Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Techniq has been offered 40% of the ordinary share capital of Batteries Ltd (Batteries), a supplier of one of the electric battery component parts

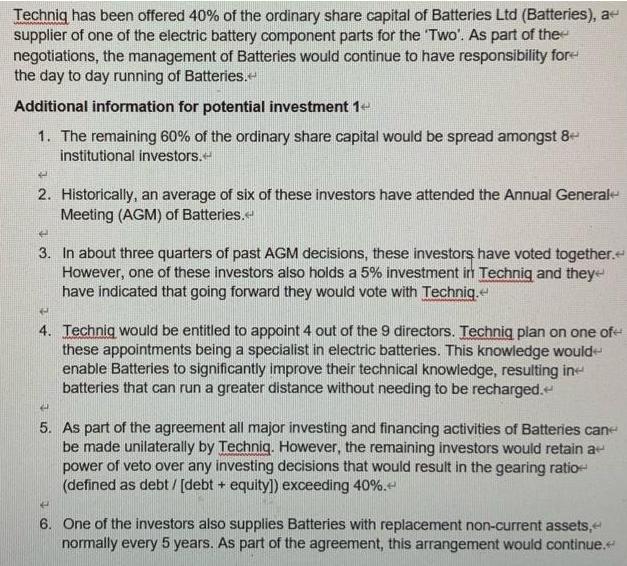

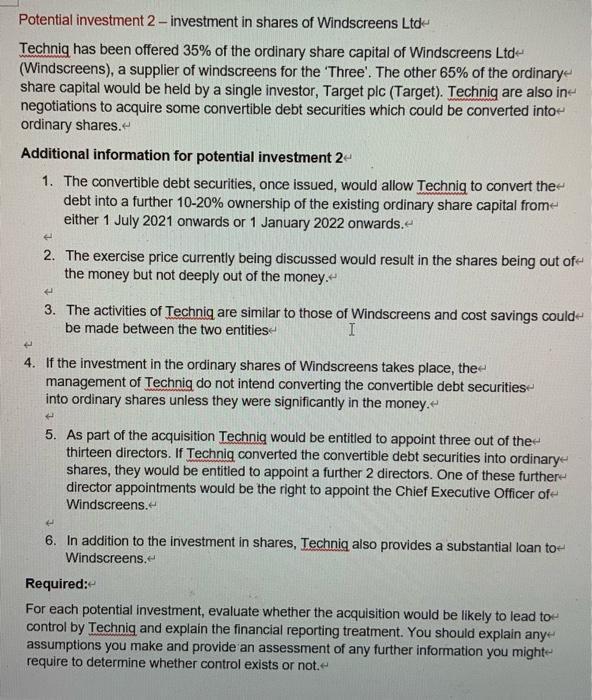

Techniq has been offered 40% of the ordinary share capital of Batteries Ltd (Batteries), a supplier of one of the electric battery component parts for the 'Two". As part of the negotiations, the management of Batteries would continue to have responsibility for the day to day running of Batteries.- Additional information for potential investment 1e 1. The remaining 60% of the ordinary share capital would be spread amongst 8 institutional investors. 2. Historically, an average of six of these investors have attended the Annual General- Meeting (AGM) of Batteries. 3. In about three quarters of past AGM decisions, these investors have voted together.e However, one of these investors also holds a 5% investment in Technig and theye have indicated that going forward they would vote with Techniq.e 4. Technig would be entitled to appoint 4 out of the 9 directors. Technig plan on one of these appointments being a specialist in electric batteries. This knowledge would enable Batteries to significantly improve their technical knowledge, resulting in batteries that can run a greater distance without needing to be recharged. 5. As part of the agreement all major investing and financing activities of Batteries can be made unilaterally by Techniq. However, the remaining investors would retain a power of veto over any investing decisions that would result in the gearing ratio (defined as debt / [debt + equity)) exceeding 40%.e 6. One of the investors also supplies Batteries with replacement non-current assets,e normally every 5 years. As part of the agreement, this arrangement would continue. Potential investment 2- investment in shares of Windscreens Ltde Techniq has been offered 35% of the ordinary share capital of Windscreens Ltde (Windscreens), a supplier of windscreens for the Three'. The other 65% of the ordinarye share capital would be held by a single investor, Target plc (Target). Techniq are also ine negotiations to acquire some convertible debt securities which could be converted intoe ordinary shares. Additional information for potential investment 2e 1. The convertible debt securities, once issued, would allow Techniq to convert the debt into a further 10-20% ownership of the existing ordinary share capital frome either 1 July 2021 onwards or 1 January 2022 onwards.e 2. The exercise price currently being discussed would result in the shares being out of the money but not deeply out of the money. 3. The activities of Techniq are similar to those of Windscreens and cost savings could be made between the two entities- I 4. If the investment in the ordinary shares of Windscreens takes place, thee management of Techniq do not intend converting the convertible debt securities into ordinary shares unless they were significantly in the money. 5. As part of the acquisition Techniq would thirteen directors. If Techniq converted the convertible debt securities into ordinary shares, they would be entitled to appoint a further 2 directors. One of these further director appointments would be the right to appoint the Chief Executive Officer of- Windscreens. entitled to appoint three out of the 6. In addition to the investment in shares, Techniq also provides a substantial loan to Windscreens. Required: For each potential investment, evaluate whether the acquisition would be likely to lead to control by Techniq and explain the financial reporting treatment. You should explain any assumptions you make and provide an assessment of any further information you mighte require to determine whether control exists or not. Techniq has been offered 40% of the ordinary share capital of Batteries Ltd (Batteries), a supplier of one of the electric battery component parts for the 'Two". As part of the negotiations, the management of Batteries would continue to have responsibility for the day to day running of Batteries.