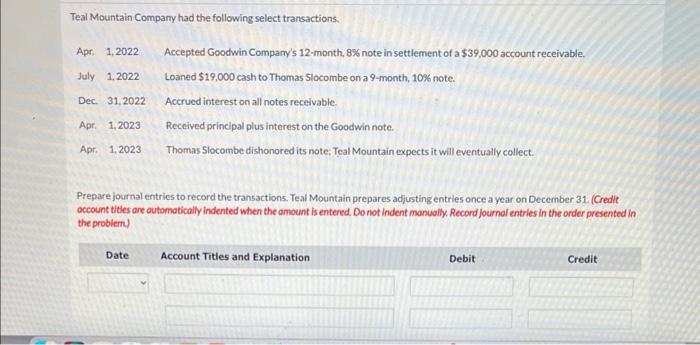

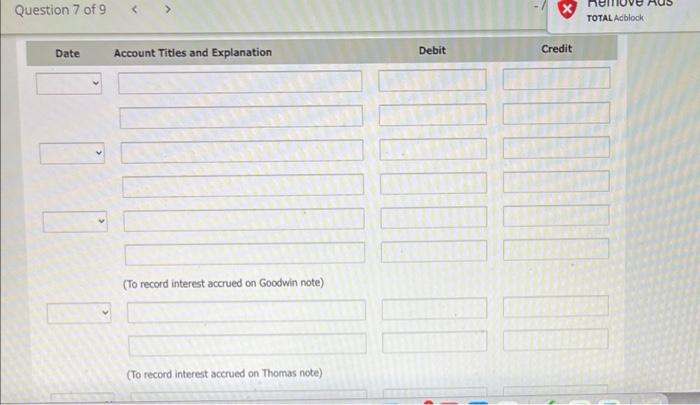

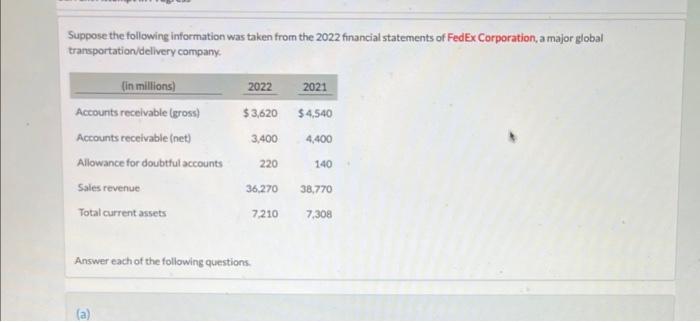

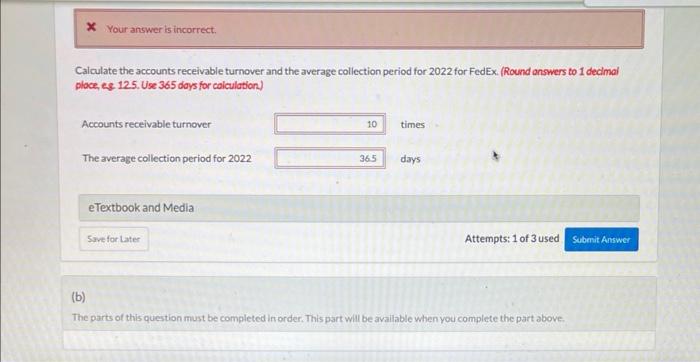

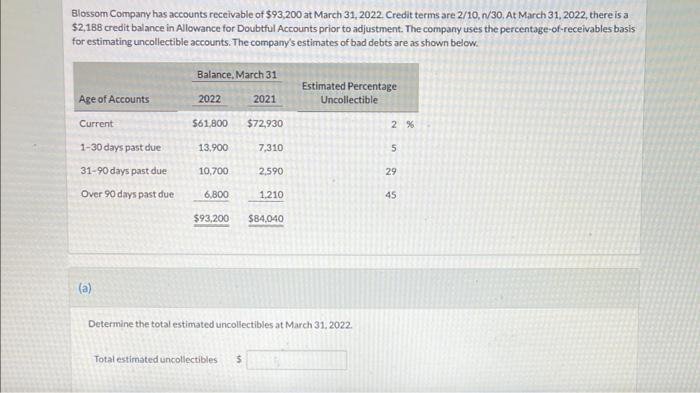

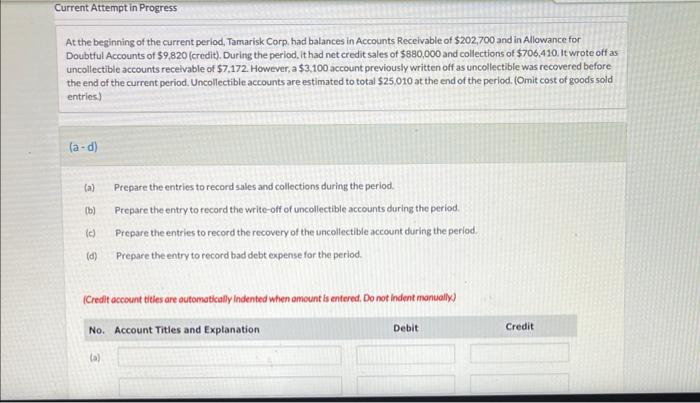

Teal Mountain Company had the following select transactions. Apr. 1,2022 Accepted Goodwin Company's 12-month, 8% note in settlement of a $39,000 account receivable. Loaned $19,000 cash to Thomas Slocombe on a 9-month, 10% note. July 1,2022 Dec. 31,2022 Accrued interest on all notes receivable. Apr. 1.2023 Received principal plus interest on the Goodwin note. Apr. 1.2023 Thomas Slocombe dishonored its note: Teal Mountain expects it will eventually collect. Prepare journal entries to record the transactions. Teal Mountain prepares adjusting entries once a year on December 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem) Date Account Titles and Explanation Debit Credit Question 7 of 9 Date Account Titles and Explanation (To record interest accrued on Goodwin note) (To record interest accrued on Thomas note) Debit Credit TOTAL Adblock Suppose the following information was taken from the 2022 financial statements of FedEx Corporation, a major global transportation/delivery company. (in millions) Accounts receivable (gross) Accounts receivable (net) Allowance for doubtful accounts Sales revenue Total current assets 2022 $3,620 (a) 2021 $4,540 3,400 4,400 220 36,270 38,770 7,210 7,308 Answer each of the following questions. 140 * Your answer is incorrect. Calculate the accounts receivable turnover and the average collection period for 2022 for FedEx. (Round answers to 1 decimal ploce, eg 12.5. Use 365 days for calculation) Accounts receivable turnover The average collection period for 2022 eTextbook and Media