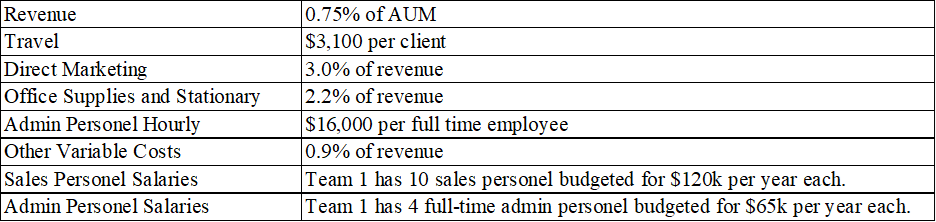

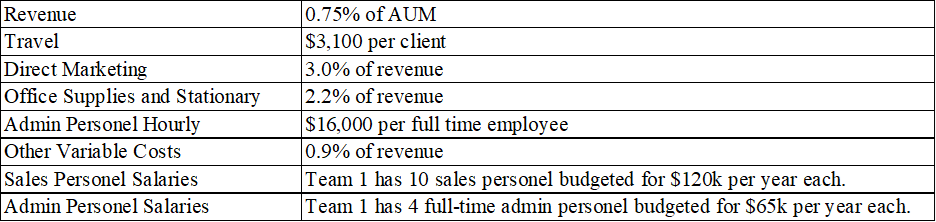

Team 1s revenue and expense formulas used for flexible budget are provided:

A) Using the formulas above, calculate the flexible budget for Team 1, using last years AUM from page 1. Exclude all allocated overhead from this budget. Expenses estimated based on revenue should use actual revenue also from page 1.

B) Using your flexible budget calculate the revenue and expense spending variances for Team 1.

C) Based on these variances comment on whether the Team 1s manager is doing a good job of managing the department. Your answer should be about one paragraph highlight the notable variances

