Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TeaTime is a business that manufactures and sells porcelain tea sets. The business is based in Johannesburg, and has end of 31 July. All

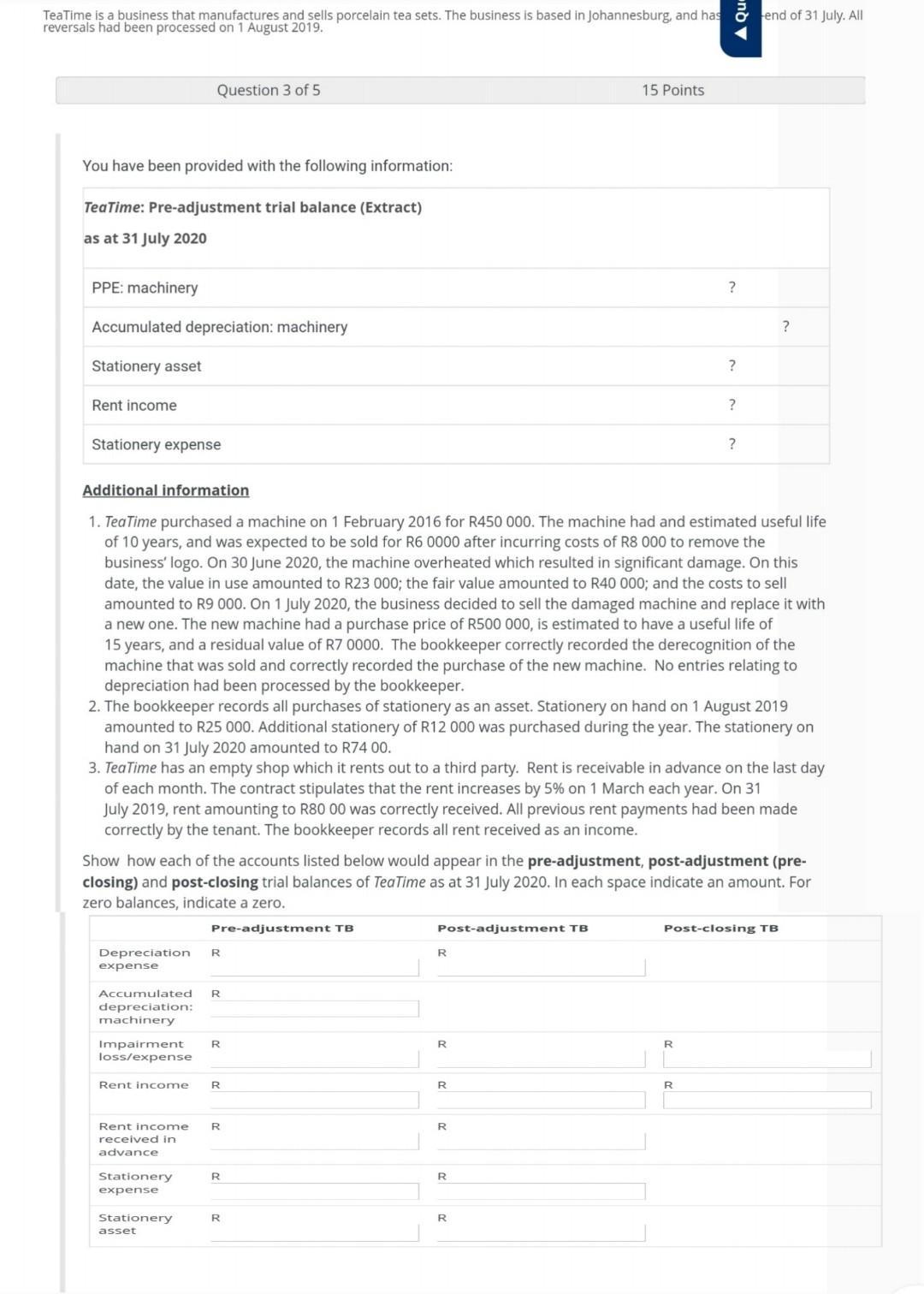

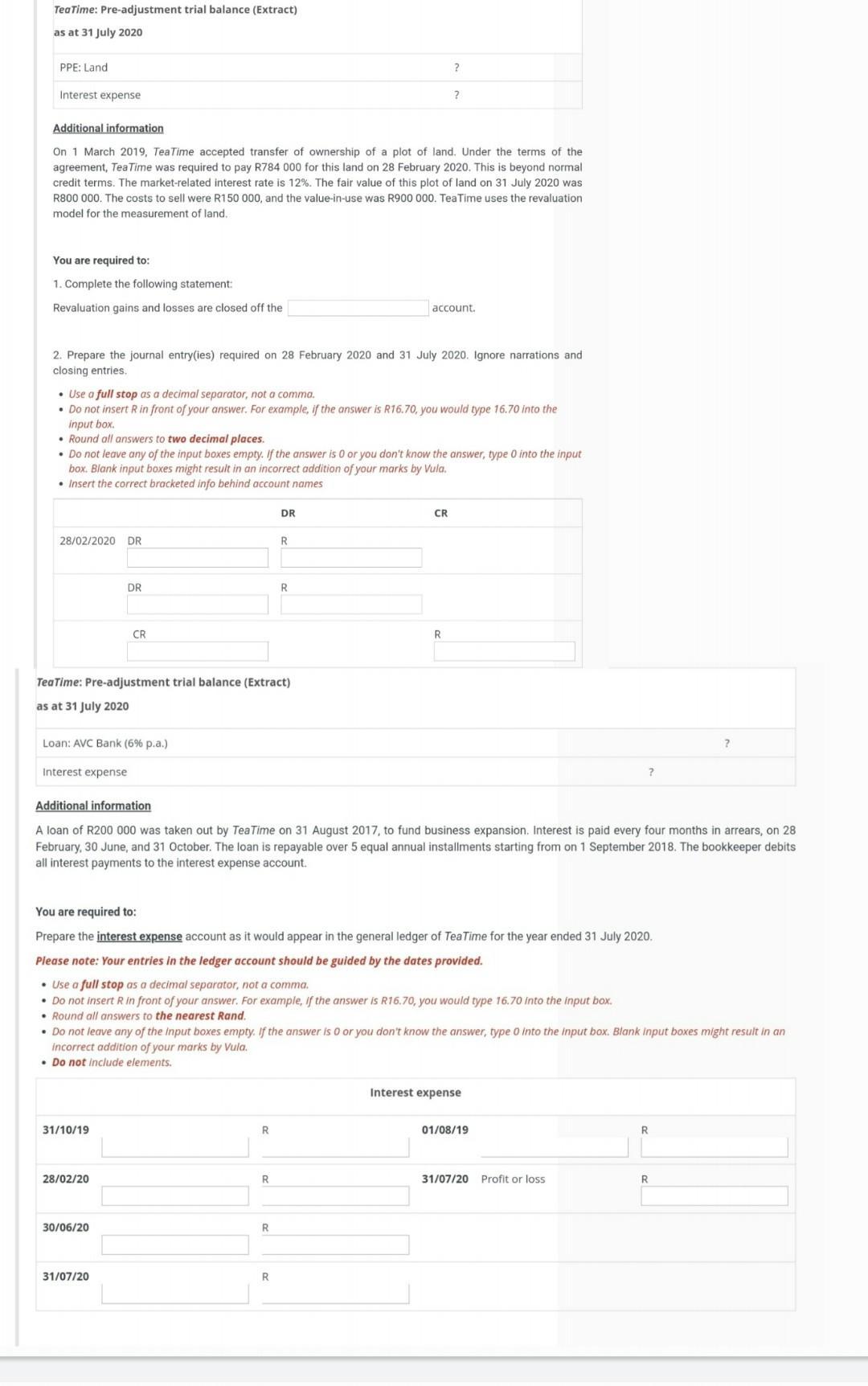

TeaTime is a business that manufactures and sells porcelain tea sets. The business is based in Johannesburg, and has end of 31 July. All reversals had been processed on 1 August 2019. You have been provided with the following information: TeaTime: Pre-adjustment trial balance (Extract) as at 31 July 2020 PPE: machinery Accumulated depreciation: machinery Stationery asset Rent income Question 3 of 5 Stationery expense Depreciation R expense Accumulated R depreciation: machinery Impairment R loss/expense Rent income R Additional information 1. TeaTime purchased a machine on 1 February 2016 for R450 000. The machine had and estimated useful life of 10 years, and was expected to be sold for R6 0000 after incurring costs of R8 000 to remove the business' logo. On 30 June 2020, the machine overheated which resulted in significant damage. On this date, the value in use amounted to R23 000; the fair value amounted to R40 000; and the costs to sell amounted to R9 000. On 1 July 2020, the business decided to sell the damaged machine and replace it with a new one. The new machine had a purchase price of R500 000, is estimated to have a useful life of 15 years, and a residual value of R7 0000. The bookkeeper correctly recorded the derecognition of the machine that was sold and correctly recorded the purchase of the new machine. No entries relating to depreciation had been processed by the bookkeeper. 2. The bookkeeper records all purchases of stationery as an asset. Stationery on hand on 1 August 2019 amounted to R25 000. Additional stationery of R12 000 was purchased during the year. The stationery on hand on 31 July 2020 amounted R74 00. 