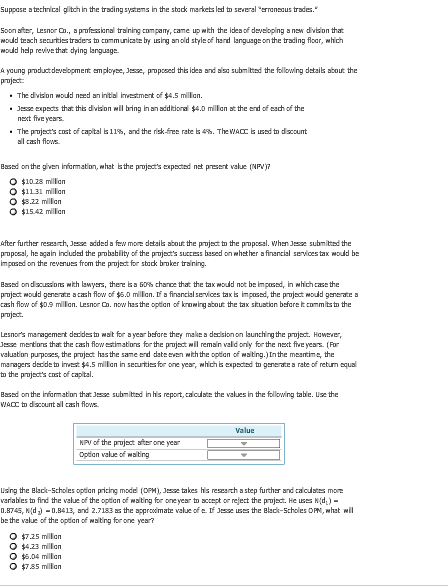

technical glitch in the trading systems the stock markets led to several-rransous trades.. suppose Soondter, Lesnora., a profesind training com pamy, came up with the idea of developing new dvtion th mould teach secutiss traders to communiate by using anold style of hard languageon the trading floar, which mould help rewive that dying language a young ductdevelopment smployse, J0e, proposed this idea and submitted the following dataik about the . The dvison would n d an nitid lme tment of 4.5 millan. pects thd: this dition nll bring in an add tora ,4.0 millan t te erd of d of the . J se next fre years The pmject's trst of capital lcash flows is 11%, and the risk-ree rate is 4%. Thew.a used to dscount . Based on the given ifarmaion, whst te pruject's expected net prsert value (NPV $10.28 million $1131 millan $822 millian O $1542 mill n ter further researth, Jsse added a few more details abour the project to the proposal. When Jese submited the proposal, he again induded the probsblity of the project's success based onwhether afinancial services tax oud be imposnd on the revenuss from the pruject for stack broker training. Based on dscussions with lawyrs, there G0% chane that the tax mould not be impase, in hich case the 5ct would generate cash flow of $6.0 millan. If financial services taX5 mpased, the project mould generate cash flow of $0.9 millan. Lesnor. now has te option of knowing about the tax stuation befare t commits to the Lesnor's managemert dodesto malt for year befare they make d sion on launching te pojed. However, esse metins that the cash flowestmatins for the project wil remain vald only for the next five years. aluson puposes, the pruject hasthe same and date even with the optian of wating.)Inthe meantims, the managers d ideto iest $4.5 millan sentes for one year, hich txpectsd to generate rate of return equal to the projact's cust of capital. Based onthe infurmation that Jese submiited in his report, caculate the values in the following tabe. Use the ACC to discount al cash lows Value NP of the prujsct aterone year an value of "ating using the Black-Scholes opdan pricing modd OPM)Jesse takes his ressth astep furth and taculats more enables to find the value of the option of aiting for one year to accept or reject the prject. Heus,gd:)- 0.8745, N(dz)0.B413, and 2.7183the approodmate value ofe. If Jsseus=s the Black-scholes om,what il be the value of the option of mating for one year? $725 million O $4.23 millan O $5.04 millan $785 millan technical glitch in the trading systems the stock markets led to several-rransous trades.. suppose Soondter, Lesnora., a profesind training com pamy, came up with the idea of developing new dvtion th mould teach secutiss traders to communiate by using anold style of hard languageon the trading floar, which mould help rewive that dying language a young ductdevelopment smployse, J0e, proposed this idea and submitted the following dataik about the . The dvison would n d an nitid lme tment of 4.5 millan. pects thd: this dition nll bring in an add tora ,4.0 millan t te erd of d of the . J se next fre years The pmject's trst of capital lcash flows is 11%, and the risk-ree rate is 4%. Thew.a used to dscount . Based on the given ifarmaion, whst te pruject's expected net prsert value (NPV $10.28 million $1131 millan $822 millian O $1542 mill n ter further researth, Jsse added a few more details abour the project to the proposal. When Jese submited the proposal, he again induded the probsblity of the project's success based onwhether afinancial services tax oud be imposnd on the revenuss from the pruject for stack broker training. Based on dscussions with lawyrs, there G0% chane that the tax mould not be impase, in hich case the 5ct would generate cash flow of $6.0 millan. If financial services taX5 mpased, the project mould generate cash flow of $0.9 millan. Lesnor. now has te option of knowing about the tax stuation befare t commits to the Lesnor's managemert dodesto malt for year befare they make d sion on launching te pojed. However, esse metins that the cash flowestmatins for the project wil remain vald only for the next five years. aluson puposes, the pruject hasthe same and date even with the optian of wating.)Inthe meantims, the managers d ideto iest $4.5 millan sentes for one year, hich txpectsd to generate rate of return equal to the projact's cust of capital. Based onthe infurmation that Jese submiited in his report, caculate the values in the following tabe. Use the ACC to discount al cash lows Value NP of the prujsct aterone year an value of "ating using the Black-Scholes opdan pricing modd OPM)Jesse takes his ressth astep furth and taculats more enables to find the value of the option of aiting for one year to accept or reject the prject. Heus,gd:)- 0.8745, N(dz)0.B413, and 2.7183the approodmate value ofe. If Jsseus=s the Black-scholes om,what il be the value of the option of mating for one year? $725 million O $4.23 millan O $5.04 millan $785 millan