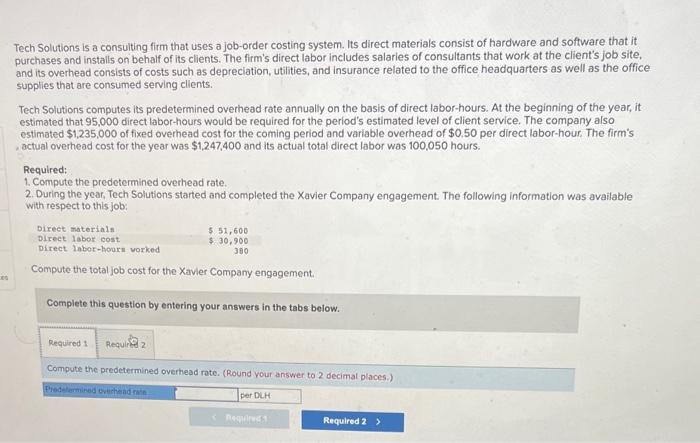

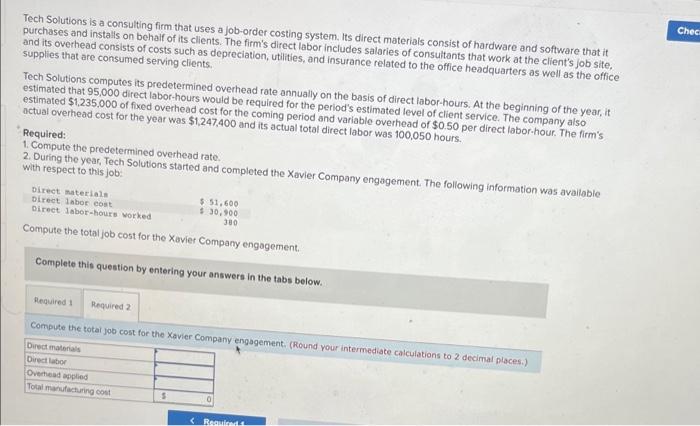

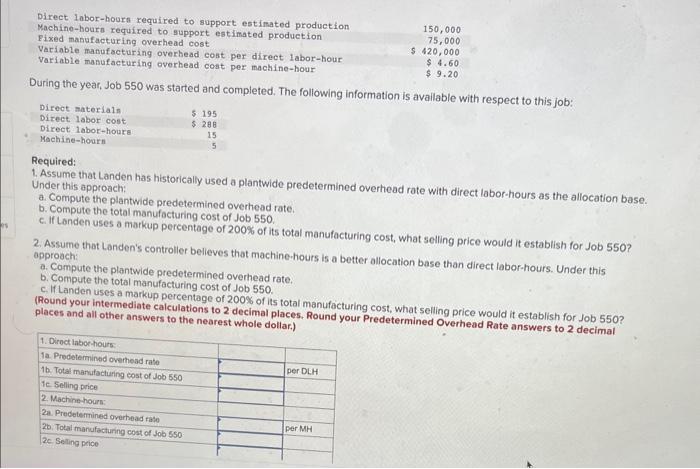

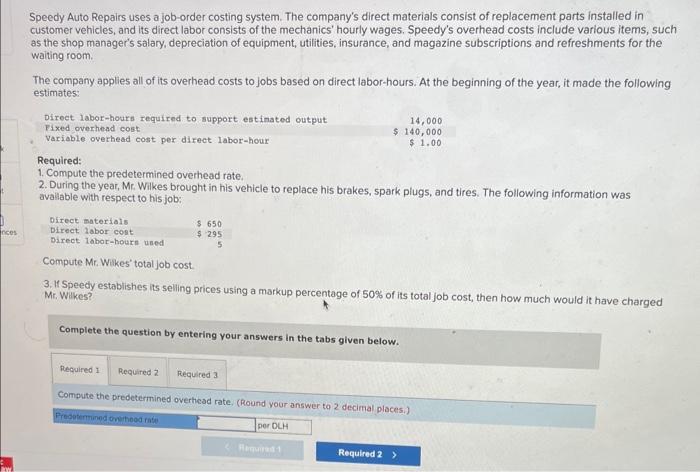

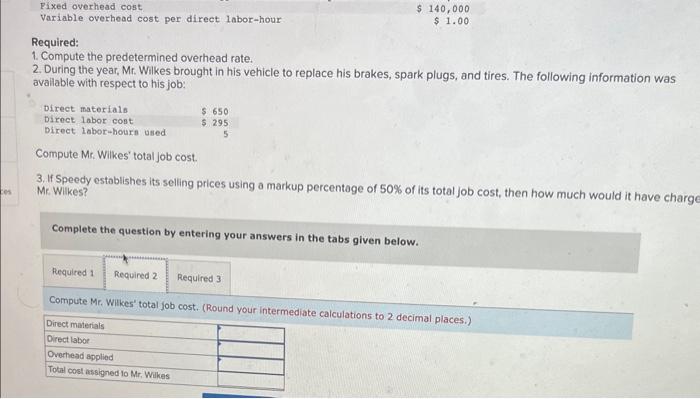

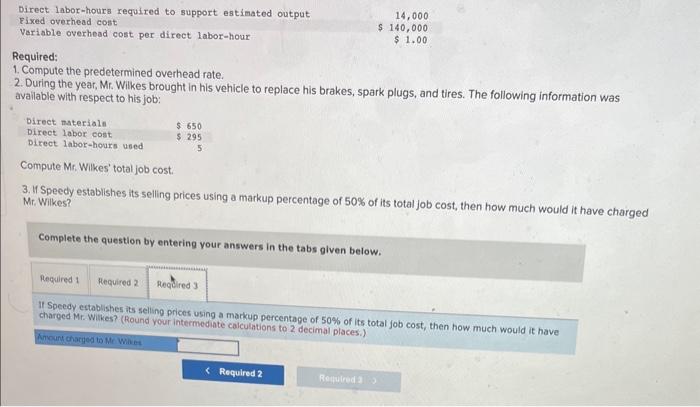

Tech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm's direct labor includes salaries of consultants that work at the client's job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office. supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 95,000 direct labor-hours would be required for the period's estimated level of client service. The company also estimated $1,235,000 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm's , actual overhead cost for the year was $1,247,400 and its actual total direct labor was 100,050 hours. Required: 1. Compute the predetermined overhead rate. 2. During the year, Tech Solutions started and completed the Xavier Company engagement. The following information was available with respect to this job: Compute the total job cost for the Xavier Company engagement. Complete this question by entering your answers in the tabs below. Compute the predetermined overhead rate, (Round your answer to 2 decimal places.) Tech Solutions is a consulting firm that uses a job-order costing system. Its direct materiais consist of hardware and software that it putchases and installs on behaif of its cllents. The firm's direct labor includes salaries of consultants that work at the client's job site, and its overhead consists of costs such as de conties that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 95,000 direct labor-hours would be required for the period's estimated level of client service. The company also Required: 1. Compute the predetermined overhead rate. 2. Duting the year, Tech Solutions started and completed the Xavier Company engagement. The following information was available. with respect to this job: Compute the total job cost for the Xavier Company engagement. Complete this question by entering your answers in the tabs below. Compute the total joo cost for the Xavier Comanny engagement, (Round your intermediate calculations to 2 decimal nlaces.) Required: 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550 . c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550 ? 