3. TeaTime has an empty shop which it rents out to a third party. Rent is receivable in advance on the last day of each month. The contract stipulates that the rent increases by 5% on 1 March each year. On 31 July 2019, rent amounting to R80 00 was correctly received. All previous rent payments had been made correctly by the tenant. The bookkeeper records all rent received as an income. Rent income R received in advance Stationery expense Show how each of the accounts listed below would appear in the pre-adjustment, post-adjustment (pre- closing) and post-closing trial balances of TeaTime as at 31 July 2020. In each space indicate an amount. For zero balances, indicate a zero. Pre-adjustment TB Stationery asset R R Post-adjustment TB R R R 15 Points R R ? ? R ? R ? Post-closing TB ? TeaTime: Pre-adjustment trial balance (Extract) as at 31 July 2020 PPE: Land Interest expense You are required to: 1. Complete the following statement: Revaluation gains and losses are closed off the Additional information On 1 March 2019, TeaTime accepted transfer of ownership of a plot of land. Under the terms of the agreement, Tea Time was required to pay R784 000 for this land on 28 February 2020. This is beyond normal credit terms. The market-related interest rate is 12%. The fair value of this plot of land on 31 July 2020 was R800 000. The costs to sell were R150 000, and the value-in-use was R900 000. Tea Time uses the revaluation model for the measurement of land. 28/02/2020 DR 2. Prepare the journal entry(ies) required on 28 February 2020 and 31 July 2020. Ignore narrations and closing entries. Use a full stop as a decimal separator, not a comma. Do not insert R in front of your answer. For example, if the answer is