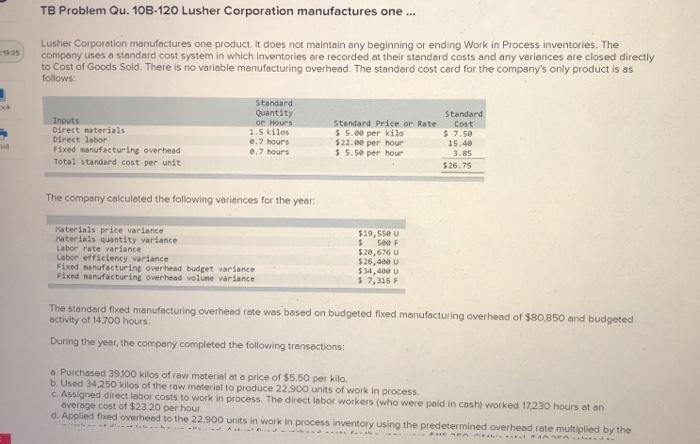

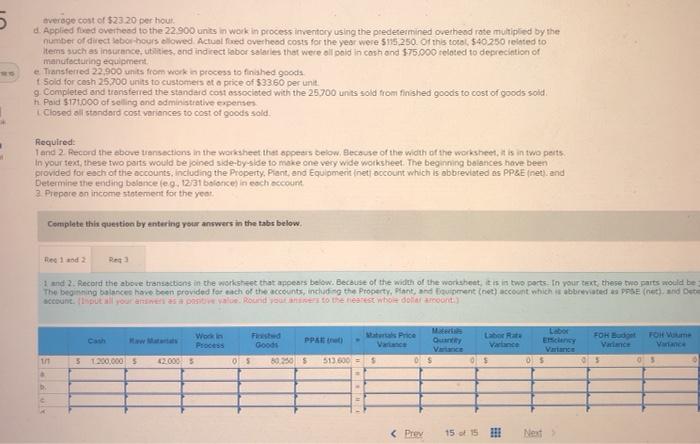

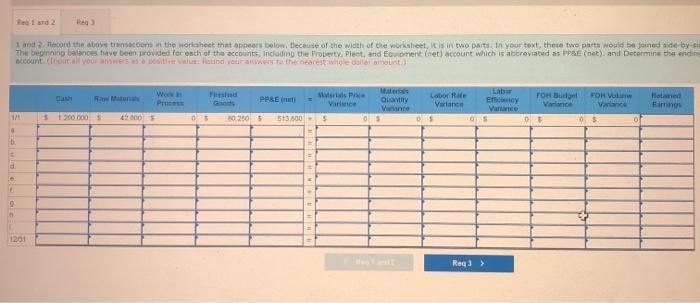

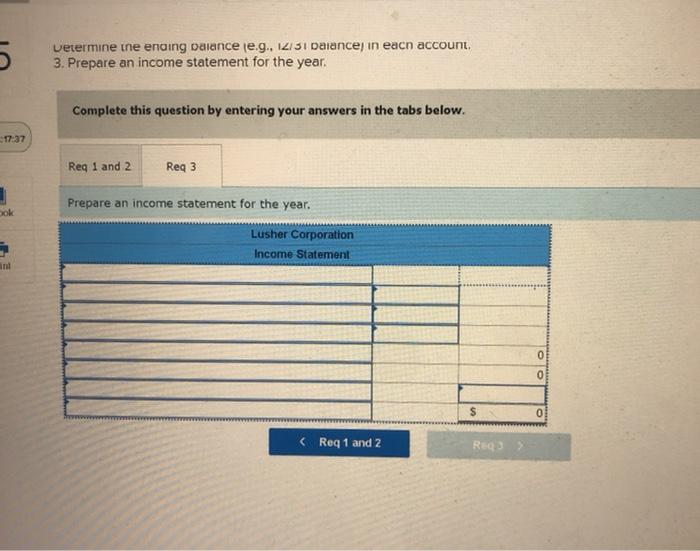

TB Problem Qu. 10B-120 Lusher Corporation manufactures one... Lusher Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variences are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows: Inputs Direct materials Direct labor Fixed manufacturing overhead Total standard cost per unit Standard Quantity or Hours 1.5 kilos .. 7 hours e. 7 hours Standard Price or Rate $ 5.00 per kilo $22.00 per hour 5 5.50 per hour Standard Cost $ 7.50 15.40 3.85 $26.75 The company calculated the following variences for the year Materials price variance Materiais quantity variance Labor rate variance Labor efficiency variance Fixed manufacturing overhead budget variance Fixed manufacturing overhead volune variance $19,550 5 500F $20,6760 $26,400 $ 54,400 W $ 7,315 The standard fived manufacturing overheed rate was based on budgeted fixed manufacturing over head of $80,850 and budgeted activity of 14.700 hours During the year, the company completed the following transactions: Purchased 39100 kilos of raw material at a price of $5,50 per kilo. b. Used 34,250 kilos of the raw material to produce 22,900 units of work in process c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cashi worked 17,230 hours at an average cost of $23.20 per hour d. Applied fixed overhead to the 22.900 units in work in process inventory using the predetermined overhead rate multiplied by the A tverage cost of $23.20 per hout d. Applied feed overhead to the 22.900 units in work in process inventory using the predetermined ovethend rate multiplied by the number of direct bor bours allowed Actueled overhead costs for the year were 515.250 of this total $40250 reinted to Items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $75,000 related to depreciation of manufacturing equipment e Transferred 22.900 units from work in process to finished goods Sold for cash 25.700 units to customers at a price of $3360 per unit 9. Completed and transferred the standard cost associated with the 25700 units sold from finished goods to cost of goods sold h Paid $171000 of selling and administrative expenses Closed all standard cost variances to cost of goods sold Required: and 2. Record the sbove transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts in your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property. Piant, and Equipment (net account which is abbreviated as PPEE net) and Determine the ending balance le... 12/31 balone in each account 2. Prepare an income statement for the year Complete this question by entering your answers in the tabs below. Read 2 and 2. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text these two parts would be The beginning balance have been provided for each of the accounts, including the property, plant, and tourment (net) account which is abbreviated PPE (net), and Det account at all your tale Round to rest word dollar amount) Work in PPA FOHB Valance Quy Foi me Valace Goodi Ercancy Variance 05 th 5 200,000 20005 05 80505 513 600 = 5 0$ os 15 of 15 !!! Net Retard 2 Ra 1 and Mecord the above con the worlaneet that appears below. Because of the width of the worksheet, is in two parts. In your text, these two parts would be joined side by su The beginning balances have been provided for each of the accounts, including the Property. Plent, and Ecument (net account which is abbreviated as PSE (nat) and Determine the endine account (nout voor answers thround your awers to the nearest we dollar amount PPSE wo Proces 20005 Fished Goods 302505 Malas Varance 5 Matarts Oy Variant 0$ Laborate Variance Emaily Varian OS OS FOH Budget FOH V Variance Variance 05 Haland Earings 200 000 $ 5+3.500 d le 9 1201 Reg 3 > vetermine the ending balance (e.g., IZISI Darance in eacn account, 3. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. 