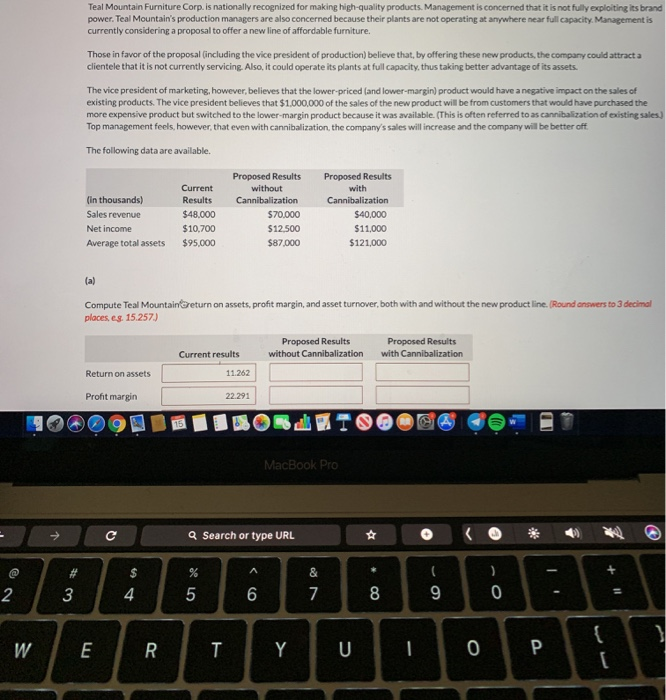

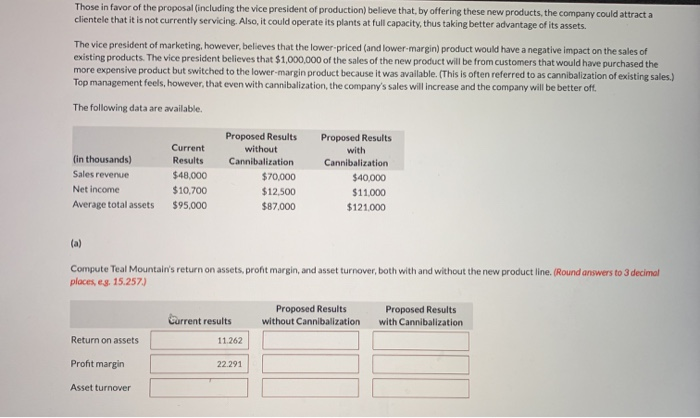

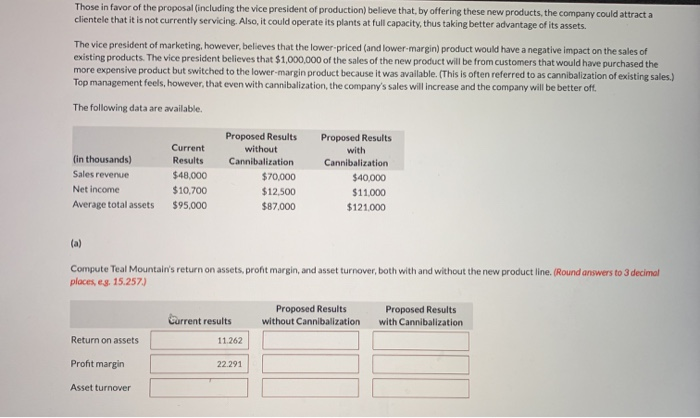

Teal Mountain Furniture Corp. is nationally recognized for making high-quality products. Management is concerned that it is not fully exploiting its power. Teal Mountain's production managers are also concerned because their plants are not operating at anywhere near full capacity. Managementi currently considering a proposal to offfer a new line of affordable furniture. Those in favor of the proposal (including the vice president of production) believe that, by offering these new products, the company could attract a clientele that it is not currently servicing. Also, it could operate its plants at full capacity, thus taking better advantage of its assets. The vice president of marketing, however, believes that the lower-priced (and lower-margin) product would have a negative impact on the sales of existing products. The vice president believes that $1.000,000 of the sales of the new product will be from customers that would have purchased the more expensive product but switched to the lower-margin product because it was available. (This is often referred to as cannibalization of existing sal Top management feels, however, that even with cannibalization, the company's sales will increase and the company will be better off. The following data are available. Proposed Results Proposed Results Current without with (in thousands) Results Cannibalization Cannibalization Sales revenue $48,000 $40,000 $70.000 Net income $10,700 $12,500 $11,000 $95,000 $87,000 $121,000 Average total assets (al Compute Teal MountainGreturn on assets, profit margin, and asset turnover, both with and without the new product line. (Round answers to 3 decimal places, e.g. 15.257) Proposed Results Proposed Results with Cannibalization without Cannibalization Current results 11.262 Return on assets Profit margin 22.291 MacBook Pro Q Search or type URL # $ 0 9 4 7 2 3 { U 0 P R T Y W + OC CO LO LU Those in favor of the proposal (including the vice president of production) believe that, by offering these new products, the company could attract a clientele that it is not currently servicing. Also, it could operate its plants at full capacity, thus taking better advantage of its assets The vice president of marketing, however, believes that the lower-priced (and lower-margin) product would have a negative impact on the sales of existing products. The vice president believes that $1,000,000 of the sales of the new product will be from customers that would have purchased the more expensive product but switched to the lower-margin product because it was available. (This is often referred to as cannibalization of existing sales.) Top management feels, however, that even with cannibalization, the company's sales will increase and the company will be better off. The following data are available. Proposed Results Proposed Results Current Results without Cannibalization with (in thousands) Cannibalization Sales revenue $48,000 $70,000 $40,000 Net income $10,700 $12,500 $11,000 Average total assets $95,000 $87,000 $121,000 (a) Compute Teal Mountain's return on assets, profit margin, and asset turnover, both with and without the new product line. (Round answers to 3 decimal places, eg. 15.257) Proposed Results without Cannibalization Proposed Results with Cannibalization Corrent results Return on assets 11.262 Profit margin 22.291 Asset turnover