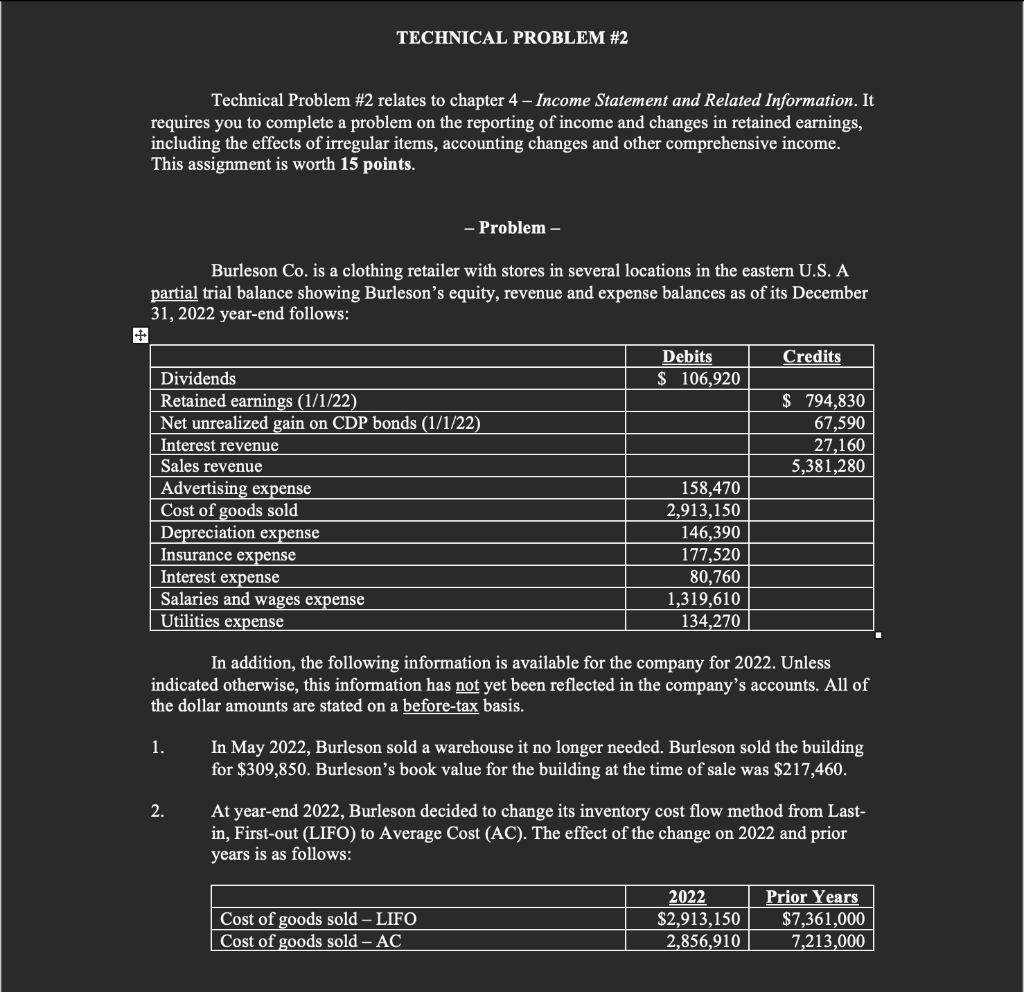

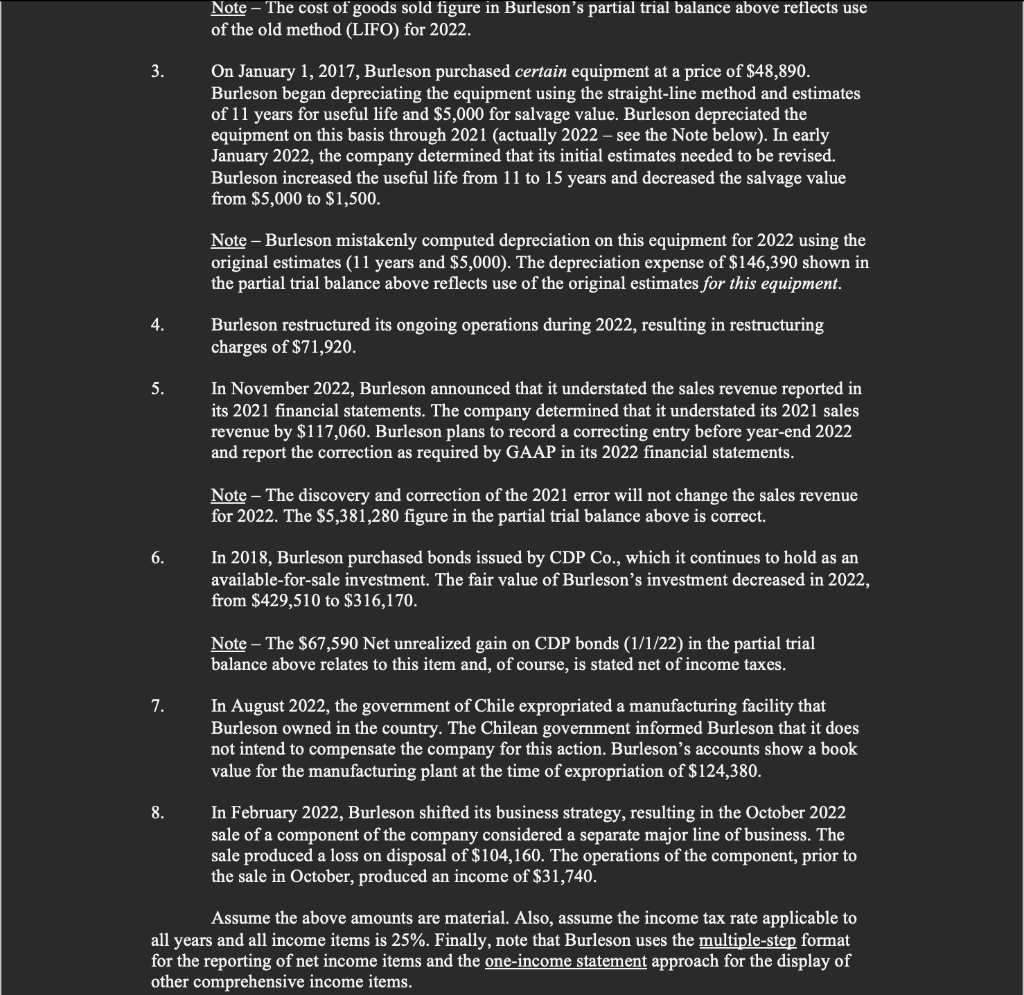

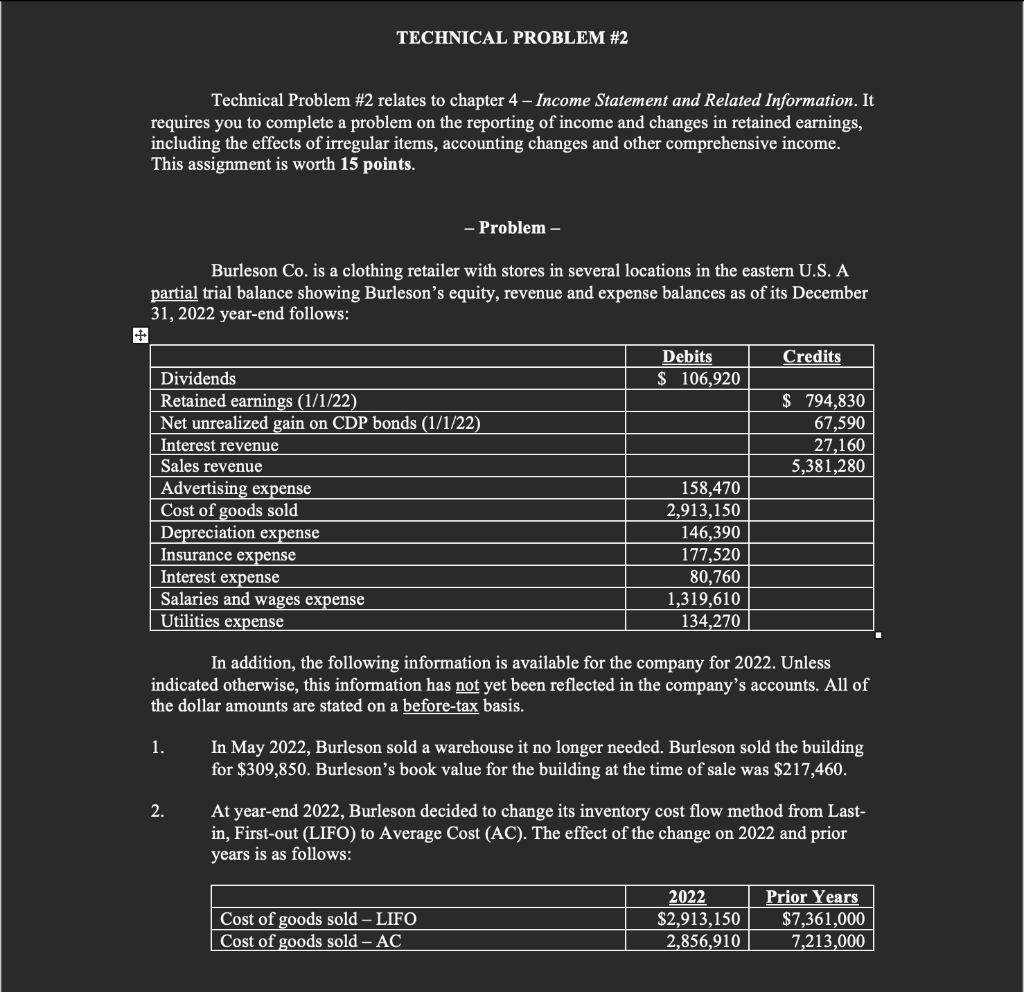

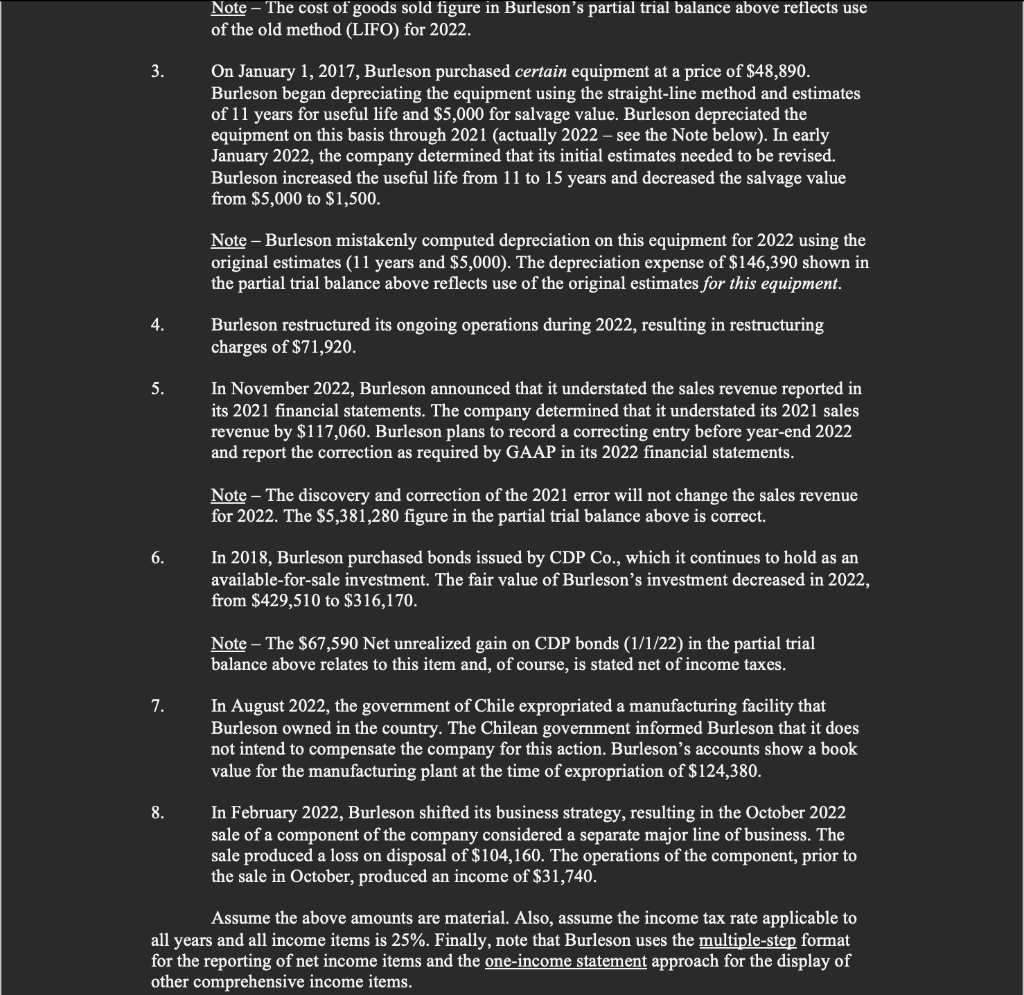

TECHNICAL PROBLEM #2 Technical Problem #2 relates to chapter 4 - Income Statement and Related Information. It requires you to complete a problem on the reporting of income and changes in retained earnings, including the effects of irregular items, accounting changes and other comprehensive income. This assignment is worth 15 points. - Problem - Burleson Co. is a clothing retailer with stores in several locations in the eastern U.S. A partial trial balance showing Burleson's equity, revenue and expense balances as of its December 31, 2022 year-end follows: Credits Debits $ 106,920 $ 794,830 67,590 27,160 5,381,280 Dividends Retained earnings (1/1/22) Net unrealized gain on CDP bonds (1/1/22) Interest revenue Sales revenue Advertising expense Cost of goods sold Depreciation expense Insurance expense Interest expense Salaries and wages expense Utilities expense 158,470 2,913,150 146,390 177,520 80,760 1,319,610 134,270 In addition, the following information is available for the company for 2022. Unless indicated otherwise, this information has not yet been reflected in the company's accounts. All of the dollar amounts are stated on a before-tax basis. 