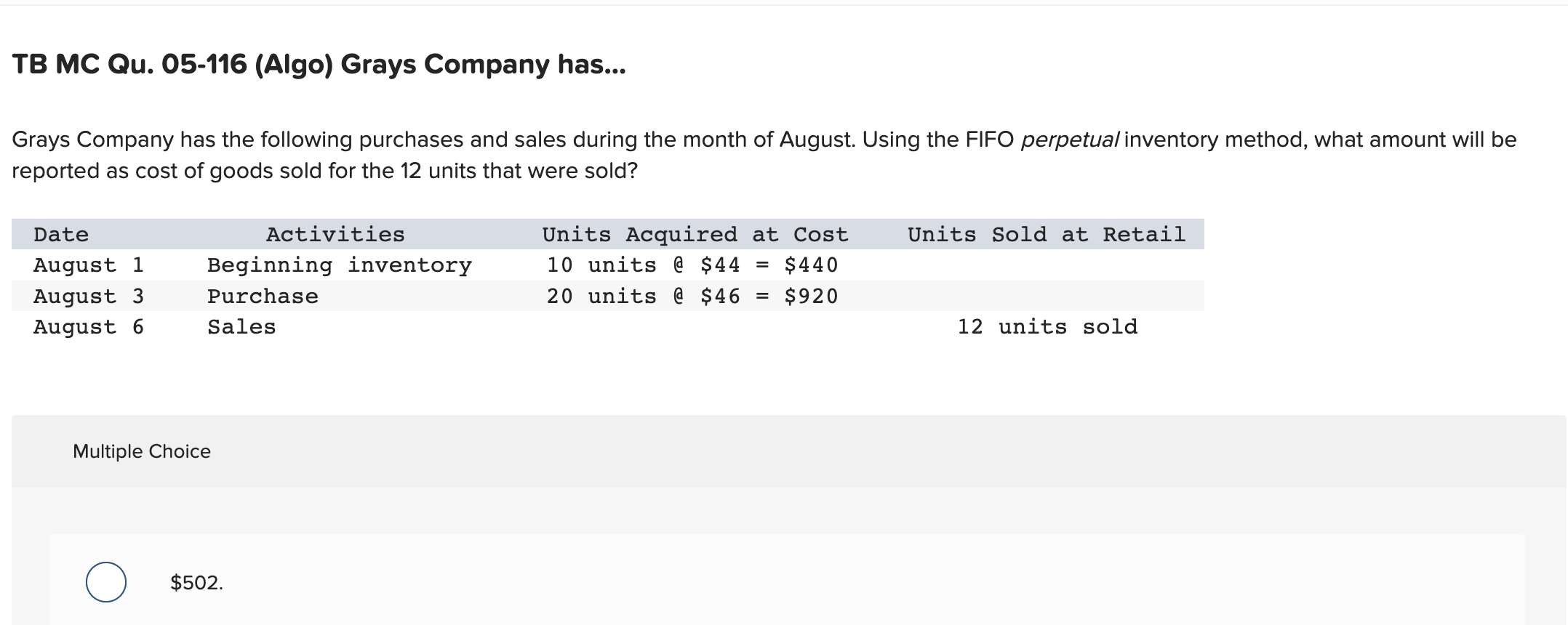

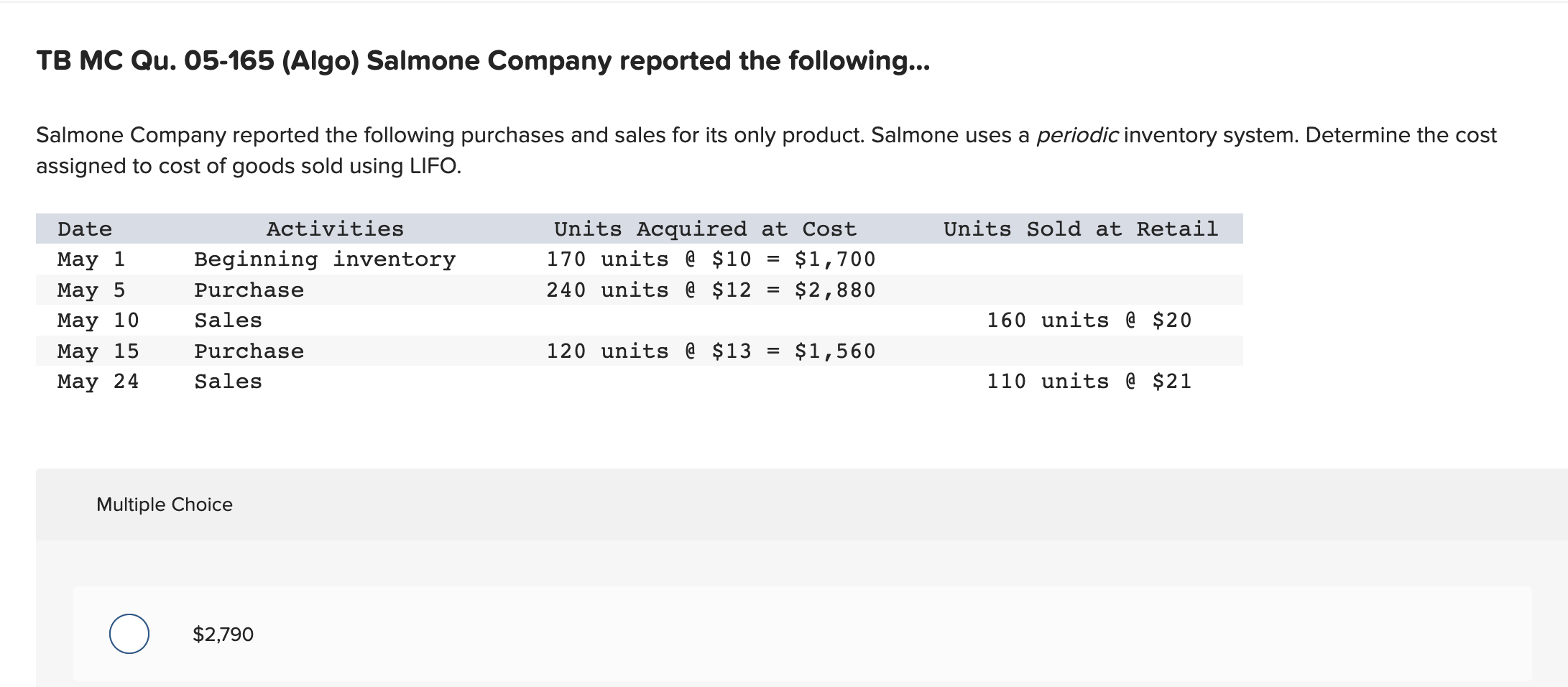

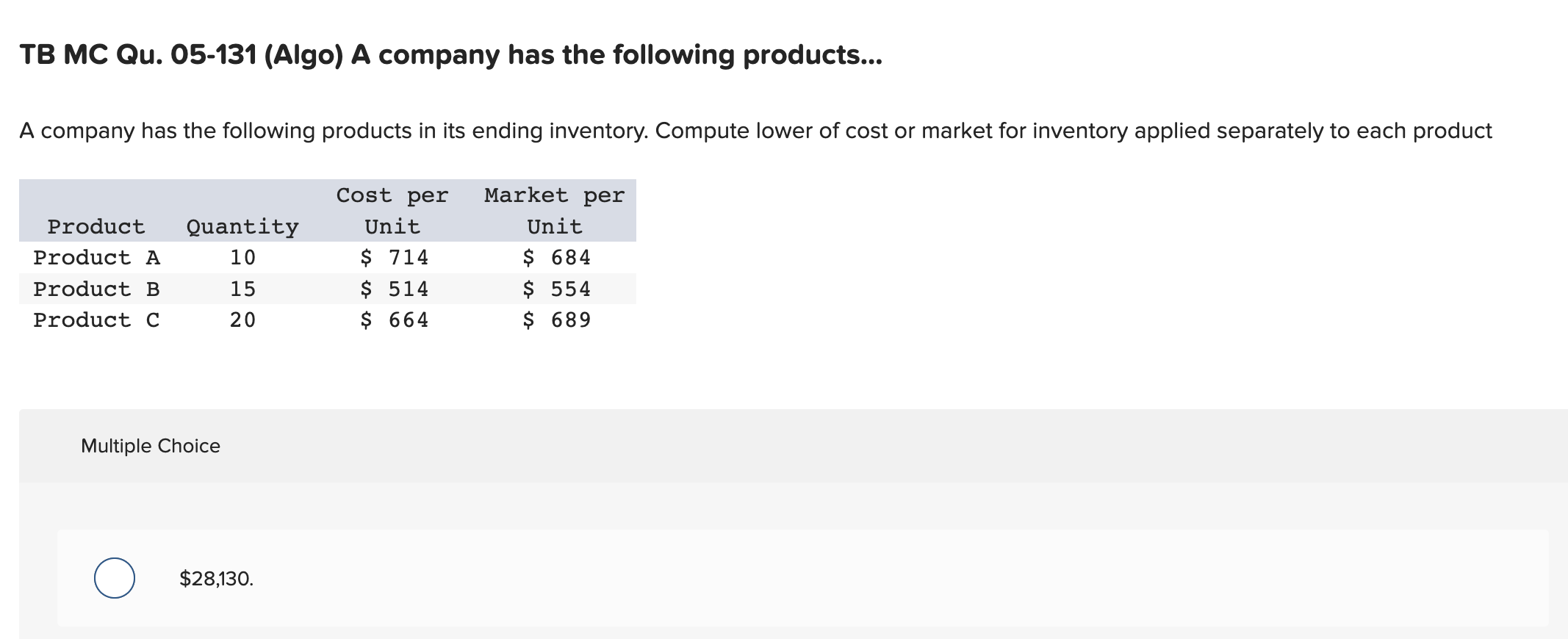

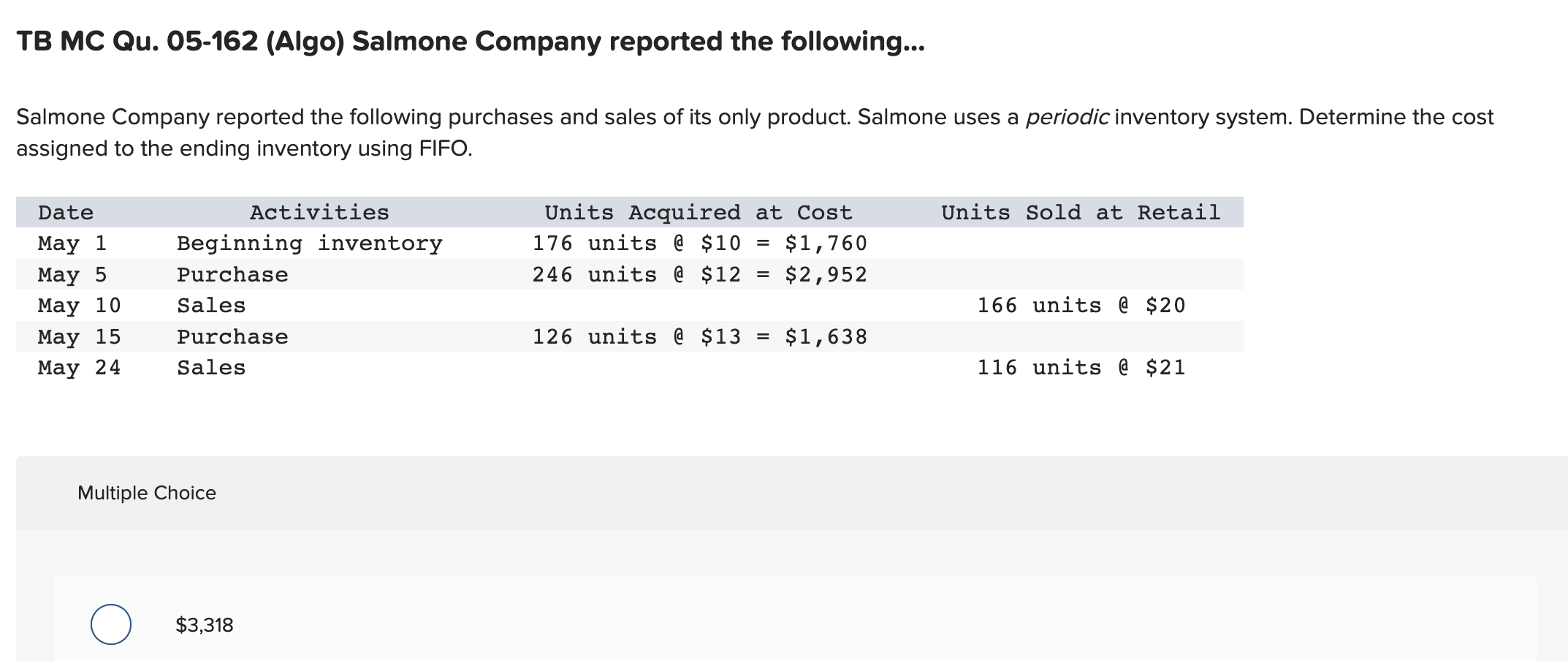

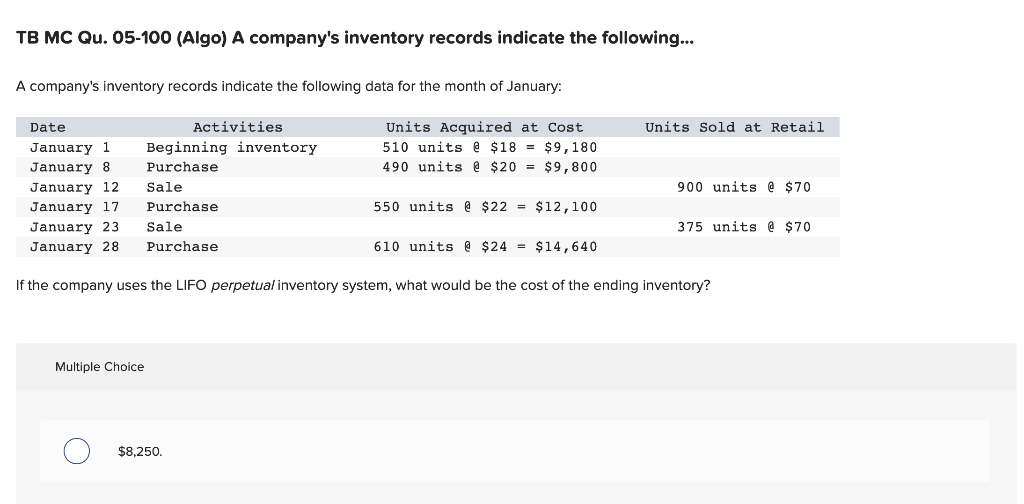

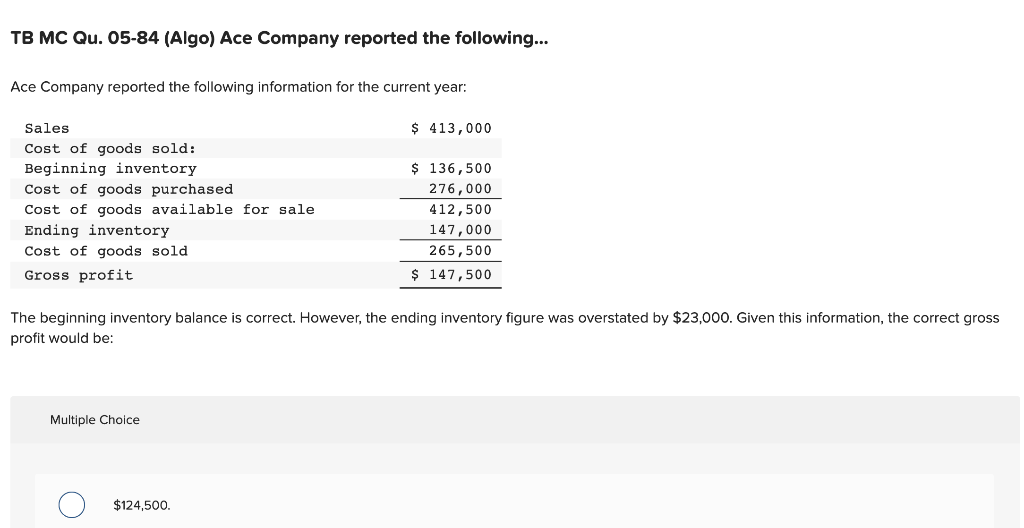

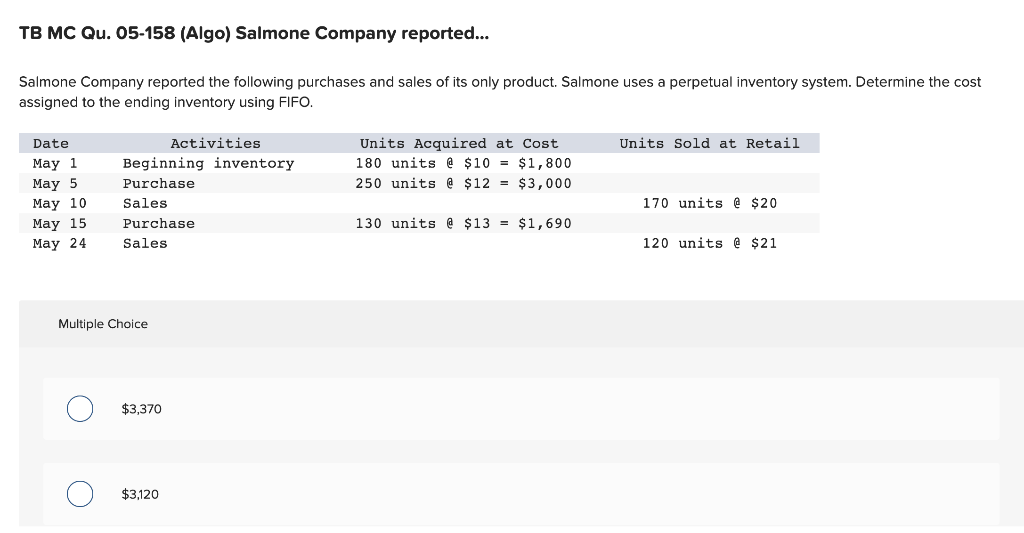

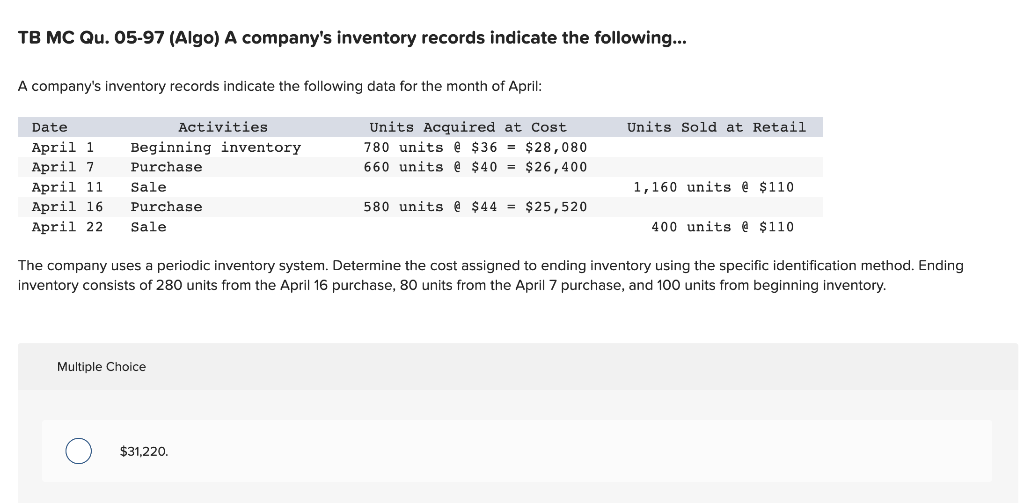

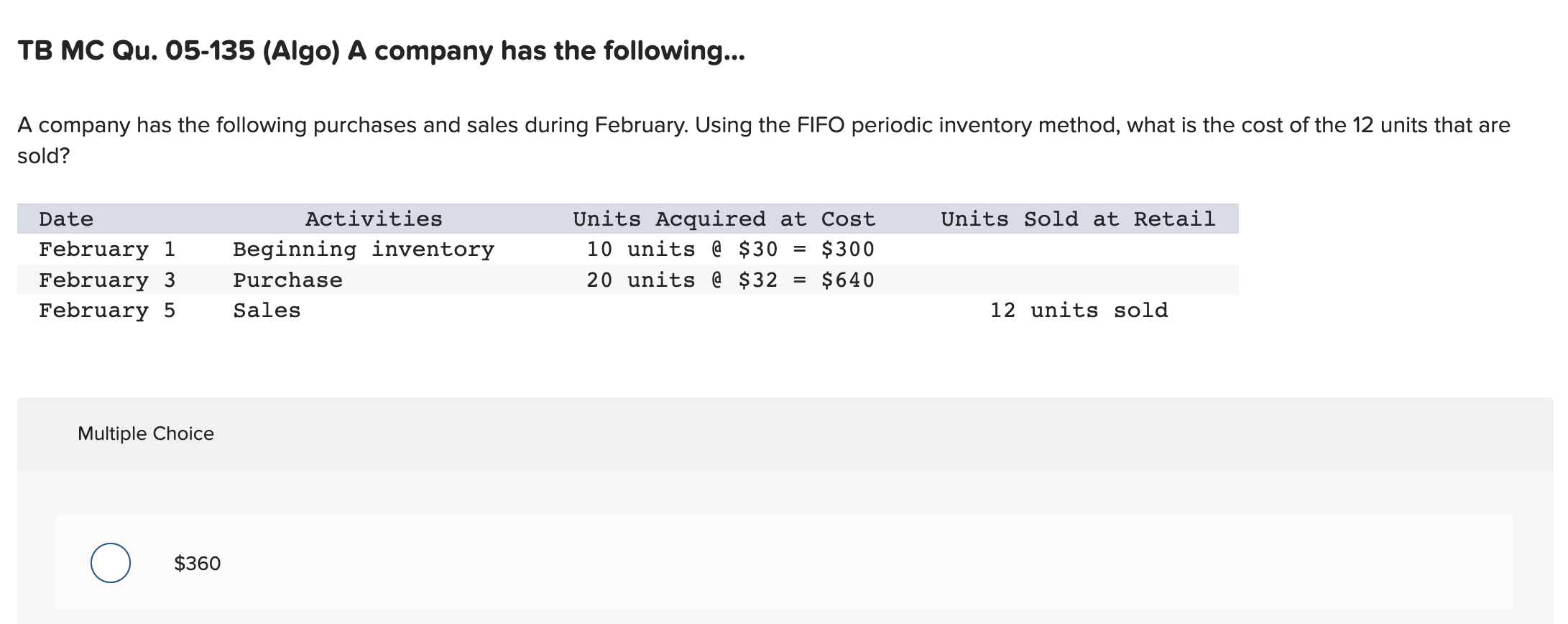

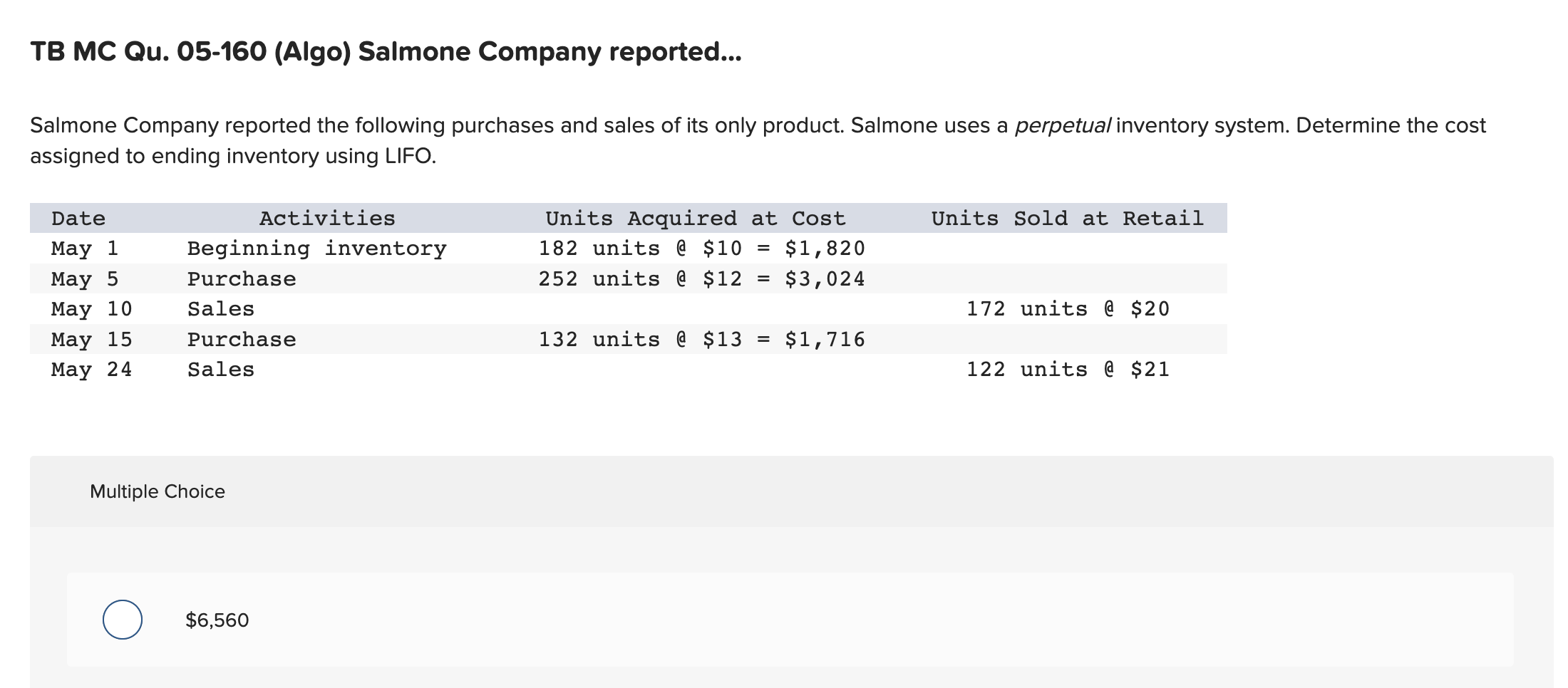

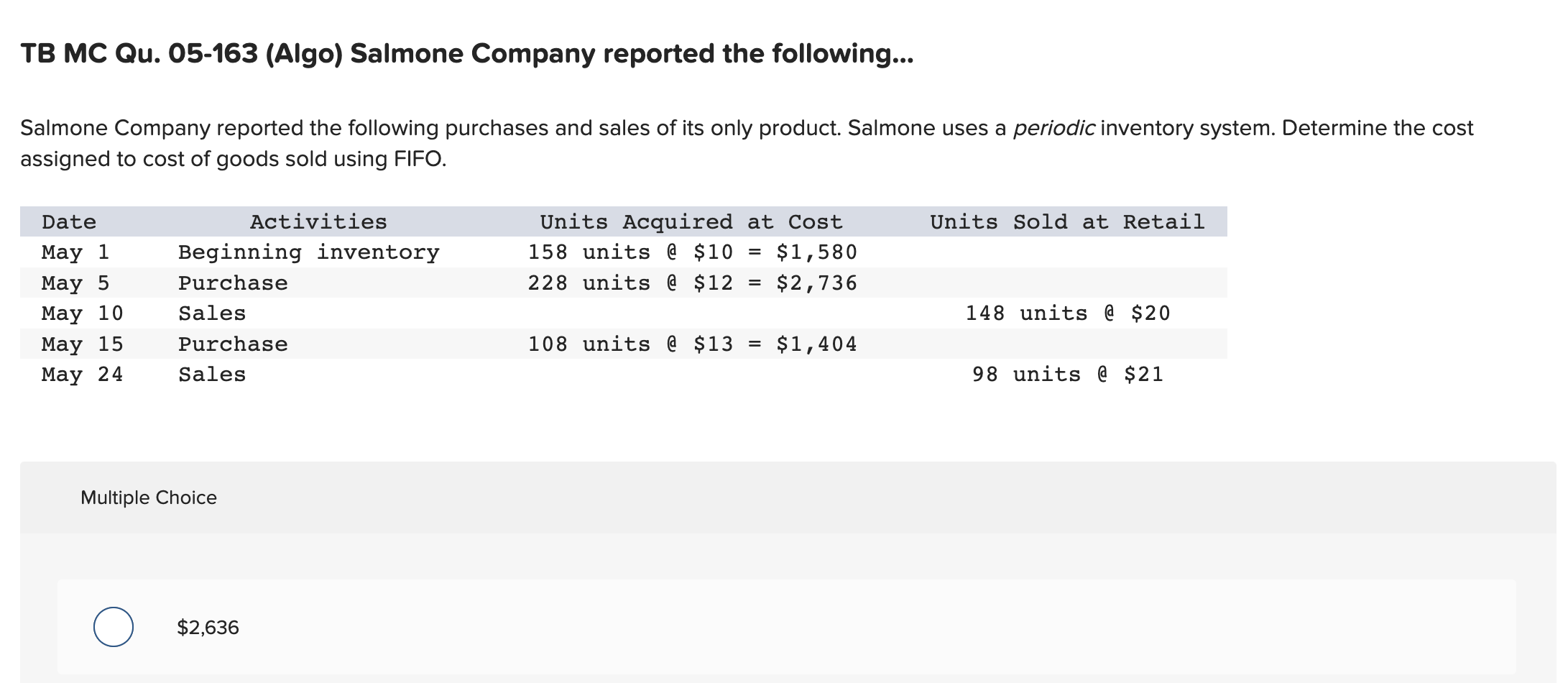

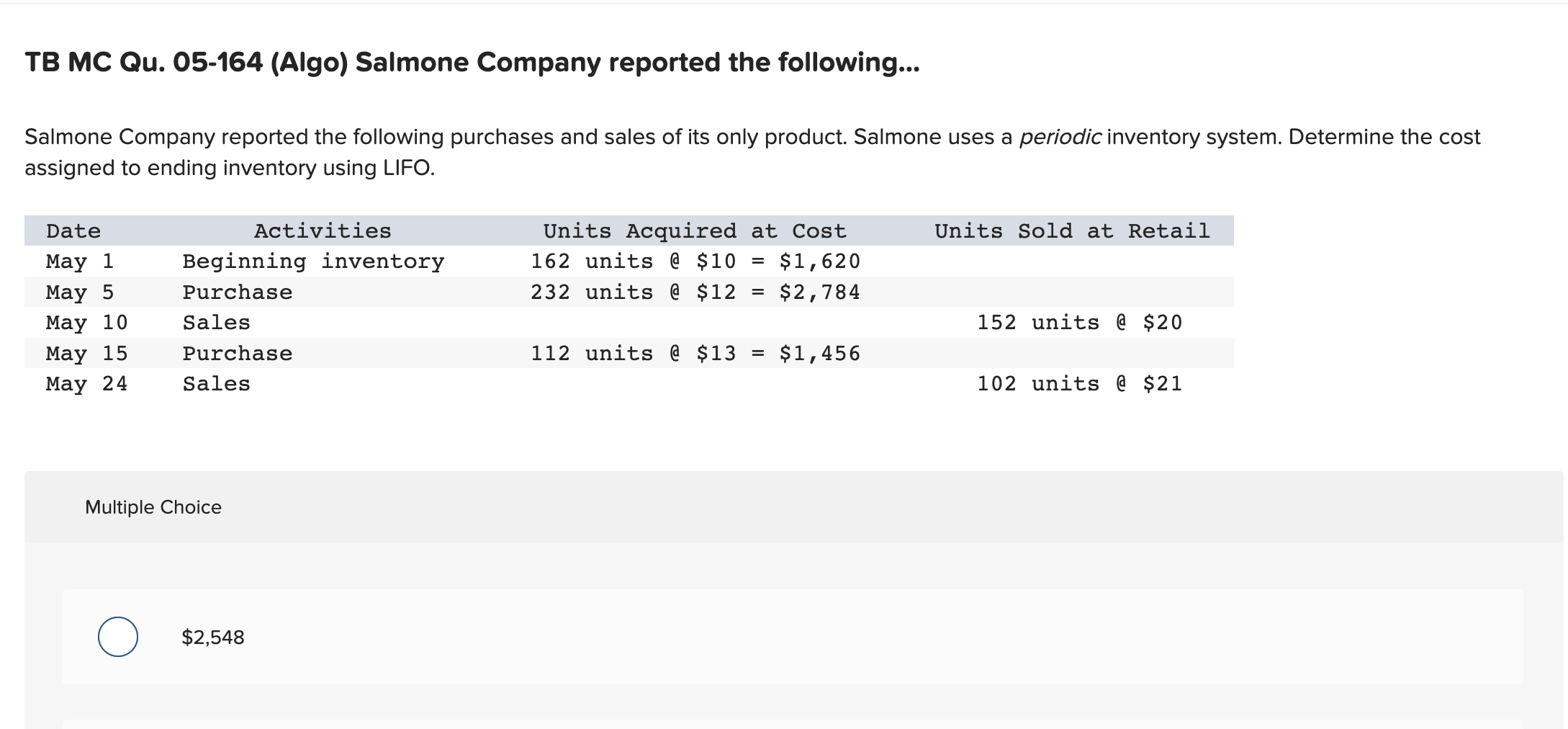

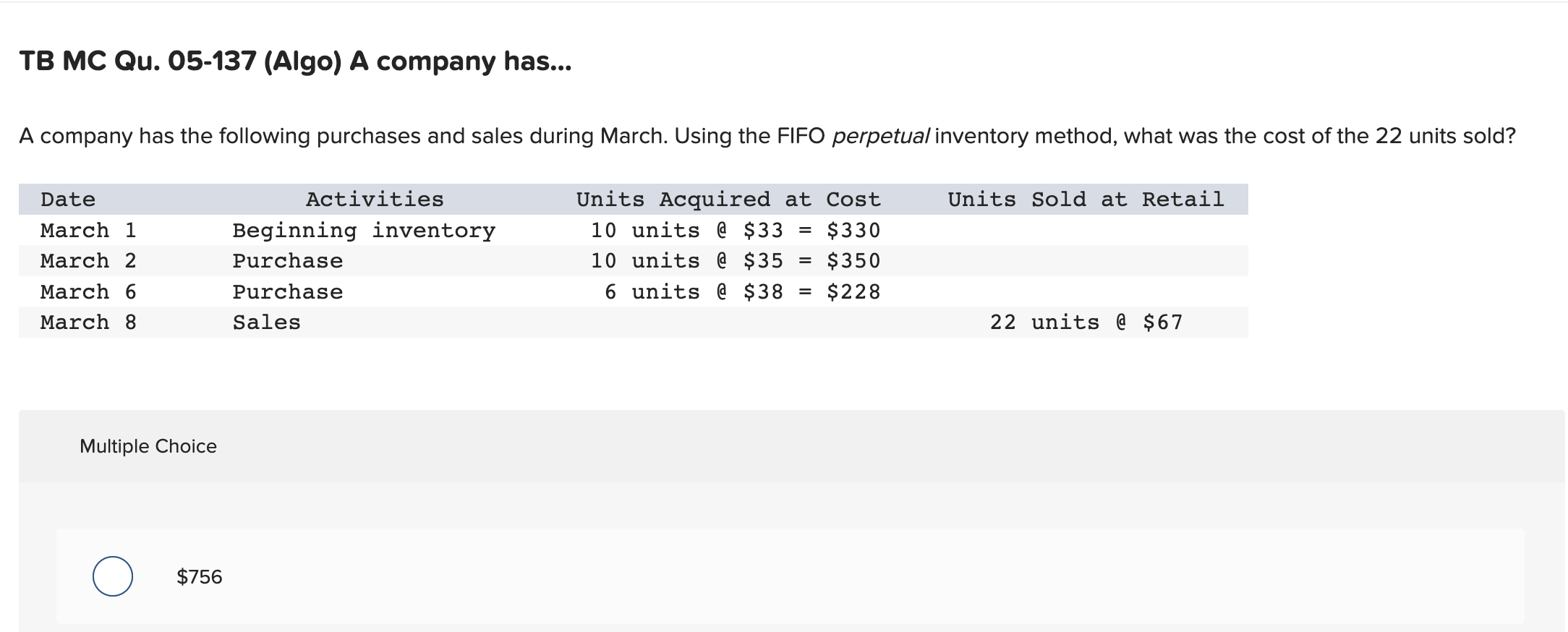

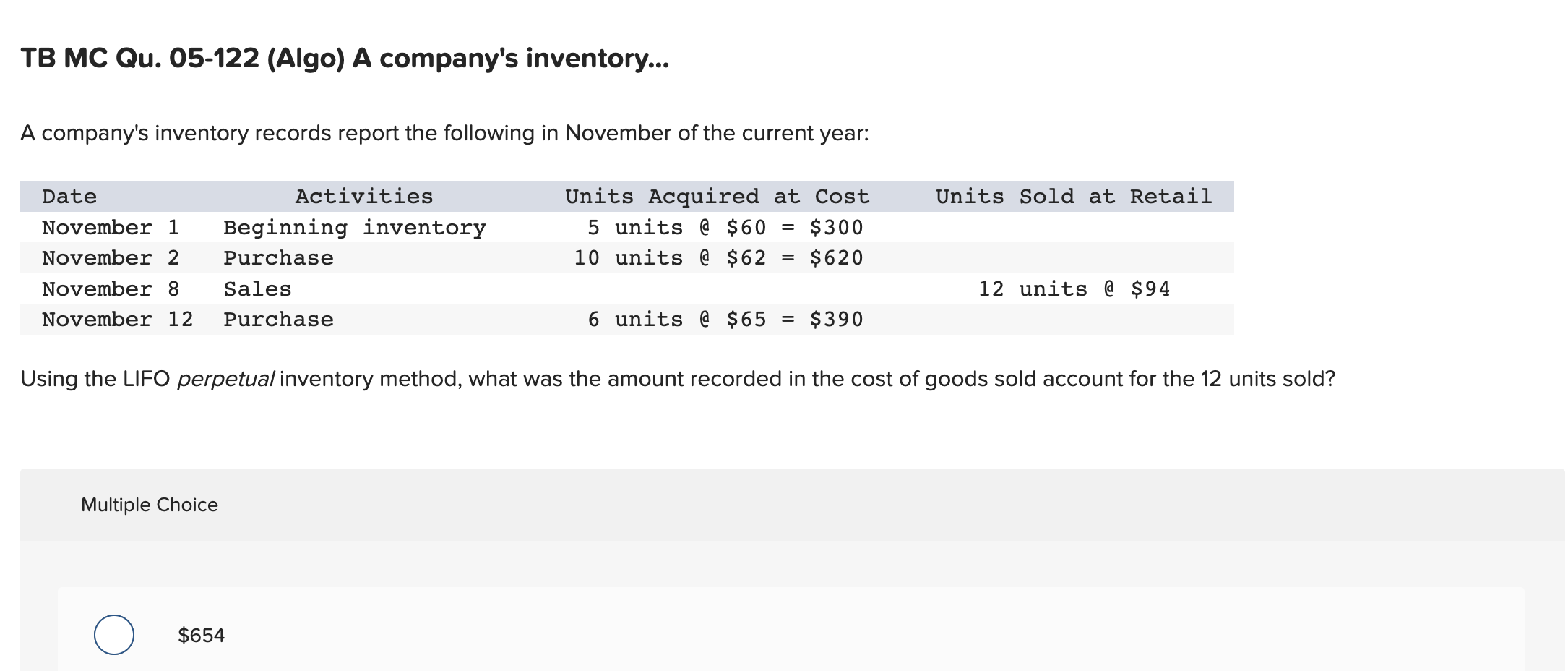

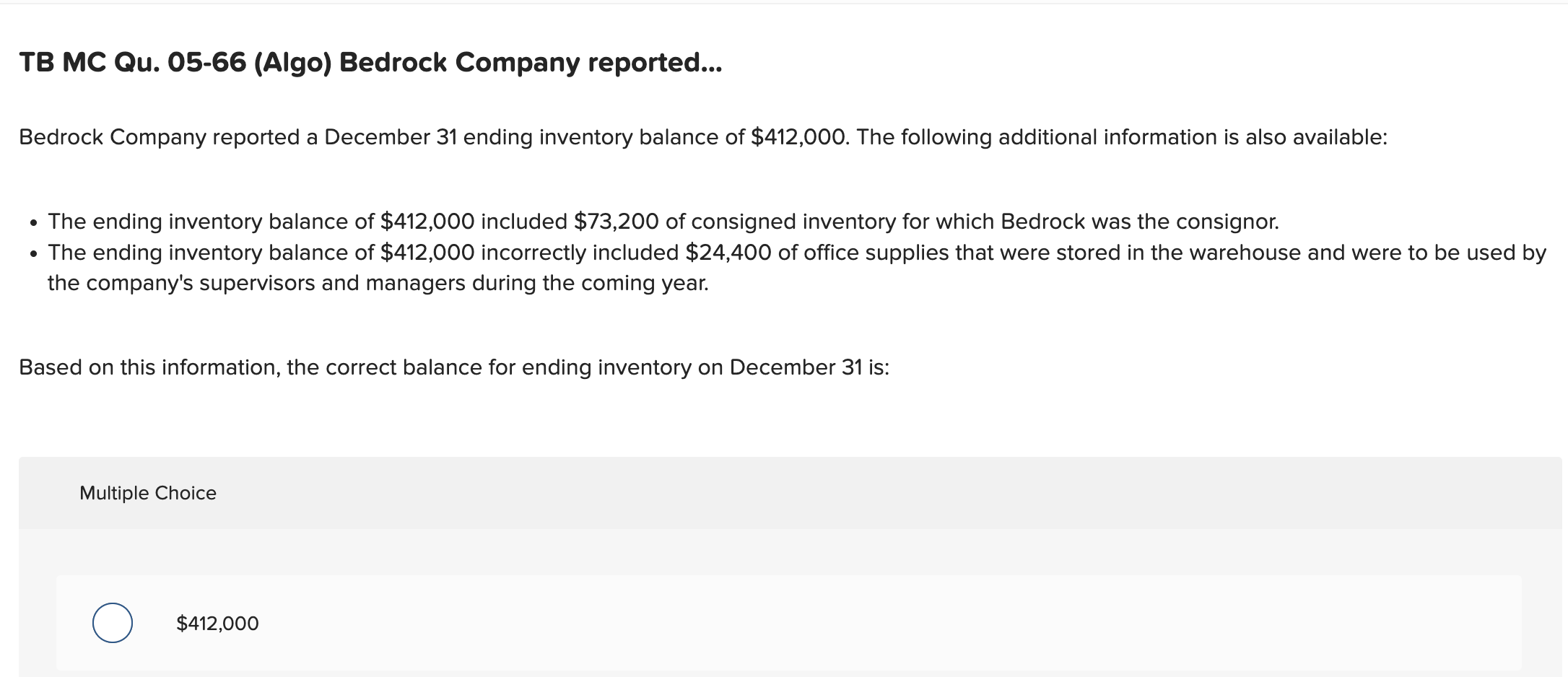

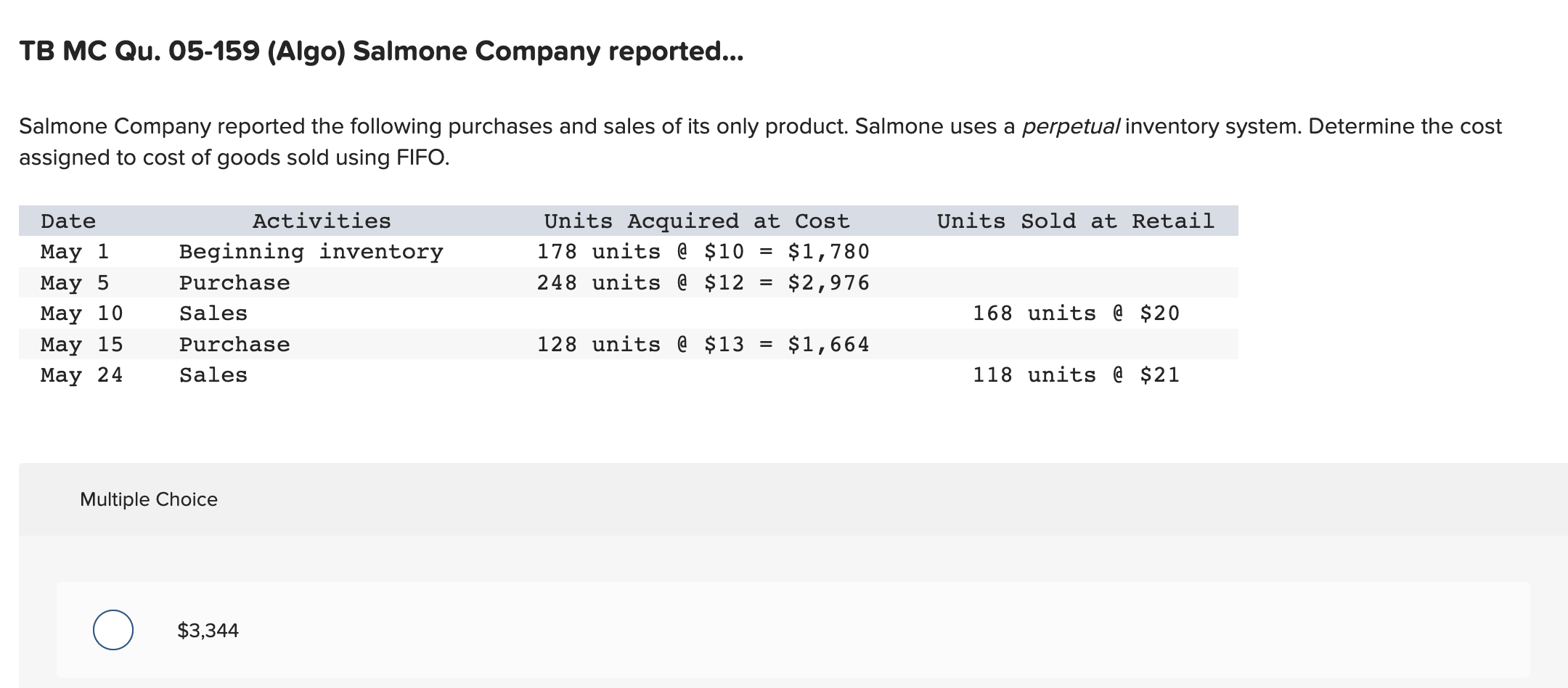

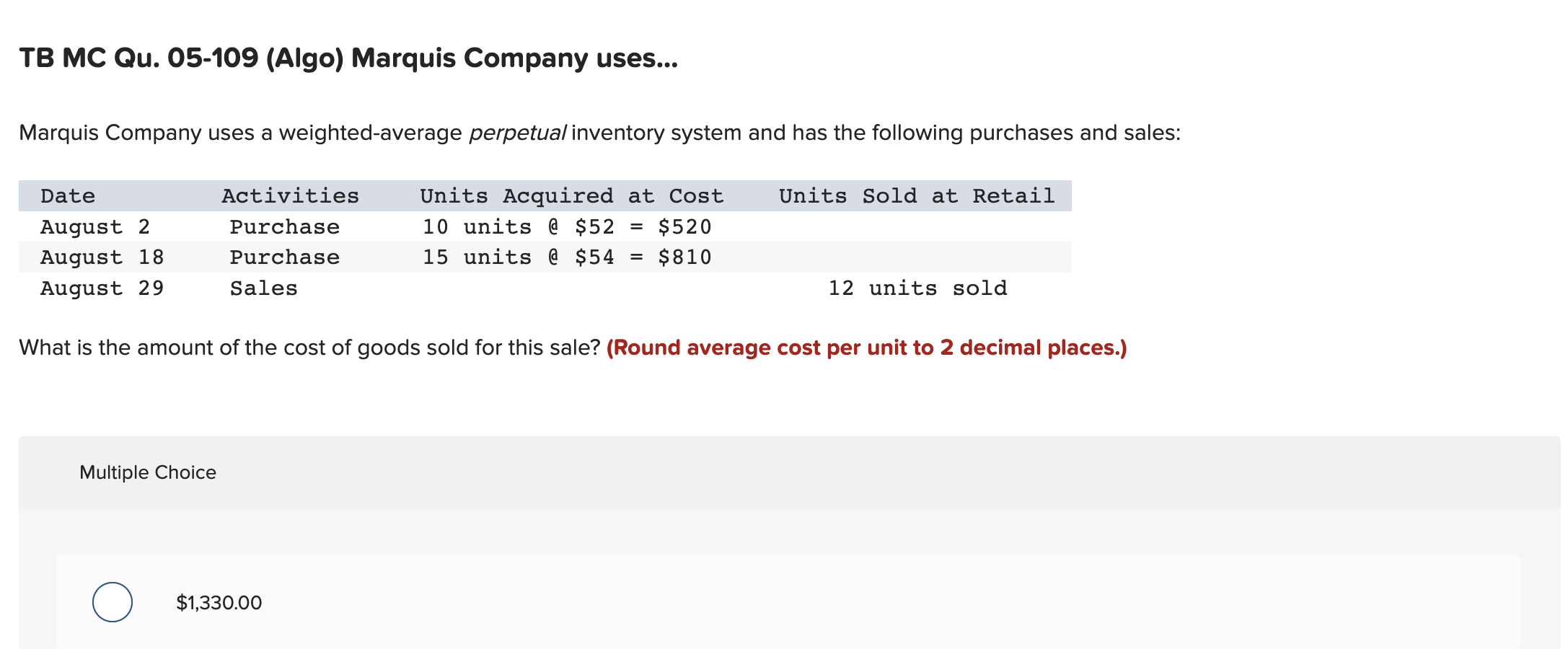

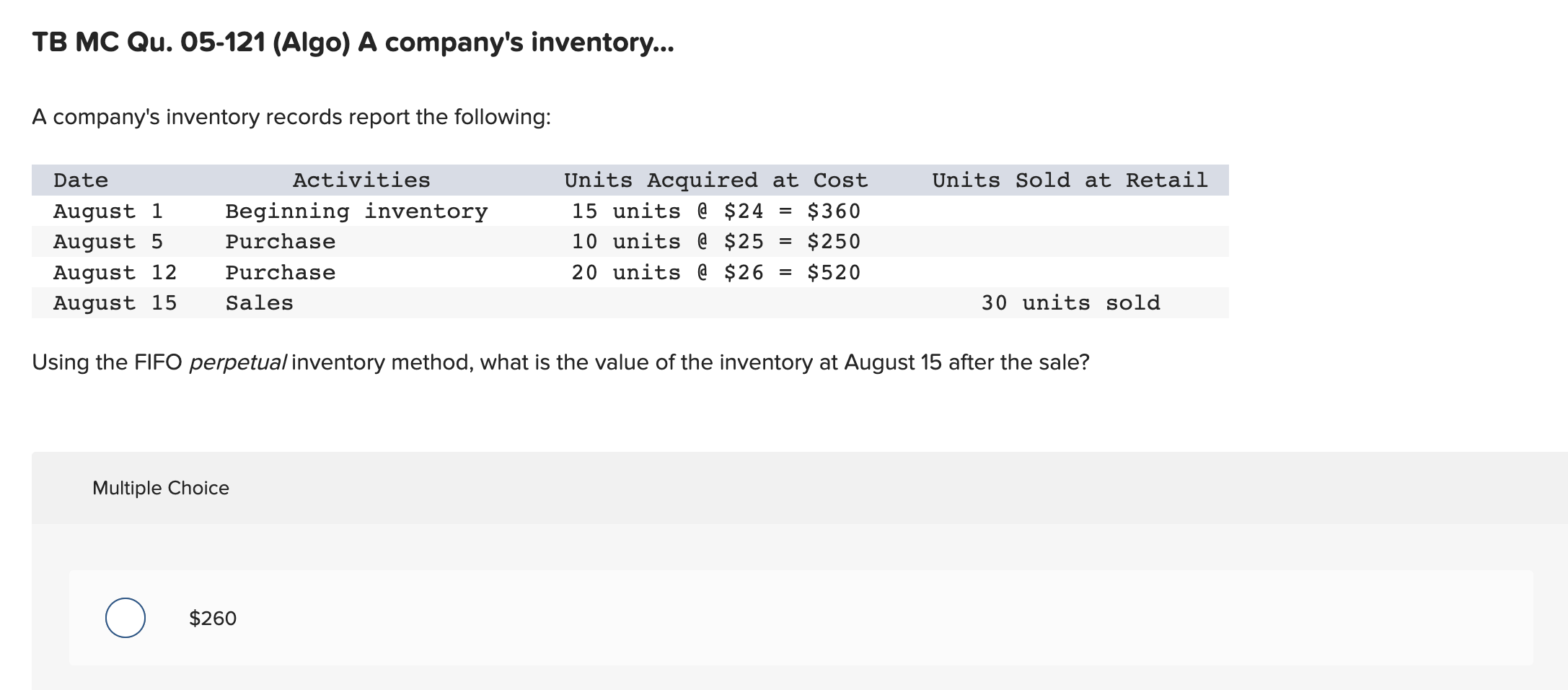

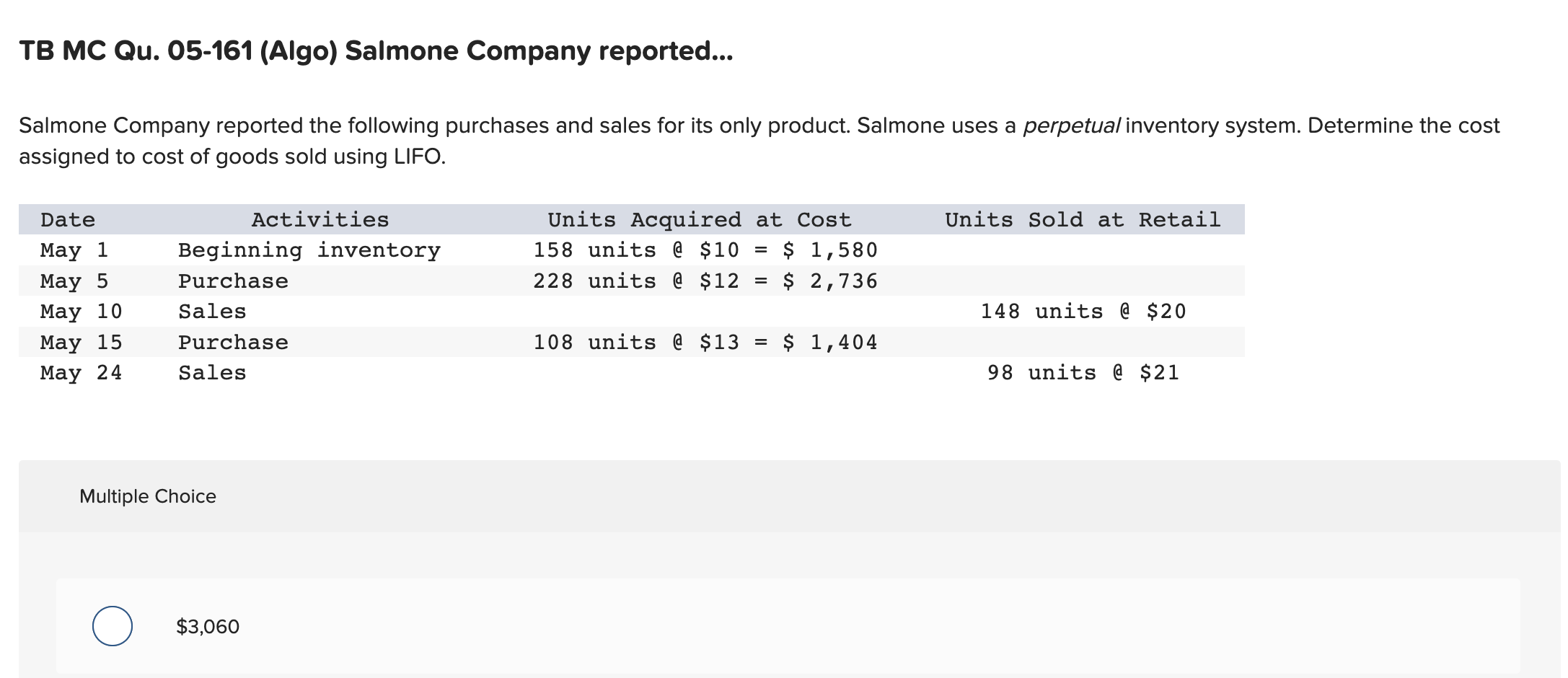

