Answered step by step

Verified Expert Solution

Question

1 Approved Answer

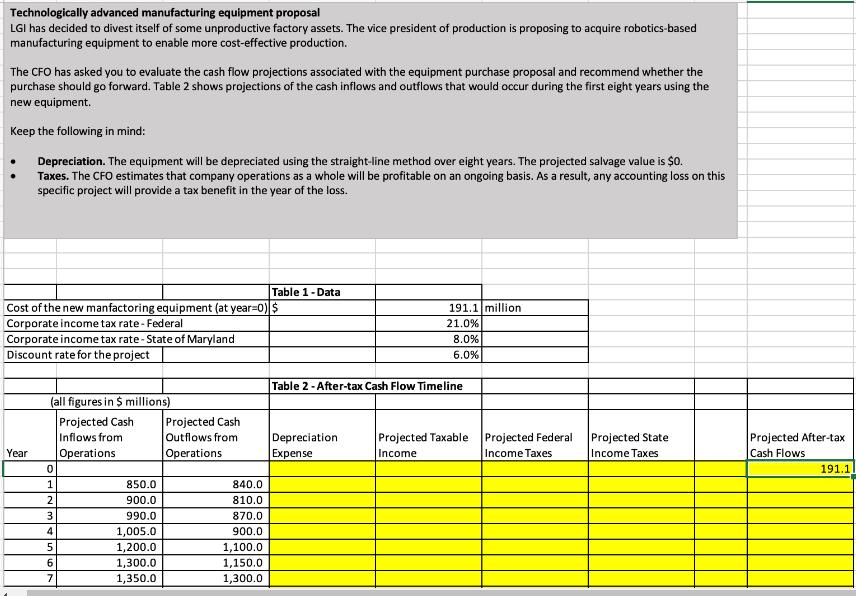

Technologically advanced manufacturing equipment proposal LGI has decided to divest itself of some unproductive factory assets. The vice president of production is proposing to

