Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TechZoo Company bought a Model 1 machine three years ago for $1,300,000. It is being depreciated using the straight-line method with a useful life of

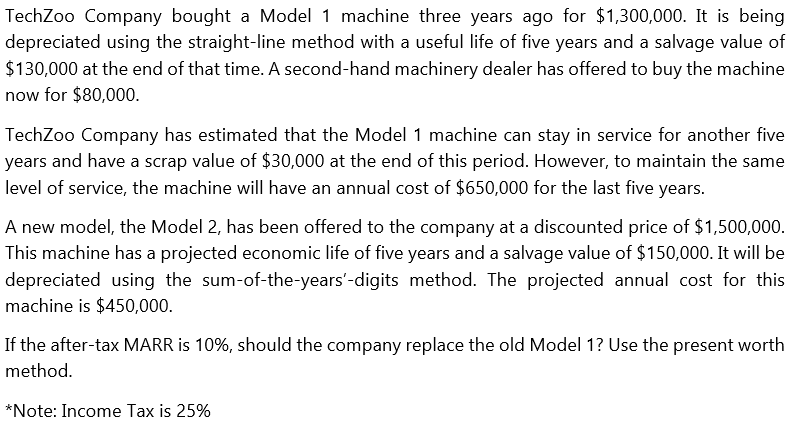

TechZoo Company bought a Model 1 machine three years ago for $1,300,000. It is being depreciated using the straight-line method with a useful life of five years and a salvage value of $130,000 at the end of that time. A second-hand machinery dealer has offered to buy the machine now for $80,000. TechZoo Company has estimated that the Model 1 machine can stay in service for another five years and have a scrap value of $30,000 at the end of this period. However, to maintain the same level of service, the machine will have an annual cost of $650,000 for the last five years. A new model, the Model 2, has been offered to the company at a discounted price of $1,500,000. This machine has a projected economic life of five years and a salvage value of $150,000. It will be depreciated using the sum-of-the-years'-digits method. The projected annual cost for this machine is $450,000. If the after-tax MARR is 10%, should the company replace the old Model 1? Use the present worth method. *Note: Income Tax is 25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started