Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TB MC Qu. 15-145 (Algo) On January 1, 2024, Botosan... On January 1, 2024, Botosan Corporation leased equipment under a finance lease designed to earn

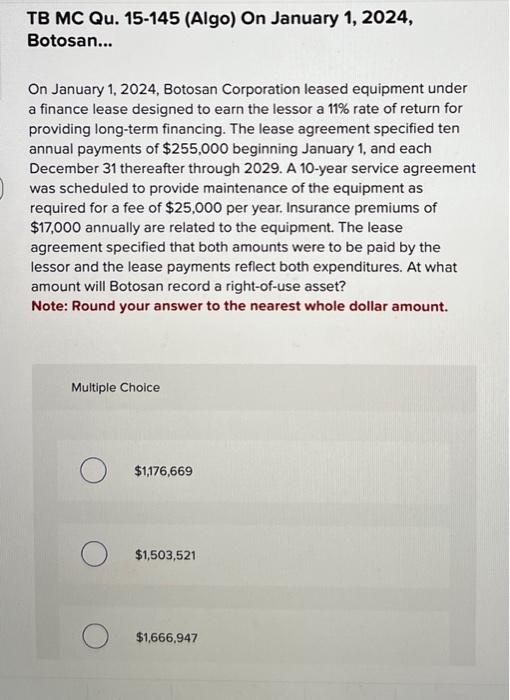

TB MC Qu. 15-145 (Algo) On January 1, 2024, Botosan... On January 1, 2024, Botosan Corporation leased equipment under a finance lease designed to earn the lessor a 11% rate of return for providing long-term financing. The lease agreement specified ten annual payments of $255,000 beginning January 1, and each December 31 thereafter through 2029. A 10-year service agreement was scheduled to provide maintenance of the equipment as required for a fee of $25,000 per year. Insurance premiums of $17,000 annually are related to the equipment. The lease agreement specified that both amounts were to be paid by the lessor and the lease payments reflect both expenditures. At what amount will Botosan record a right-of-use asset? Note: Round your answer to the nearest whole dollar amount. Multiple Choice O O O $1,176,669 $1,503,521 $1,666,947

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started