R16.70, you would type 16.70 into the input box. Round all answers to two decimal places. Do not leave any of the input boxes empty. If the answer is 0 or you don't know the answer, type 0 into the input box. Blank input boxes might result in an incorrect addition of your marks by Vula. Insert the correct bracketed info behind account names Loan: AVC Bank ( 6% p.a.) Interest expense DR TeaTime: Pre-adjustment trial balance (Extract) as at 31 July 2020 CR 31/10/19 28/02/20 30/06/20 31/07/20 DR R R R R Additional information A loan of R200 000 was taken out by Tea Time on 31 August 2017, to fund business expansion. Interest is paid every four months in arrears, on 28 February, 30 June, and 31 October. The loan is repayable over 5 equal annual installments starting from on 1 September 2018. The bookkeeper debits all interest payments to the interest expense account. R ? You are required to: Prepare the interest expense account as it would appear in the general ledger of Tea Time for the year ended 31 July 2020. Please note: Your entries in the ledger account should be guided by the dates provided. Use a full stop as a decimal separator, not a comma. Do not insert R in front of your answer. For example, if the answer is R16.70, you would type 16.70 into the input box. Round all answers to the nearest Rand. R ? account. Do not leave any of the input boxes empty. If the answer is 0 or you don't know the answer, type 0 into the input box. Blank input boxes might result in an incorrect addition of your marks by Vula. . Do not include elements. CR R Interest expense ? 01/08/19 31/07/20 Profit or loss R R

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Question Analysis FOR Teatimes Purchase Machine on 15012016 for RASO000 with an Useful Life value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started