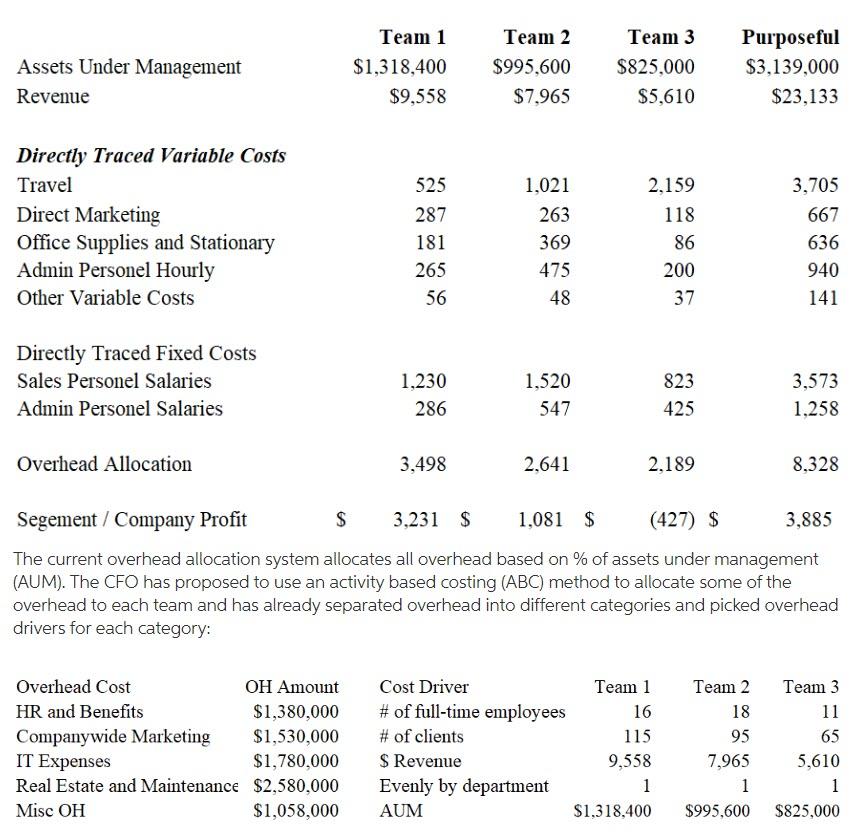

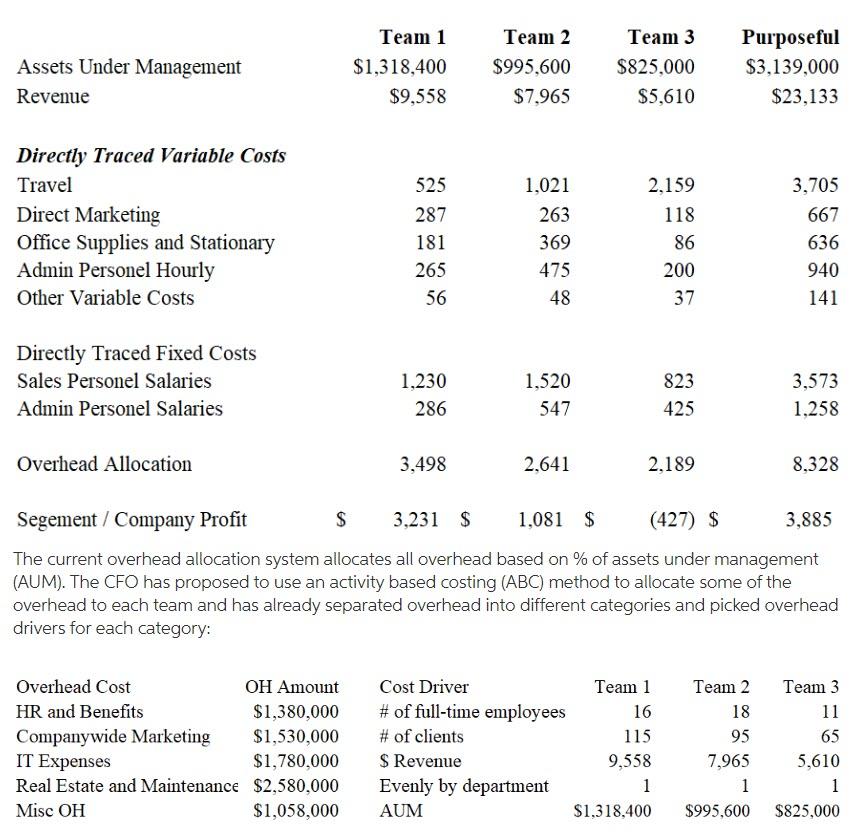

Revenue Travel Direct Marketing Office Supplies and Stationary Admin Personel Hourly Other Variable Costs Sales Personel Salaries Admin Personel Salaries 0.75% of AUM $3,100 per client 3.0% of revenue 2.2% of revenue $16,000 per full time employee 0.9% of revenue Team 1 has 10 sales personel budgeted for $120k per year each. Team 1 has 4 full-time admin personel budgeted for $65k per year each. Team 1 Team 2 Team 3 Assets Under Management $1,318,400 $995,600 $825,000 Revenue $9,558 $7.965 $5,610 Directly Traced Variable Costs Travel 525 1,021 2,159 Direct Marketing 287 263 118 Office Supplies and Stationary 181 369 86 Admin Personel Hourly 265 475 200 Other Variable Costs 56 48 37 Directly Traced Fixed Costs Sales Personel Salaries 1,230 1,520 823 Admin Personel Salaries 286 547 425 Overhead Allocation 3,498 2,641 2,189 Segement Company Profit $ 3,231 $ 1,081 $ (427) S 3,885 The current overhead allocation system allocates all overhead based on % of assets under management (AUM). The CFO has proposed to use an activity based costing (ABC) method to allocate some of the overhead to each team and has already separated overhead into different categories and picked overhead drivers for each category: Overhead Cost Cost Driver Team 1 Team 2 Team 3 OH Amount $1,380,000 HR and Benefits 16 18 11 # of full-time employees # of clients Companywide Marketing $1,530,000 95 65 IT Expenses $1,780,000 $ Revenue 7,965 5,610 Real Estate and Maintenance $2,580,000 Evenly by department 1 1 Misc OH $995,600 $825,000 $1,058,000 AUM 115 9,558 1 $1,318,400 Purposeful $3,139,000 $23,133 3,705 667 636 940 141 3,573 1,258 8.328 Revenue Travel Direct Marketing Office Supplies and Stationary Admin Personel Hourly Other Variable Costs Sales Personel Salaries Admin Personel Salaries 0.75% of AUM $3,100 per client 3.0% of revenue 2.2% of revenue $16,000 per full time employee 0.9% of revenue Team 1 has 10 sales personel budgeted for $120k per year each. Team 1 has 4 full-time admin personel budgeted for $65k per year each. Team 1 Team 2 Team 3 Assets Under Management $1,318,400 $995,600 $825,000 Revenue $9,558 $7.965 $5,610 Directly Traced Variable Costs Travel 525 1,021 2,159 Direct Marketing 287 263 118 Office Supplies and Stationary 181 369 86 Admin Personel Hourly 265 475 200 Other Variable Costs 56 48 37 Directly Traced Fixed Costs Sales Personel Salaries 1,230 1,520 823 Admin Personel Salaries 286 547 425 Overhead Allocation 3,498 2,641 2,189 Segement Company Profit $ 3,231 $ 1,081 $ (427) S 3,885 The current overhead allocation system allocates all overhead based on % of assets under management (AUM). The CFO has proposed to use an activity based costing (ABC) method to allocate some of the overhead to each team and has already separated overhead into different categories and picked overhead drivers for each category: Overhead Cost Cost Driver Team 1 Team 2 Team 3 OH Amount $1,380,000 HR and Benefits 16 18 11 # of full-time employees # of clients Companywide Marketing $1,530,000 95 65 IT Expenses $1,780,000 $ Revenue 7,965 5,610 Real Estate and Maintenance $2,580,000 Evenly by department 1 1 Misc OH $995,600 $825,000 $1,058,000 AUM 115 9,558 1 $1,318,400 Purposeful $3,139,000 $23,133 3,705 667 636 940 141 3,573 1,258 8.328