Answered step by step

Verified Expert Solution

Question

1 Approved Answer

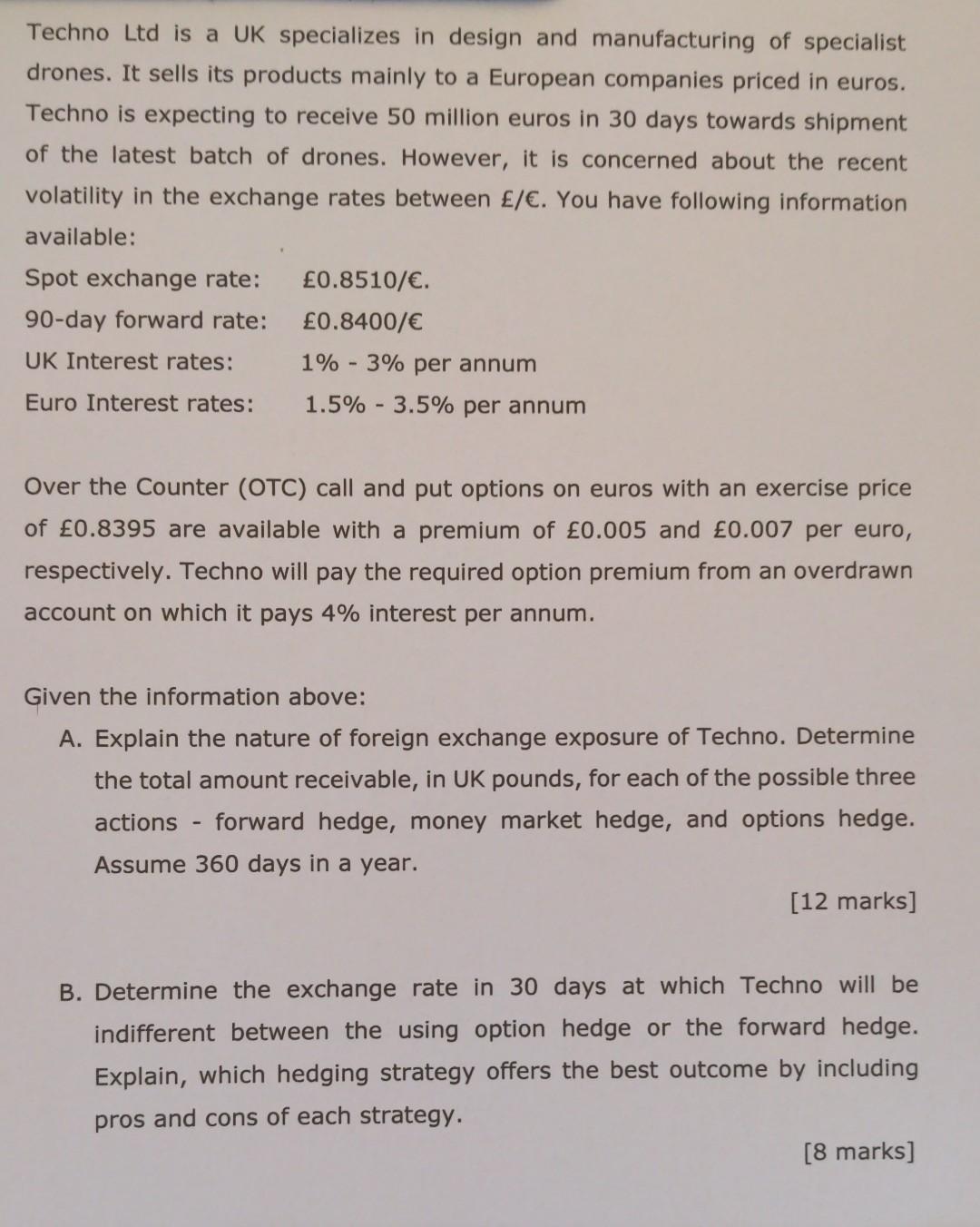

Techno Ltd is a UK specializes in design and manufacturing of specialist drones. It sells its products mainly to a European companies priced in euros.

Techno Ltd is a UK specializes in design and manufacturing of specialist drones. It sells its products mainly to a European companies priced in euros. Techno is expecting to receive 50 million euros in 30 days towards shipment of the latest batch of drones. However, it is concerned about the recent volatility in the exchange rates between /. You have following information available: Spot exchange rate: 90-day forward rate: 0.8510/. 0.8400/ 1% - 3% per annum 1.5% - 3.5% per annum UK Interest rates: Euro Interest rates: Over the Counter (OTC) call and put options on euros with an exercise price of 0.8395 are available with a premium of 0.005 and 0.007 per euro, respectively. Techno will pay the required option premium from an overdrawn account on which it pays 4% interest per annum. Given the information above: A. Explain the nature of foreign exchange exposure of Techno. Determine the total amount receivable, in UK pounds, for each of the possible three actions forward hedge, money market hedge, and options hedge. Assume 360 days in a year. [12 marks] B. Determine the exchange rate in 30 days at which Techno will be indifferent between the using option hedge or the forward hedge. Explain, which hedging strategy offers the best outcome by including pros and cons of each strategy. [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started