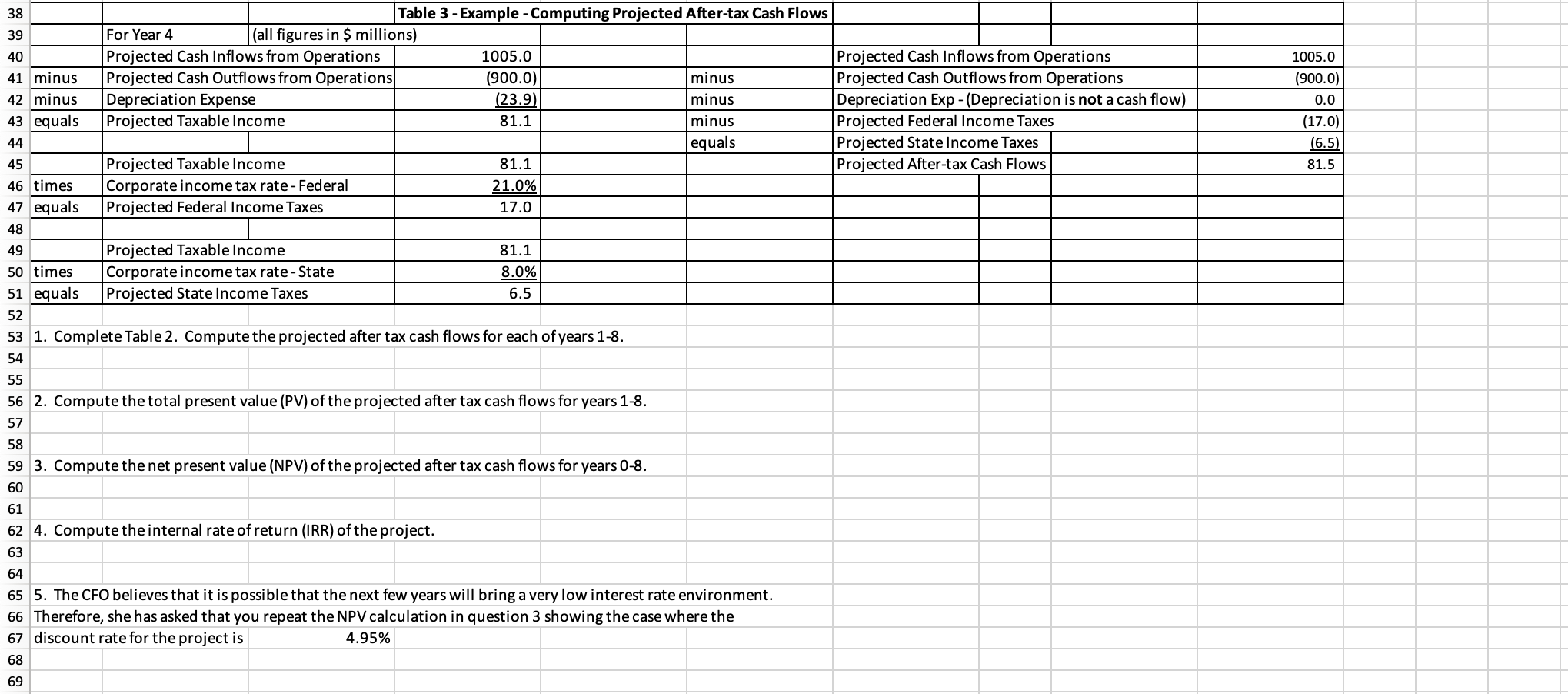

Technologically advanced manufacturing equipment proposal LGI has decided to divest itself of some unproductive factory assets. The vice president of production is proposing to acquire robotics-based manufacturing equipment to enable more cost-effective production. The CFO has asked you to evaluate the cash flow projections associated with the equipment purchase proposal and recommend whether the purchase should go forward. Table 2 shows projections of the cash inflows and outflows that would occur during the first eight years using the new equipment. Keep the following in mind: Depreciation. The equipment will be depreciated using the straight-line method over eight years. The projected salvage value is $0. Taxes. The CFO estimates that company operations as a whole will be profitable on an ongoing basis. As a result, any accounting loss on this specific project will provide a tax benefit in the year of the loss. Table 1-Data Cost of the new manfactoring equipment (at year=0) $ Corporate income tax rate-Federal Corporate income tax rate-State of Maryland Discount rate for the project (all figures in $ millions) 191.1 million 21.0% 8.0% 6.0% Table 2-After-tax Cash Flow Timeline Projected Cash Projected Cash Inflows from Outflows from Year Operations Operations Depreciation Expense Projected Taxable Income Projected Federal Income Taxes Projected State Income Taxes Projected After-tax Cash Flows 0 191.1 1 850.0 840.0 2 900.0 810.0 3 990.0 870.0 4 1,005.0 900.0 5 1,200.0 1,100.0 6 1,300.0 1,150.0 7 1,350.0 1,300.0 38 39 For Year 4 40 Table 3 - Example - Computing Projected After-tax Cash Flows (all figures in $ millions) Projected Cash Inflows from Operations 1005.0 Projected Cash Inflows from Operations 41 minus Projected Cash Outflows from Operations (900.0) minus 42 minus Depreciation Expense (23.9) minus 43 equals Projected Taxable Income 81.1 minus Projected Cash Outflows from Operations Depreciation Exp - (Depreciation is not a cash flow) Projected Federal Income Taxes 44 45 equals Projected State Income Taxes Projected Taxable Income 81.1 Projected After-tax Cash Flows 46 times Corporate income tax rate - Federal 21.0% 47 equals Projected Federal Income Taxes 17.0 48 49 Projected Taxable Income 50 times Corporate income tax rate - State 51 equals Projected State Income Taxes 81.1 8.0% 6.5 52 53 1. Complete Table 2. Compute the projected after tax cash flows for each of years 1-8. 54 55 56 2. Compute the total present value (PV) of the projected after tax cash flows for years 1-8. 57 58 59 3. Compute the net present value (NPV) of the projected after tax cash flows for years 0-8. 60 61 62 4. Compute the internal rate of return (IRR) of the project. 63 64 65 5. The CFO believes that it is possible that the next few years will bring a very low interest rate environment. 66 Therefore, she has asked that you repeat the NPV calculation in question 3 showing the case where the 67 discount rate for the project is 68 69 4.95% 1005.0 (900.0) 0.0 (17.0) (6.5) 81.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the detailed calculations to evaluate the cash flow projections for the manufacturing equipment proposal Year 0 Cash outflow for equipment pu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started