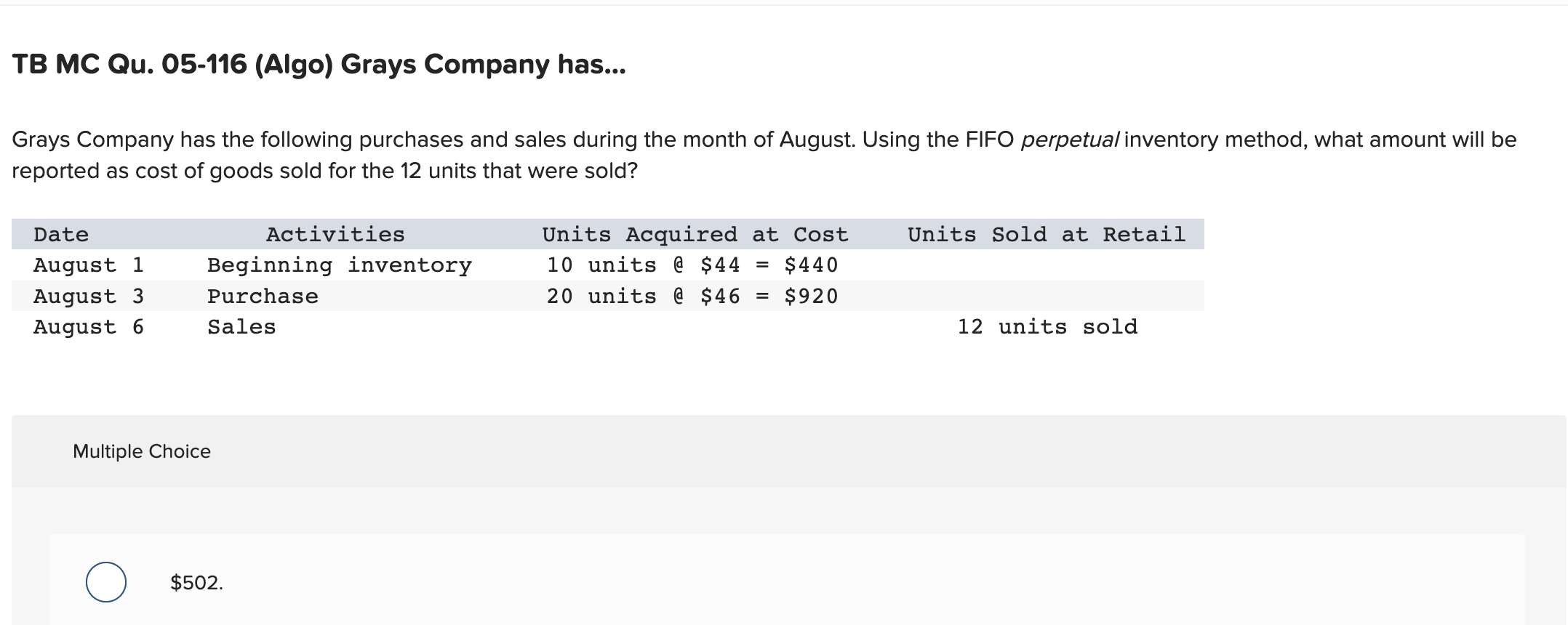

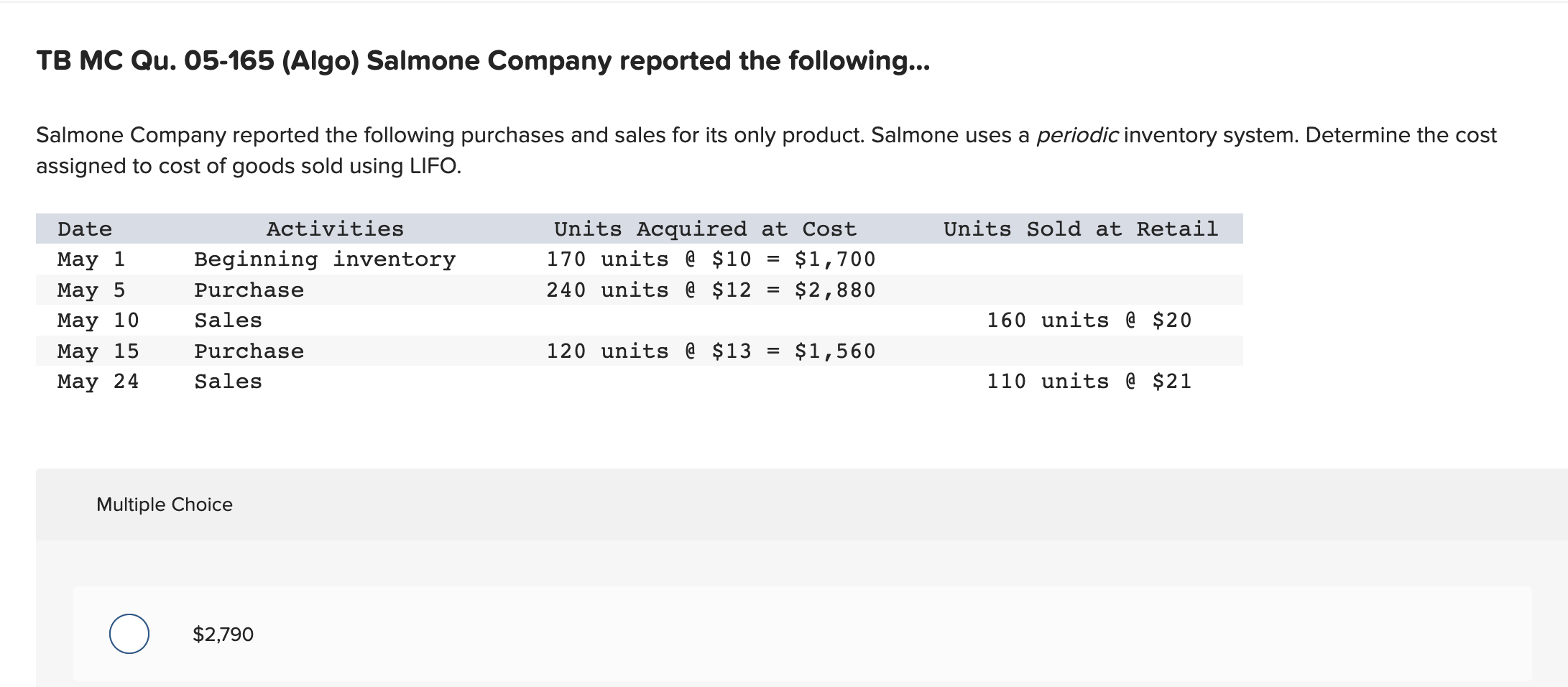

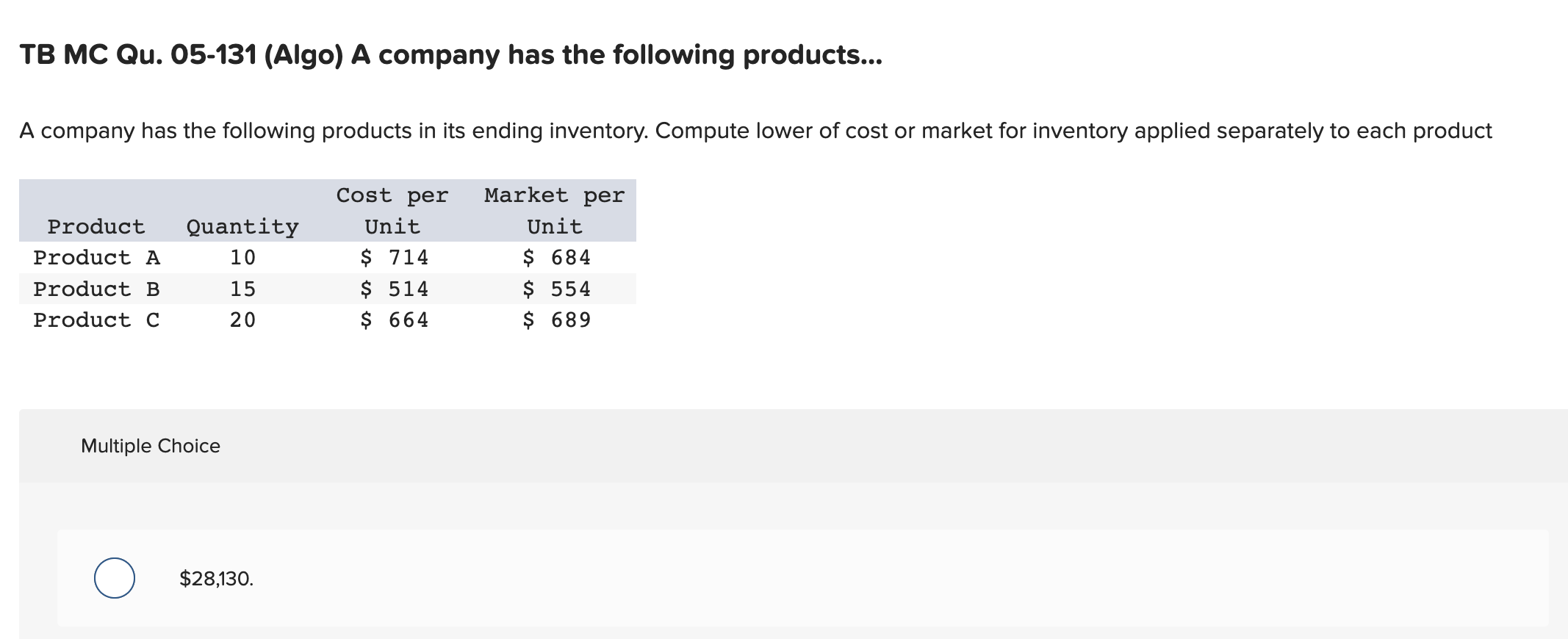

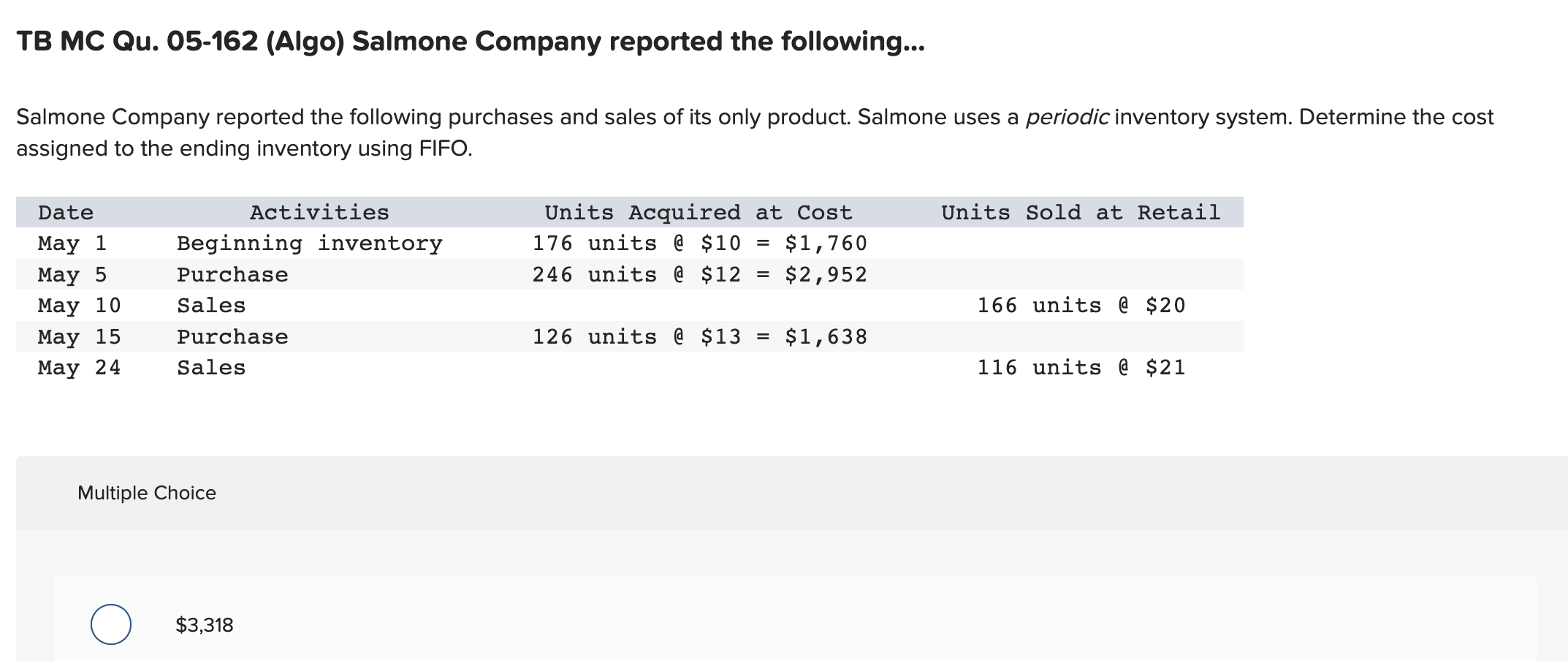

TB MC Qu. 05-100 (Algo) A company's inventory records indicate the following... A company's inventory records indicate the following data for the month of January: If the company uses the LIFO perpetual inventory system, what would be the cost of the ending inventory? Multiple Choice $8,250. TB MC Qu. 05-84 (Algo) Ace Company reported the following... Ace Company reported the following information for the current year: The beginning inventory balance is correct. However, the ending inventory figure was overstated by $23,000. Given this information, the correct gross profit would be: Multiple Choice $124,500. TB MC Qu. 05-158 (Algo) Salmone Company