Question

TBA, Inc., manufactures and sells concrete block for residential and commercial building. TBA expects to sell the following in 20x1:TBA expects the following unit sales

TBA, Inc., manufactures and sells concrete block for residential and commercial building. TBA expects to sell the following in 20x1:TBA expects the following unit sales and desired ending inventory in 20x1:Inventory on both January 1, 20x1, and January 1, 20x2, is expected to be 100,000 blocks.Each block requires 26 pounds of raw materials (a mixture of cement, sand, gravel, shale, pumice, and water). TBA's raw materials inventory policy is to have 5 million pounds in ending inventory for the third and fourth quarters and 8 million pounds in ending inventory for the first and second quarters. Thus, desired direct materials inventory on both January 1, 20x1, and January 1, 20x2, is 5,000,000 pounds of materials. Each pound of raw materials costs $0.01.Each block requires 0.015 direct labor hour; direct labor is paid $14 per direct labor hour.Variable overhead is $8 per direct labor hour. Fixed overhead is budgeted at $320,000 per quarter ($100,000 for supervision, $200,000 for depreciation, and $20,000 for rent).TBA also provided the information that beginning finished goods inventory is $55,000; and the ending finished goods inventory budget for ABT for the year $67,000.

TBA's only variable marketing expense is a $0.05 commission per unit (block) sold. Fixed marketing expenses for each quarter include the following:

Advertising expense is $10,000 in Quarters 1, 3, and 4. However, at the beginning of the summer building season, TBA increases advertising; in Quarter 2, advertising expense is $15,000.TBA has no variable administrative expense. Fixed administrative expenses for each quarter include the following:Income taxes are paid at the rate of 30 percent of operating income.Of the sales on account, 70 percent are collected in the quarter of sale; the remaining 30 percent are collected in the quarter following the sale. Total sales for the fourth quarter of 20x0 totaled $2,000,000.All materials are purchased on account; 80 percent of purchases are paid for in the quarter of purchase. The remaining 20 percent are paid in the following quarter. The purchases for the fourth quarter of 20x0 were $500,000.TBA requires a $100,000 minimum cash balance for the end of each quarter. On December 31, 20x0, the cash balance was $120,000.Money can be borrowed and repaid in multiples of $100,000. Interest is 12 percent per year. Interest payments are made only for the amount of the principal being repaid. All borrowing takes place at the beginning of a quarter, and all repayment takes place at the end of a quarter.Budgeted depreciation is $200,000 per quarter for overhead, $5,000 for marketing expense, and $12,000 for administrative expense. (Remember that depreciation is not a cash expense and must be deleted from total expenses before the cash budget is prepared.)The capital budget for 20x1 revealed plans to purchase additional equipment for $600,000 in the first quarter. The acquisition will be financed with operating cash, supplementing it with short-term loans as necessary.Corporate income taxes of $20,700 will be paid at the end of the fourth quarter.

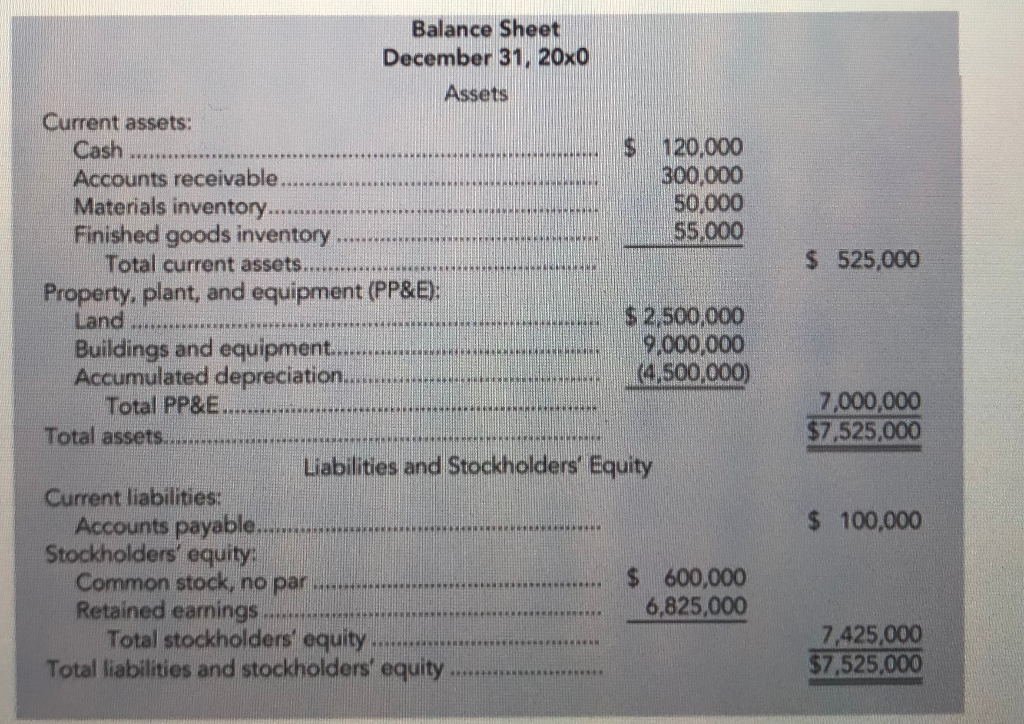

The balance sheet for the beginning of the year is given:

6. Prepare a cost of goods sold budget for the coming year.7. Construct a marketing expense budget for the coming year. Show total amounts by quarter and in total for the year 8. Construct an administrative expense budget for the coming year. Show total amounts by quarter and in total for the year. 9. Construct a budgeted income statement for the coming year.

$ 525,000 Balance Sheet December 31, 20x0 Assets Current assets: Cash $ 120,000 Accounts receivable........ 300,000 Materials inventory.......... 50,000 Finished goods inventory 55,000 Total current assets......... Property, plant, and equipment (PP&E): Land .. . $ 2,500,000 Buildings and equipment.. 9,000,000 Accumulated depreciation.... (4,500,000) Total PP&E....... Total assets........... Liabilities and Stockholders' Equity Current liabilities: Accounts payable........ Stockholders' equity: Common stock, no par 600,000 Retained earnings ........... 6,825,000 Total stockholders' equity....... Total liabilities and stockholders' equity 7,000,000 $7,525,000 $ 100,000 MEN 7,425,000 $7,525,000 $ 525,000 Balance Sheet December 31, 20x0 Assets Current assets: Cash $ 120,000 Accounts receivable........ 300,000 Materials inventory.......... 50,000 Finished goods inventory 55,000 Total current assets......... Property, plant, and equipment (PP&E): Land .. . $ 2,500,000 Buildings and equipment.. 9,000,000 Accumulated depreciation.... (4,500,000) Total PP&E....... Total assets........... Liabilities and Stockholders' Equity Current liabilities: Accounts payable........ Stockholders' equity: Common stock, no par 600,000 Retained earnings ........... 6,825,000 Total stockholders' equity....... Total liabilities and stockholders' equity 7,000,000 $7,525,000 $ 100,000 MEN 7,425,000 $7,525,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started