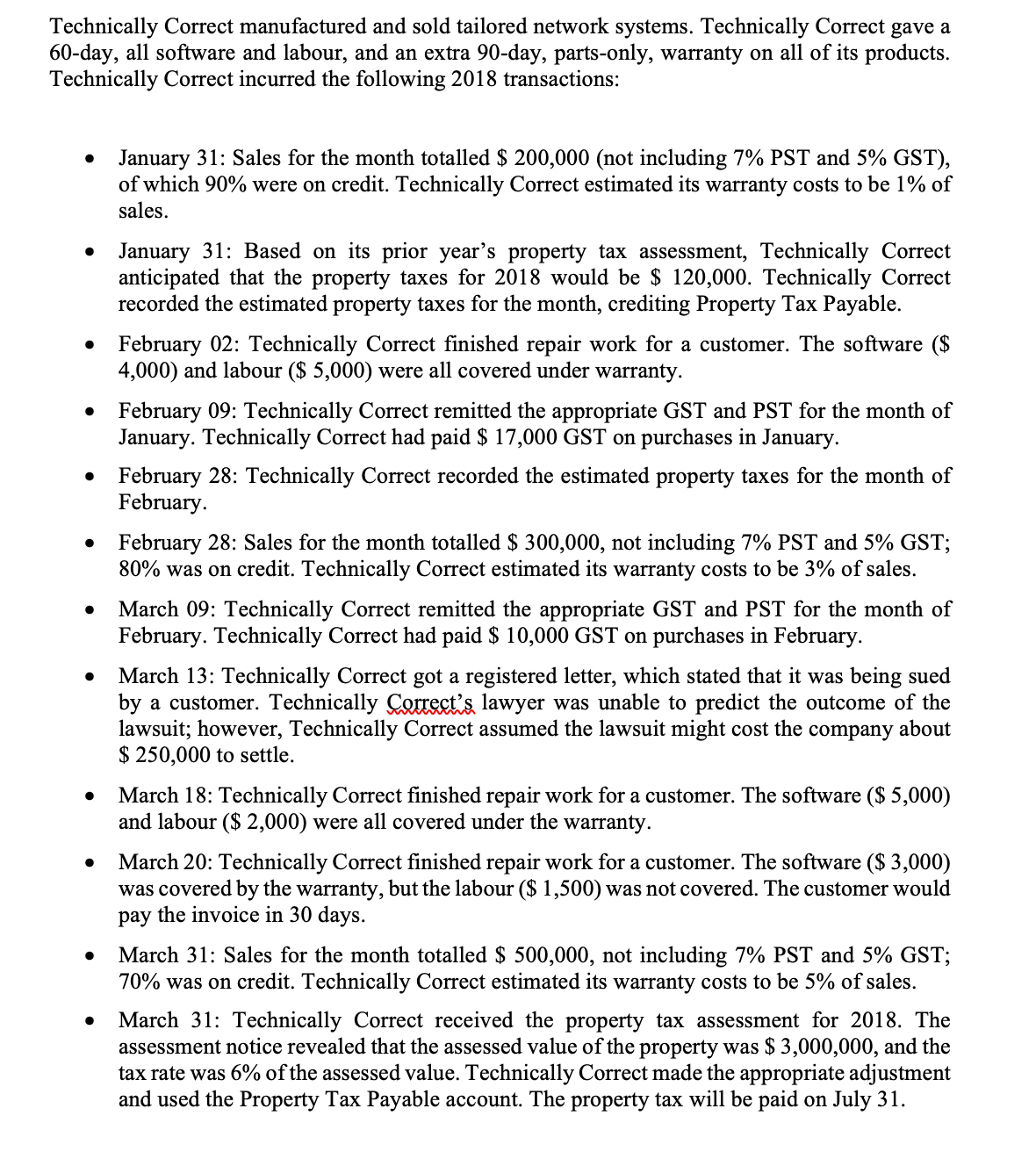

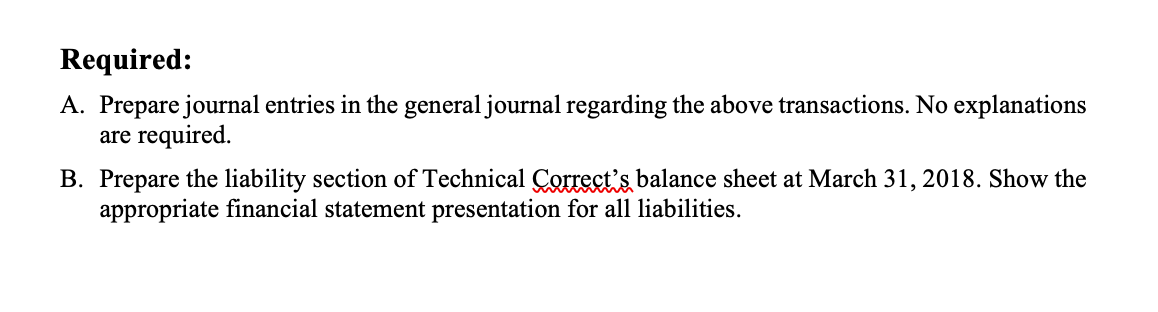

Technically Correct manufactured and sold tailored network systems. Technically Correct gave a 60-day, all software and labour, and an extra 90-day, partsonly, warranty on all of' its products. Technically Correct incurred the following 2018 transactions: 0 January 31: Sales for the month totalled $ 200,000 (not including 7% PST and 5% GST), of which 90% were on credit. Technically Correct estimated its warranty costs to be 1% of sales. 0 January 31: Based on its prior year's property tax assessment, Technically Correct anticipated that the property taxes for 2018 would be $ 120,000. Technically Correct recorded the estimated property taxes for the month, crediting Property Tax Payable. - February 02: Technically Correct nished repair work for a customer. The software ($ 4,000) and labour ($ 5,000) were all covered under warranty. 0 February 09: Technically Correct remitted the appropriate GST and PST for the month of January. Technically Correct had paid 8 17,000 GST on purchases in January. 0 February 28: Technically Correct recorded the estimated property taxes for the month of February. 0 February 28: Sales for the month totalled $ 300,000, not including 7% PST and 5% GST; 80% was on credit. Technically Correct estimated its warranty costs to be 3% of sales. 0 March 09: Technically Correct remitted the appropriate GST and PST for the month of February. Technically Correct had paid $ 10,000 GST on purchases in February. 0 March 13: Technically Correct got a registered letter, which stated that it was being sued by a customer. Technically m lawyer was unable to predict the outcome of the lawsuit; however, Technically Correct assumed the lawsuit might cost the company about $ 250,000 to settle. a March 18: Technically Correct nished repair work for a customer. The software ($ 5,000) and labour (:5 2,000) were all covered under the warranty. 0 March 20: Technically Correct nished repair work for a customer. The software ($ 3,000) was covered by the warranty, but the labour ($ 1 ,5 00) was not covered. The customer would pay the invoice in 30 days. 0 March 31: Sales for the month totalled $ 500,000, not including 7% PST and 5% GST; 70% was on credit. Technically Correct estimated its warranty costs to be 5% of sales. a March 31: Technically Correct received the property tax assessment for 2018. The assessment notice revealed that the assessed value of the property was $ 3 ,000,000, and the tax rate was 6% of the assessed value. Technically Correct made the appropriate adjustment and used the Property Tax Payable account. The property tax will be paid on July 31. Required: A. Prepare journal entries in the general journal regarding the above transactions. No explanations are required. B. Prepare the liability section of Technical Correct's balance sheet at March 31, 2018. Show the appropriate financial statement presentation for all liabilities