reported... Salmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to the ending inventory using FIFO. Multiple Choice $3,370 $3,120 TB MC Qu. 05-97 (Algo) A company's inventory records indicate the following... A company's inventory records indicate the following data for the month of April: The company uses a periodic inventory system. Determine the cost assigned to ending inventory using the specific identification method. Ending inventory consists of 280 units from the April 16 purchase, 80 units from the April 7 purchase, and 100 units from beginning inventory. Multiple Choice $31,220. TB MC Qu. 05-135 (Algo) A company has the following... A company has the following purchases and sales during February. Using the FIFO periodic inventory method, what is the cost of the 12 units that are sold? Multiple Choice $360 TB MC Qu. 05-160 (Algo) Salmone Company reported... Salmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to ending inventory using LIFO. Multiple Choice $6,560 TB MC Qu. 05-163 (Algo) Salmone Company reported the following... Salmone Company reported the following purchases and sales of its only product. Salmone uses a periodic inventory system. Determine the cost assigned to cost of goods sold using FIFO. Multiple Choice $2,636 TB MC Qu. 05-164 (Algo) Salmone Company reported the following... Salmone Company reported the following purchases and sales of its only product. Salmone uses a periodic inventory system. Determine the cost assigned to ending inventory using LIFO. Multiple Choice $2,548 TB MC Qu. 05-137 (Algo) A company has... A company has the following purchases and sales