17:37 Req 1 and 2 Reg 3 Sok Prepare an income statement for the year. Lusher Corporation Income Statement and 0 0 $ 0 ( Req 1 and 2 Reg TB Problem Qu. 10B-120 Lusher Corporation manufactures one... Lusher Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variences are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows: Inputs Direct materials Direct labor Fixed manufacturing overhead Total standard cost per unit Standard Quantity or Hours 1.5 kilos .. 7 hours e. 7 hours Standard Price or Rate $ 5.00 per kilo $22.00 per hour 5 5.50 per hour Standard Cost $ 7.50 15.40 3.85 $26.75 The company calculated the following variences for the year Materials price variance Materiais quantity variance Labor rate variance Labor efficiency variance Fixed manufacturing overhead budget variance Fixed manufacturing overhead volune variance $19,550 5 500F $20,6760 $26,400 $ 54,400 W $ 7,315 The standard fived manufacturing overheed rate was based on budgeted fixed manufacturing over head of $80,850 and budgeted activity of 14.700 hours During the year, the company completed the following transactions: Purchased 39100 kilos of raw material at a price of $5,50 per kilo. b. Used 34,250 kilos of the raw material to produce 22,900 units of work in process c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cashi worked 17,230 hours at an average cost of $23.20 per hour d. Applied fixed overhead to the 22.900 units in work in process inventory using the predetermined overhead rate multiplied by the A tverage cost of $23.20 per hout d. Applied feed overhead to the 22.900 units in work in process inventory using the predetermined ovethend rate multiplied by the number of direct bor bours allowed Actueled overhead costs for the year were 515.250 of this total $40250 reinted to Items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $75,000 related to depreciation of manufacturing equipment e Transferred 22.900 units from work in process to finished goods Sold for cash 25.700 units to customers at a price of $3360 per unit 9. Completed and transferred the standard cost associated with the 25700 units sold from finished goods to cost of goods sold h Paid $171000 of selling and administrative expenses Closed all standard cost variances to cost of goods sold Required: and 2. Record the sbove transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts in your text, these two parts would be joined side-by-side to make one very wide worksheet. The beginning balances have been provided for each of the accounts, including the Property. Piant, and Equipment (net account which is abbreviated as PPEE net) and Determine the ending balance le... 12/31 balone in each account 2. Prepare an income statement for the year Complete this question by entering your answers in the tabs below. Read 2 and 2. Record the above transactions in the worksheet that appears below. Because of the width of the worksheet, it is in two parts. In your text these two parts would be The beginning balance have been provided for each of the accounts, including the property, plant, and tourment (net) account which is abbreviated PPE (net), and Det account at all your tale Round to rest word dollar amount) Work in PPA FOHB Valance Quy Foi me Valace Goodi Ercancy Variance 05 th 5 200,000 20005 05 80505 513 600 = 5 0$ os 15 of 15 !!! Net Retard 2 Ra 1 and Mecord the above con the worlaneet that appears below. Because of the width of the worksheet, is in two parts. In your text, these two parts would be joined side by su The beginning balances have been provided for each of the accounts, including the Property. Plent, and Ecument (net account which is abbreviated as PSE (nat) and Determine the endine account (nout voor answers thround your awers to the nearest we dollar amount PPSE wo Proces 20005 Fished Goods 302505 Malas Varance 5 Matarts Oy Variant 0$ Laborate Variance Emaily Varian OS OS FOH Budget FOH V Variance Variance 05 Haland Earings 200 000 $ 5+3.500 d le 9 1201 Reg 3 > vetermine the ending balance (e.g., IZISI Darance in eacn account, 3. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. 17:37 Req 1 and 2 Reg 3 Sok Prepare an income statement for the year. Lusher Corporation Income Statement and 0 0 $ 0 ( Req 1 and 2 Reg