- Additional information for potential investment 1e 1. The remaining 60% of the ordinary share capital would be spread amongst 8 institutional investors. 2. Historically, an average of six of these investors have attended the Annual General- Meeting (AGM) of Batteries. 3. In about three quarters of past AGM decisions, these investors have voted together.e However, one of these investors also holds a 5% investment in Technig and theye have indicated that going forward they would vote with Techniq.e 4. Technig would be entitled to appoint 4 out of the 9 directors. Technig plan on one of these appointments being a specialist in electric batteries. This knowledge would enable Batteries to significantly improve their technical knowledge, resulting in batteries that can run a greater distance without needing to be recharged. 5. As part of the agreement all major investing and financing activities of Batteries can be made unilaterally by Techniq. However, the remaining investors would retain a power of veto over any investing decisions that would result in the gearing ratio (defined as debt / [debt + equity)) exceeding 40%.e 6. One of the investors also supplies Batteries with replacement non-current assets,e normally every 5 years. As part of the agreement, this arrangement would continue. Potential investment 2- investment in shares of Windscreens Ltde Techniq has been offered 35% of the ordinary share capital of Windscreens Ltde (Windscreens), a supplier of windscreens for the Three'. The other 65% of the ordinarye share capital would be held by a single investor, Target plc (Target). Techniq are also ine negotiations to acquire some convertible debt securities which could be converted intoe ordinary shares. Additional information for potential investment 2e 1. The convertible debt securities, once issued, would allow Techniq to convert the debt into a further 10-20% ownership of the existing ordinary share capital frome either 1 July 2021 onwards or 1 January 2022 onwards.e 2. The exercise price currently being discussed would result in the shares being out of the money but not deeply out of the money. 3. The activities of Techniq are similar to those of Windscreens and cost savings could be made between the two entities- I 4. If the investment in the ordinary shares of Windscreens takes place, thee management of Techniq do not intend converting the convertible debt securities into ordinary shares unless they were significantly in the money. 5. As part of the acquisition Techniq would thirteen directors. If Techniq converted the convertible debt securities into ordinary shares, they would be entitled to appoint a further 2 directors. One of these further director appointments would be the right to appoint the Chief Executive Officer of- Windscreens. entitled to appoint three out of the 6. In addition to the investment in shares, Techniq also provides a substantial loan to Windscreens. Required: For each potential investment, evaluate whether the acquisition would be likely to lead to control by Techniq and explain the financial reporting treatment. You should explain any assumptions you make and provide an assessment of any further information you mighte require to determine whether control exists or not.

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started