Answered step by step

Verified Expert Solution

Question

1 Approved Answer

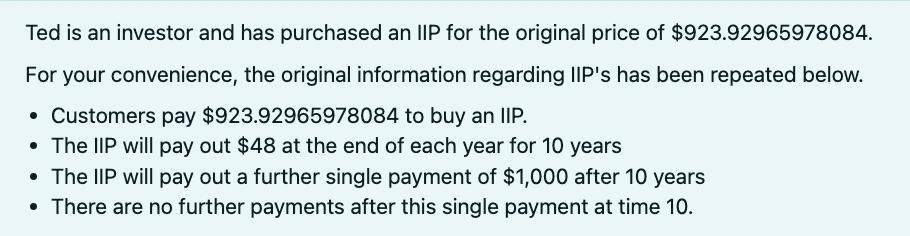

Ted is an investor and has purchased an IIP for the original price of $923.92965978084. For your convenience, the original information regarding IIP's has

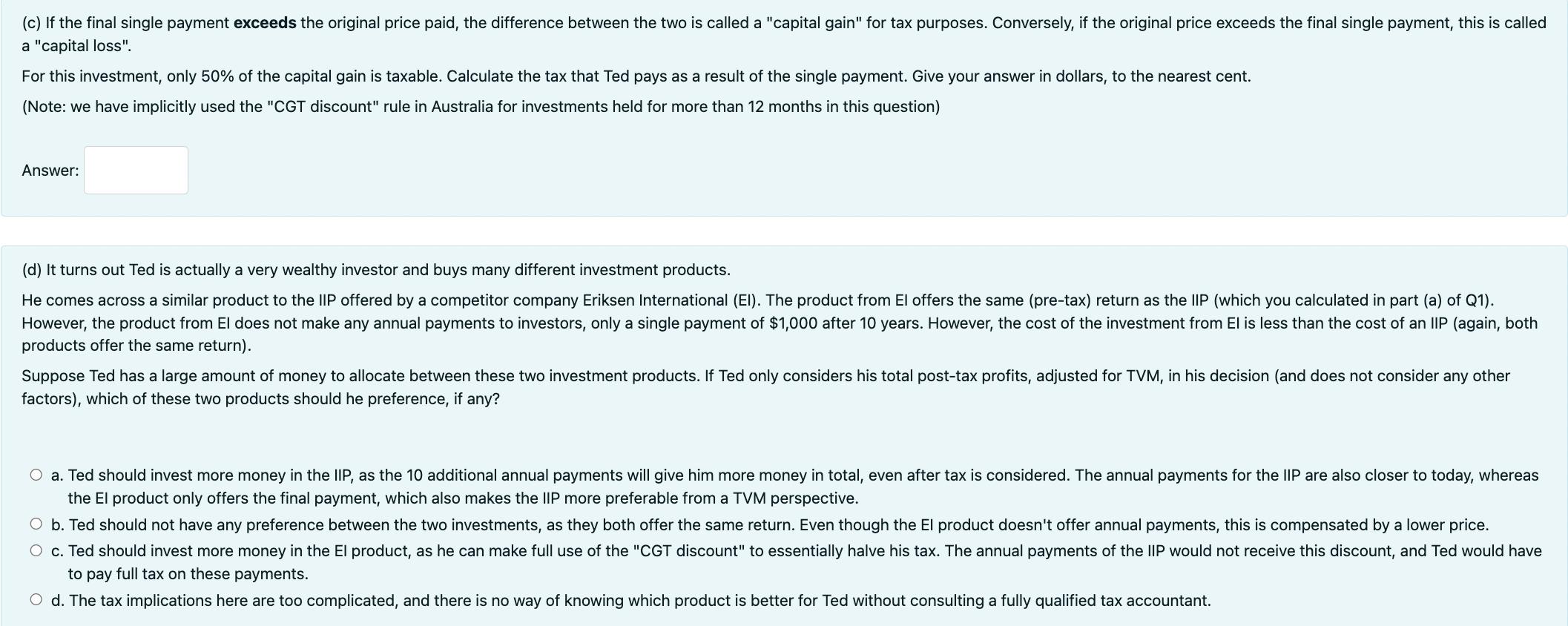

Ted is an investor and has purchased an IIP for the original price of $923.92965978084. For your convenience, the original information regarding IIP's has been repeated below. Customers pay $923.92965978084 to buy an IIP. The IIP will pay out $48 at the end of each year for 10 years The IIP will pay out a further single payment of $1,000 after 10 years There are no further payments after this single payment at time 10. (c) If the final single payment exceeds the original price paid, the difference between the two is called a "capital gain" for tax purposes. Conversely, if the original price exceeds the final single payment, this is called a "capital loss". For this investment, only 50% of the capital gain is taxable. Calculate the tax that Ted pays as a result of the single payment. Give your answer in dollars, to the nearest cent. (Note: we have implicitly used the "CGT discount" rule in Australia for investments held for more than 12 months in this question) Answer: (d) It turns out Ted is actually a very wealthy investor and buys many different investment products. He comes across a similar product to the IIP offered by a competitor company Eriksen International (EI). The product from El offers the same (pre-tax) return as the IIP (which you calculated in part (a) of Q1). However, the product from El does not make any annual payments to investors, only a single payment of $1,000 after 10 years. However, the cost of the investment from El is less than the cost of an IIP (again, both products offer the same return). Suppose Ted has a large amount of money to allocate between these two investment products. If Ted only considers his total post-tax profits, adjusted for TVM, in his decision (and does not consider any other factors), which of these two products should he preference, if any? a. Ted should invest more money in the IIP, as the 10 additional annual payments will give him more money in total, even after tax is considered. The annual payments for the IIP are also closer to today, whereas the El product only offers the final payment, which also makes the IIP more preferable from a TVM perspective. O b. Ted should not have any preference between the two investments, as they both offer the same return. Even though the El product doesn't offer annual payments, this is compensated by a lower price. c. Ted should invest more money in the El product, as he can make full use of the "CGT discount" to essentially halve his tax. The annual payments of the IIP would not receive this discount, and Ted would have to pay full tax on these payments. d. The tax implications here are too complicated, and there is no way of knowing which product is better for Ted without consulting a fully qualified tax accountant.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started