Save for Later 10 36.5 times days Attempts: 1 of 3 used (b) The parts of this question must be completed in order. This part will be available when you complete the part above. Submit Answer Blossom Company has accounts receivable of $93,200 at March 31, 2022. Credit terms are 2/10, n/30. At March 31, 2022, there is a $2,188 credit balance in Allowance for Doubtful Accounts prior to adjustment. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The company's estimates of bad debts are as shown below. Age of Accounts Current 1-30 days past due 31-90 days past due Over 90 days past due (a) Balance, March 31 2022 2021 $61,800 13,900 10,700 7,310 2,590 1.210 $93,200 $84,040 6,800 $72,930 Total estimated uncollectibles $ Estimated Percentage Uncollectible Determine the total estimated uncollectibles at March 31, 2022. 2% 5 29 45 Current Attempt in Progress At the beginning of the current period. Tamarisk Corp. had balances in Accounts Receivable of $202,700 and in Allowance for Doubtful Accounts of $9,820 (credit). During the period, it had net credit sales of $880,000 and collections of $706,410. It wrote off as uncollectible accounts receivable of $7.172. However, a $3,100 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,010 at the end of the period. (Omit cost of goods sold entries) (a-d) (a) (b) (c) (d) Prepare the entries to record sales and collections during the period. Prepare the entry to record the write-off of uncollectible accounts during the period. Prepare the entries to record the recovery of the uncollectible account during the period. Prepare the entry to record bad debt expense for the period. (Credit account titles are automatically Indented when amount is entered. Do not indent manually) No. Account Titles and Explanation (a) Debit Credit