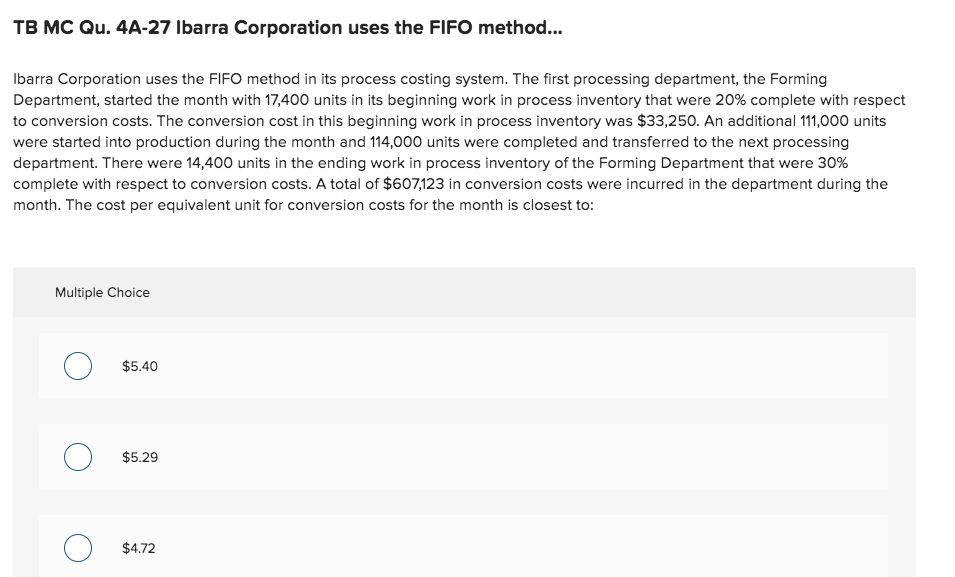

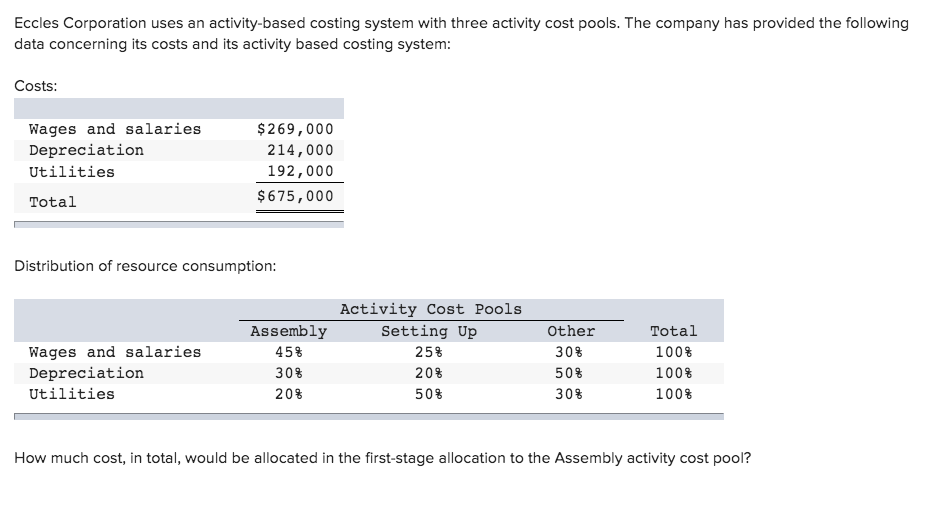

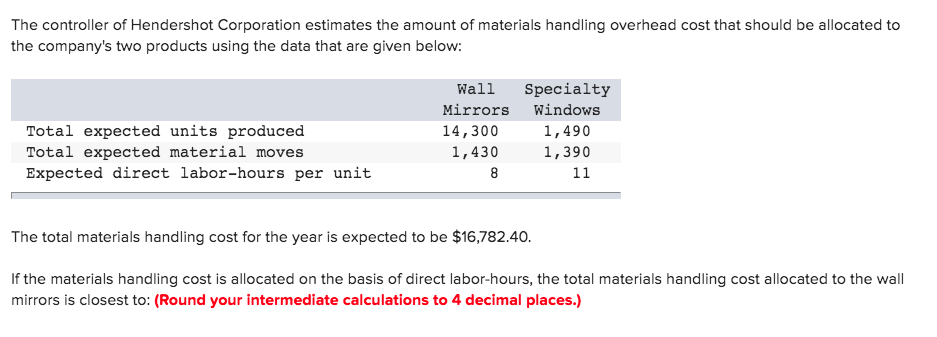

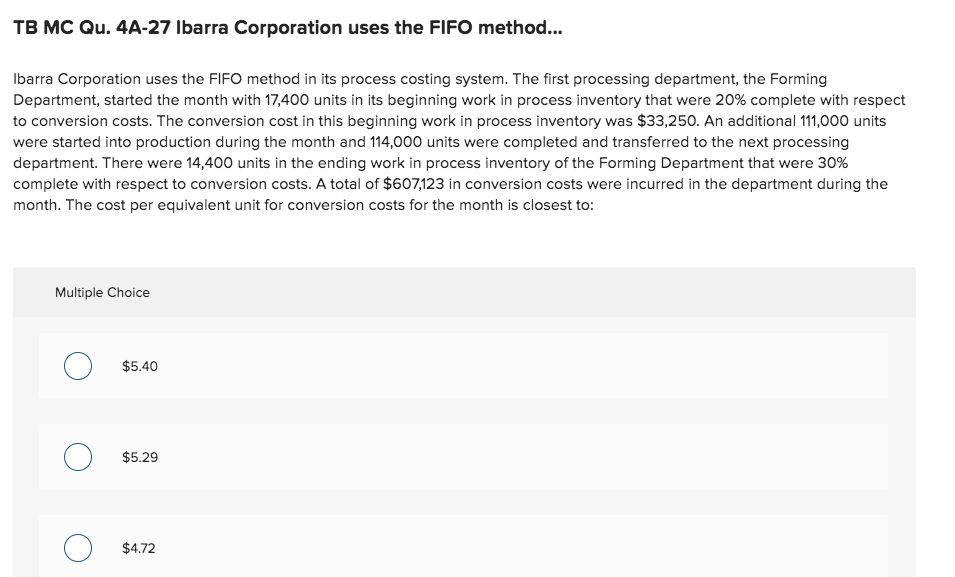

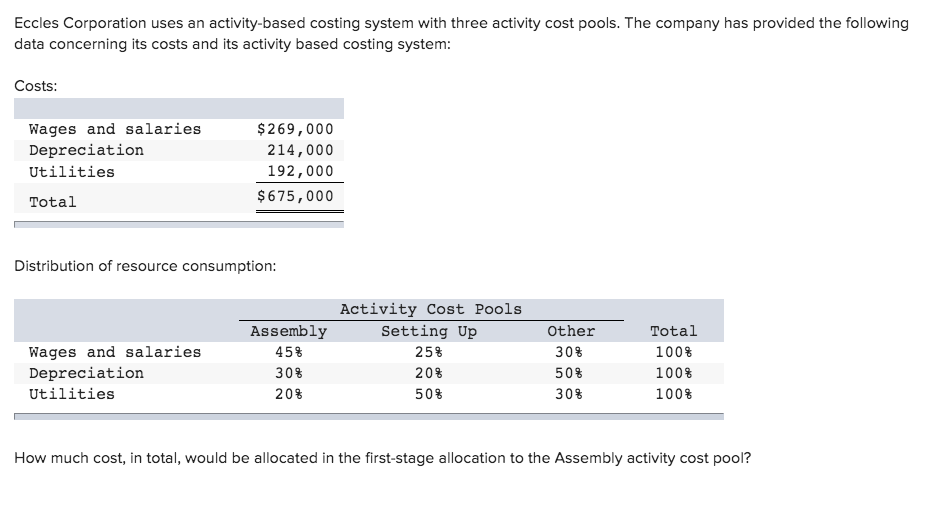

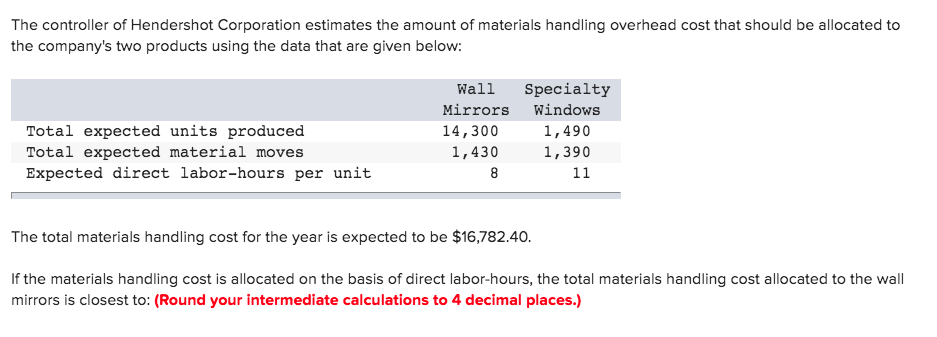

TB MC Qu. 4A-27 Ibarra Corporation uses the FIFO method... Ibarra Corporation uses the FIFO method in its process costing system. The first processing department, the Forming Department, started the month with 17,400 units in its beginning work in process inventory that were 20% complete with respect to conversion costs. The conversion cost in this beginning work in process inventory was $33,250. An additional 111,000 units were started into production during the month and 114,000 units were completed and transferred to the next processing department. There were 14,400 units in the ending work in process inventory of the Forming Department that were 30% complete with respect to conversion costs. A total of $607,123 in conversion costs were incurred in the department during the month. The cost per equivalent unit for conversion costs for the month is closest to: 1 0 $5.40 0 $5.29 0 $4.72 Eccles Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system: Costs: Wages and salaries Depreciation Utilities $ 269,000 214,000 192,000 $675,000 Total Distribution of resource consumption: Activity Cost Pools Setting Up 25% Wages and salaries Depreciation Utilities Assembly 45% 30% 20% Other 30% 50% 30% Total 100% 100% 100% 20% 50% How much cost, in total, would be allocated in the first stage allocation to the Assembly activity cost pool? The controller of Hendershot Corporation estimates the amount of materials handling overhead cost that should be allocated to the company's two products using the data that are given below: Total expected units produced Total expected material moves Expected direct labor-hours per unit Wall Specialty Mirrors Windows 14,300 1,490 1,430 1,390 8 11 The total materials handling cost for the year is expected to be $16,782.40. If the materials handling cost is allocated on the basis of direct labor-hours, the total materials handling cost allocated to the wall mirrors is closest to: (Round your intermediate calculations to 4 decimal places.)