Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TB MC Qu. 23-50 (Algo) Factor Company estimates that producing a unit of product... Factor Company estimates that producing a unit of product would require

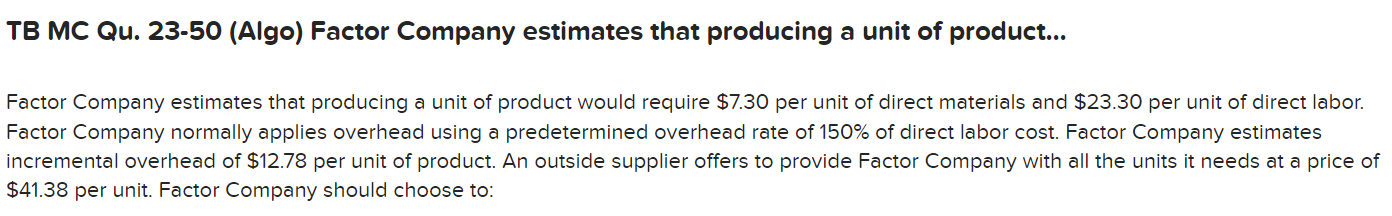

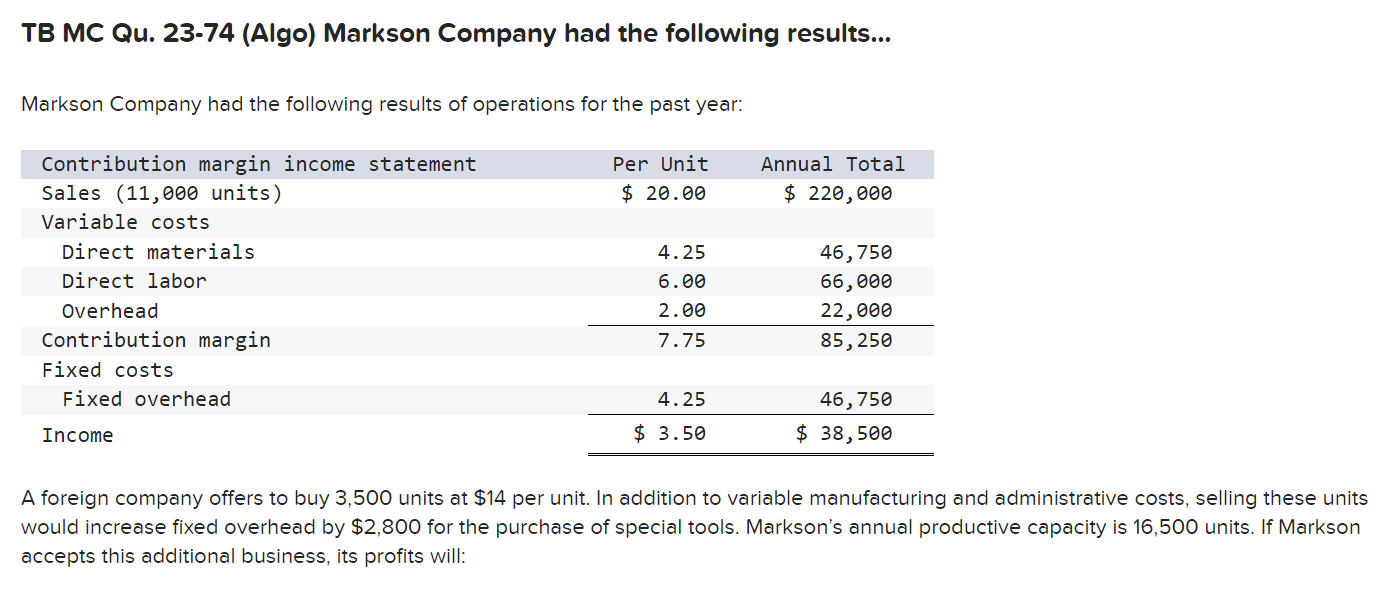

TB MC Qu. 23-50 (Algo) Factor Company estimates that producing a unit of product... Factor Company estimates that producing a unit of product would require $7.30 per unit of direct materials and $23.30 per unit of direct labor. Factor Company normally applies overhead using a predetermined overhead rate of 150% of direct labor cost. Factor Company estimates incremental overhead of $12.78 per unit of product. An outside supplier offers to provide Factor Company with all the units it needs at a price of $41.38 per unit. Factor Company should choose to: TB MC Qu. 23-74 (Algo) Markson Company had the following results... Markson Company had the following results of operations for the past year: A foreign company offers to buy 3,500 units at $14 per unit. In addition to variable manufacturing and administrative costs, selling these units would increase fixed overhead by $2,800 for the purchase of special tools. Markson's annual productive capacity is 16,500 units. If Markson accepts this additional business, its profits will

TB MC Qu. 23-50 (Algo) Factor Company estimates that producing a unit of product... Factor Company estimates that producing a unit of product would require $7.30 per unit of direct materials and $23.30 per unit of direct labor. Factor Company normally applies overhead using a predetermined overhead rate of 150% of direct labor cost. Factor Company estimates incremental overhead of $12.78 per unit of product. An outside supplier offers to provide Factor Company with all the units it needs at a price of $41.38 per unit. Factor Company should choose to: TB MC Qu. 23-74 (Algo) Markson Company had the following results... Markson Company had the following results of operations for the past year: A foreign company offers to buy 3,500 units at $14 per unit. In addition to variable manufacturing and administrative costs, selling these units would increase fixed overhead by $2,800 for the purchase of special tools. Markson's annual productive capacity is 16,500 units. If Markson accepts this additional business, its profits will Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started