2. Assume that Landen's controller believes that machine.hours is a better allocation base than direct labor-hours. Under this approach: b. Compute the total manufacturing cost of Job 550 . c. If Landen uses a markup pereentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550 ? (Round your intermediate calculations to 2 decimal places. Round your Predetermined Overhead Rate answers to 2 decimal Speedy Auto Repairs uses a job-order costing system. The company's direct materials consist of replacement parts installed in customer vehicles, and its direct labor consists of the mechanics' hourly wages. Speedy's overhead costs include various items, such as the shop manager's salary, depreciation of equipment, utilities, insurance, and magazine subscriptions and refreshments for the waiting room. The company applies all of its overhead costs to jobs based on direct labor-hours. At the beginning of the year, it made the following estimates: Required: 1. Compute the predetermined overhead rate. 2. During the year, Mr. Wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. The following information was avallable with respect to his job: Compute Mr. Wikes' total job cost. 3. If Speedy establishes its selling prices using a markup percentage of 50% of its total job cost, then how much would it have charged Mr. Wikes? Complete the question by entering your answers in the tabs given below. Compute the predetermined overhead rate, (Round your answer to 2 decimal places.) Required: 1. Compute the predetermined overhead rate. 2. During the year, Mr. Wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. The following information was avaliable with respect to his job: Compute Mr. Wilkes' total job cost. 3. If Speedy establishes its selling prices using a markup percentage of 50% of its total job cost, then how much would it have charc Me. Wilkes? Complete the question by entering your answers in the tabs given below. Compute Mr. Wilkes' total job cost. (Round your intermediate calculations to 2 decimal places.) 1. Compute the predetermined overhead rate. 2. During the year, Mr. Wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. The following information was available with respect to his job: Compute Mr. Wilkes' total job cost. 3. If Speedy establishes its selling prices using a markup percentage of 50% of its total job cost, then how much would it have charged Mr. Wilkes? Complete the question by entering your answers in the tabs given below. It Speedy establishes its selling prices using a markup percentage of 50% of its total job cost, then how much would it have. charged Mr. Wilkes? (Round your intermediate calculations to 2 decimal places.)