Question

TDB Limited has prepared the following information for the current year. The company has paid all income taxes related to prior years but has

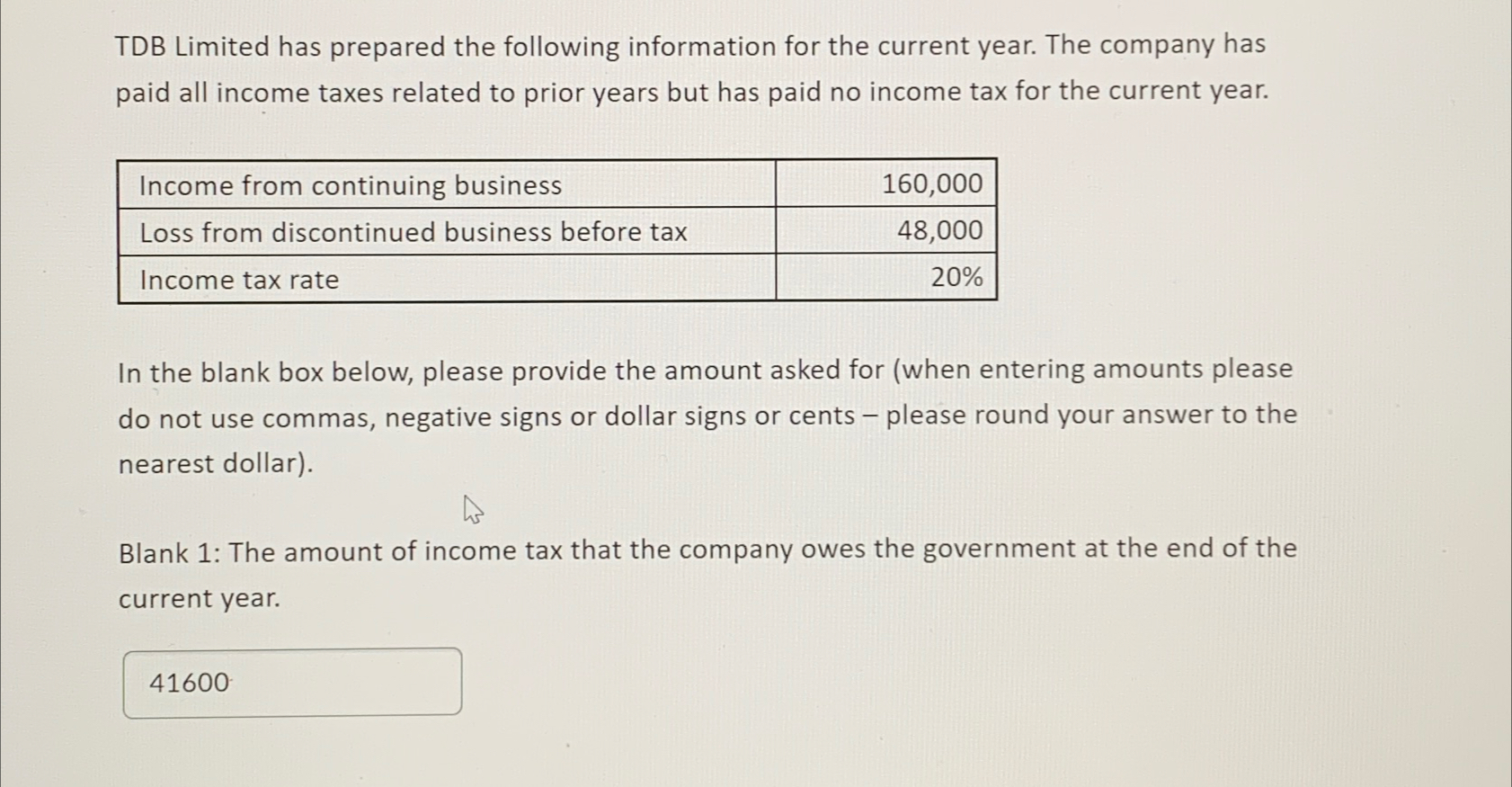

TDB Limited has prepared the following information for the current year. The company has paid all income taxes related to prior years but has paid no income tax for the current year. Income from continuing business 160,000 Loss from discontinued business before tax Income tax rate 48,000 20% In the blank box below, please provide the amount asked for (when entering amounts please do not use commas, negative signs or dollar signs or cents - please round your answer to the nearest dollar). Blank 1: The amount of income tax that the company owes the government at the end of the current year. 41600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution To calculate the income tax for the current year we need to consider the income fr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

7th edition

978-0077614041, 9780077446475, 77614046, 007744647X, 77647092, 978-0077647094

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App