during March. Using the FIFO perpetual inventory method, what was the cost of the 22 units sold? Multiple Choice $756 TB MC Qu. 05-122 (Algo) A company's inventory... A company's inventory records report the following in November of the current year: Using the LIFO perpetual inventory method, what was the amount recorded in the cost of goods sold account for the 12 units sold? Multiple Choice $654 TB MC Qu. 05-66 (Algo) Bedrock Company reported... Bedrock Company reported a December 31 ending inventory balance of $412,000. The following additional information is also available: - The ending inventory balance of $412,000 included $73,200 of consigned inventory for which Bedrock was the consignor. - The ending inventory balance of $412,000 incorrectly included $24,400 of office supplies that were stored in the warehouse and were to be used by the company's supervisors and managers during the coming year. Based on this information, the correct balance for ending inventory on December 31 is: Multiple Choice $412,000 TB MC Qu. 05-159 (Algo) Salmone Company reported... Salmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to cost of goods sold using FIFO. Multiple Choice $3,344 TB MC Qu. 05-109 (Algo) Marquis Company uses... Marquis Company uses a weighted-average perpetual inventory system and has the following purchases and sales: What is the amount of the cost of goods sold for this sale? (Round average cost per unit to 2 decimal places.) Multiple Choice $1,330.00 TB MC Qu. 05-121 (Algo) A company's inventory... A company's inventory records report the following: Using the FIFO perpetual inventory