1. In May 2022, Burleson sold a warehouse it no longer needed. Burleson sold the building for $309,850. Burleson's book value for the building at the time of sale was $217,460. 2. At year-end 2022, Burleson decided to change its inventory cost flow method from Last- in, First-out (LIFO) to Average Cost (AC). The effect of the change on 2022 and prior years is as follows: Cost of goods sold - LIFO Cost of goods sold - AC 2022 $2,913,150 2,856,910 Prior Years $7,361,000 7,213,000 Note The cost of goods sold figure in Burleson's partial trial balance above reflects use of the old method (LIFO) for 2022. 3. On January 1, 2017, Burleson purchased certain equipment at a price of $48,890. Burleson began depreciating the equipment using the straight-line method and estimates of 11 years for useful life and $5,000 for salvage value. Burleson depreciated the equipment on this basis through 2021 (actually 2022 see the Note below). In early January 2022, the company determined that its initial estimates needed to be revised. Burleson increased the useful life from 11 to 15 years and decreased the salvage value from $5,000 to $1,500. Note - Burleson mistakenly computed depreciation on this equipment for 2022 using the original estimates (11 years and $5,000). The depreciation expense of $146,390 shown in the partial trial balance above reflects use of the original estimates for this equipment. 4. Burleson restructured its ongoing operations during 2022, resulting in restructuring charges of $71,920. 5. In November 2022, Burleson announced that it understated the sales revenue reported in its 2021 financial statements. The company determined that it understated its 2021 sales revenue by $117,060. Burleson plans to record a correcting entry before year-end 2022 and report the correction as required by GAAP in its 2022 financial statements. Note The discovery and correction of the 2021 error will not change the sales revenue for 2022. The $5,381,280 figure in the partial trial balance above is correct. In 2018, Burleson purchased bonds issued by CDP Co., which it continues to hold as an available-for-sale investment. The fair value of Burleson's investment decreased in 2022, from $429,510 to $316,170. 6. Note The $67,590 Net unrealized gain on CDP bonds (1/1/22) in the partial trial balance above relates to this item and, of course, is stated net of income taxes. 7. In August 2022, the government of Chile expropriated a manufacturing facility that Burleson owned in the country. The Chilean government informed Burleson that it does not intend to compensate the company for this action. Burleson's accounts show a book value for the manufacturing plant at the time of expropriation of $124,380. 8. In February 2022, Burleson shifted its business strategy, resulting in the October 2022 sale of a component of the company considered a separate major line of business. The sale produced a loss on disposal of $104,160. The operations of the component, prior to the sale in October, produced an income of $31,740. Assume the above amounts are material. Also, assume the income tax rate applicable to all years and all income items is 25%. Finally, note that Burleson uses the multiple-step format for the reporting of net income items and the one-income statement approach for the display of other comprehensive income items