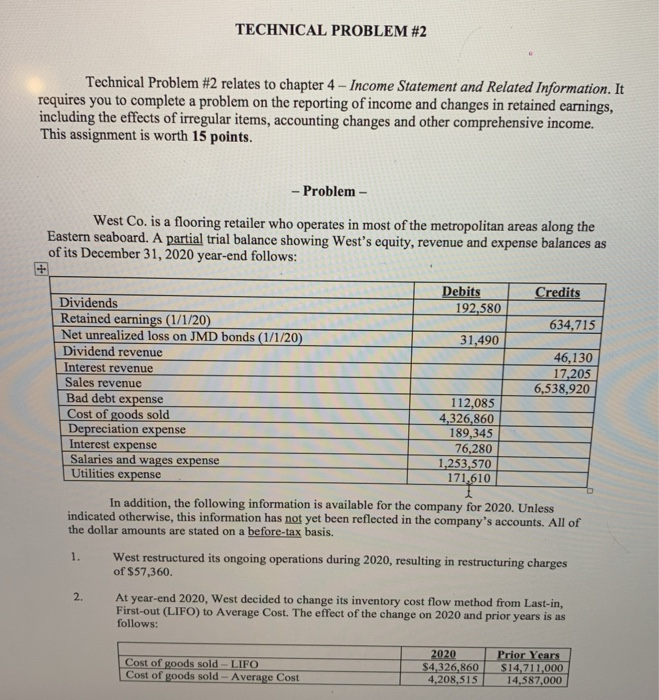

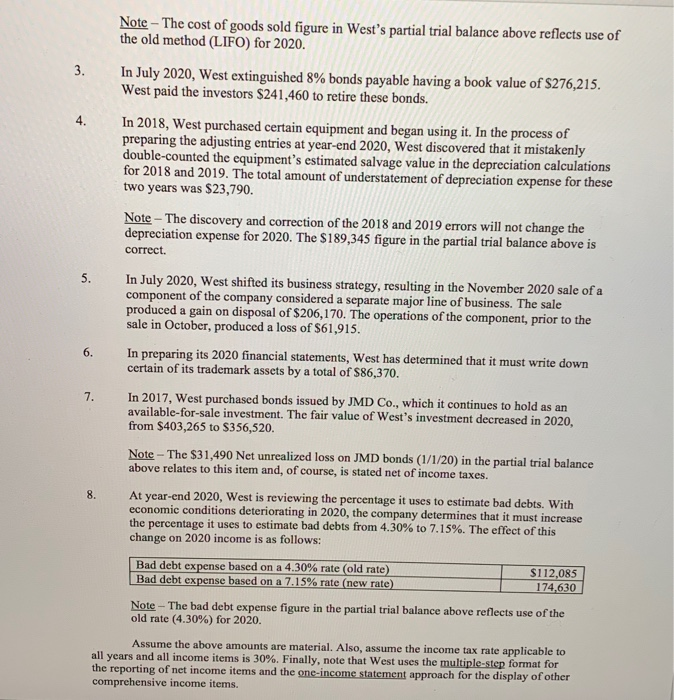

TECHNICAL PROBLEM #2 Technical Problem #2 relates to chapter 4 - Income Statement and Related Information. It requires you to complete a problem on the reporting of income and changes in retained earnings, including the effects of irregular items, accounting changes and other comprehensive income. This assignment is worth 15 points. - Problem - West Co. is a flooring retailer who operates in most of the metropolitan areas along the Eastern seaboard. A partial trial balance showing West's equity, revenue and expense balances as of its December 31, 2020 year-end follows: Debits Credits Dividends 192,580 Retained earnings (1/1/20) 634,715 Net unrealized loss on JMD bonds (1/1/20) 31,490 Dividend revenue 46,130 Interest revenue 17,205 Sales revenue 6,538,920 Bad debt expense 112,085 Cost of goods sold 4,326,860 Depreciation expense 189,345 Interest expense 76,280 Salaries and wages expense 1,253,570 Utilities expense 171,610 In addition, the following information is available for the company for 2020. Unless indicated otherwise, this information has not yet been reflected in the company's accounts. All of the dollar amounts are stated on a before-tax basis. 1. West restructured its ongoing operations during 2020, resulting in restructuring charges of $57,360. 2. At year-end 2020, West decided to change its inventory cost flow method from Last-in, First-out (LIFO) to Average Cost. The effect of the change on 2020 and prior years is as follows: Cost of goods sold-LIFO Cost of goods sold - Average Cost 2020 $4,326,860 4,208,515 Prior Years $14,711,000 14,587,000 3. 4. 5. 6. Note The cost of goods sold figure in West's partial trial balance above reflects use of the old method (LIFO) for 2020. In July 2020, West extinguished 8% bonds payable having a book value of $276,215. West paid the investors $241,460 to retire these bonds. In 2018, West purchased certain equipment and began using it. In the process of preparing the adjusting entries at year-end 2020, West discovered that it mistakenly double-counted the equipment's estimated salvage value in the depreciation calculations for 2018 and 2019. The total amount of understatement of depreciation expense for these two years was $23,790. Note The discovery and correction of the 2018 and 2019 errors will not change the depreciation expense for 2020. The $189,345 figure in the partial trial balance above is correct In July 2020, West shifted its business strategy, resulting in the November 2020 sale of a component of the company considered a separate major line of business. The sale produced a gain on disposal of $206,170. The operations of the component, prior to the sale in October, produced a loss of $61,915. In preparing its 2020 financial statements, West has determined that it must write down certain of its trademark assets by a total of $86,370. In 2017, West purchased bonds issued by JMD Co., which it continues to hold as an available-for-sale investment. The fair value of West's investment decreased in 2020, from $403,265 to $356,520. Note - The $31,490 Net unrealized loss on JMD bonds (1/1/20) in the partial trial balance above relates to this item and, of course, is stated net of income taxes. At year-end 2020, West is reviewing the percentage it uses to estimate bad debts. With economic conditions deteriorating in 2020, the company determines that it must increase the percentage it uses to estimate bad debts from 4.30% to 7.15%. The effect of this change on 2020 income is as follows: Bad debt expense based on a 4.30% rate (old rate) $112,085 Bad debt expense based on a 7.15% rate (new rate) 174,630 Note - The bad debt expense figure in the partial trial balance above reflects use of the old rate (4.30%) for 2020. Assume the above amounts are material. Also, assume the income tax rate applicable to all years and all income items is 30%. Finally, note that West uses the multiple-step format for the reporting of net income items and the one-income statement approach for the display of other comprehensive income items. 7. 8. - Instructions - Prepare the financial statements for the year ended December 31, 2020 to show the proper reporting of West's: (a) income and (b) changes in retained earnings. Prepare these statements in good form, according to GAAP requirements. Refer to models of the financial statements in the textbook (pages 4-1 to 4-25), the practice problems and the class notes and examples. Please observe the following checklist of instructions as you complete this assignment: Prepare your financial statements and any supporting analyses using Excel. Give careful attention to your formatting of information. Formatting includes effective presentation of information, correct spelling and capitalization, and proper use of dollar signs, commas, and underscoring. Refer to examples in the text for guidance. Round all dollar amounts you present in your financial statements to the nearest dollar O