method, what is the value of the inventory at August 15 after the sale? Multiple Choice $260 TB MC Qu. 05-161 (Algo) Salmone Company reported... Salmone Company reported the following purchases and sales for its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to cost of goods sold using LIFO. Multiple Choice $3,060 TB MC Qu. 05-116 (Algo) Grays Company has... Grays Company has the following purchases and sales during the month of August. Using the FIFO perpetual inventory method, what amount will be reported as cost of goods sold for the 12 units that were sold? Multiple Choice $502. TB MC Qu. 05-165 (Algo) Salmone Company reported the following... Salmone Company reported the following purchases and sales for its only product. Salmone uses a periodic inventory system. Determine the cost assigned to cost of goods sold using LIFO. Multiple Choice $2,790 TB MC Qu. 05-131 (Algo) A company has the following products... A company has the following products in its ending inventory. Compute lower of cost or market for inventory applied separately to each product Multiple Choice $28,130 TB MC Qu. 05-162 (Algo) Salmone Company reported the following... Salmone Company reported the following purchases and sales of its only product. Salmone uses a periodic inventory system. Determine the cost assigned to the ending inventory using FIFO. Multiple Choice $3,318 TB MC Qu. 05-90 (Algo) Giorgio had cost of goods sold... Giorgio had cost of goods sold of $9,601 million, ending inventory of $2,269 million, and average inventory of $2,145 million. Its inventory turnover equals: Multiple Choice 4.24. 86.3 days