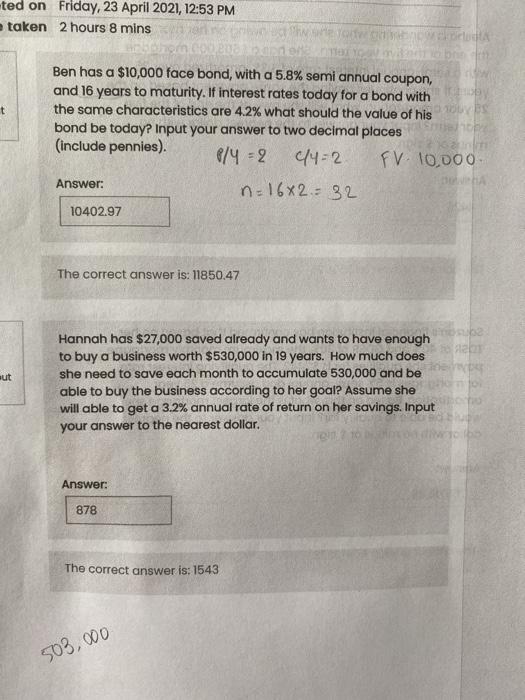

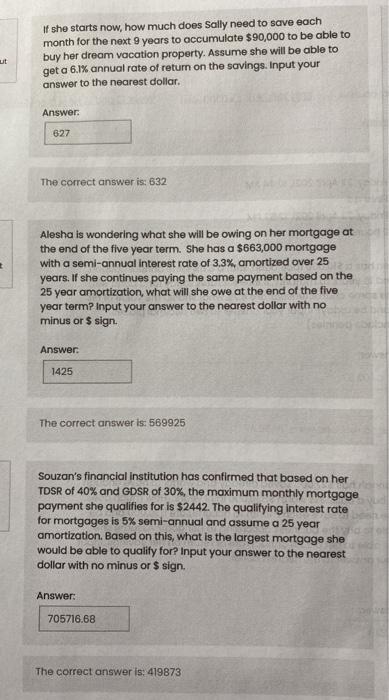

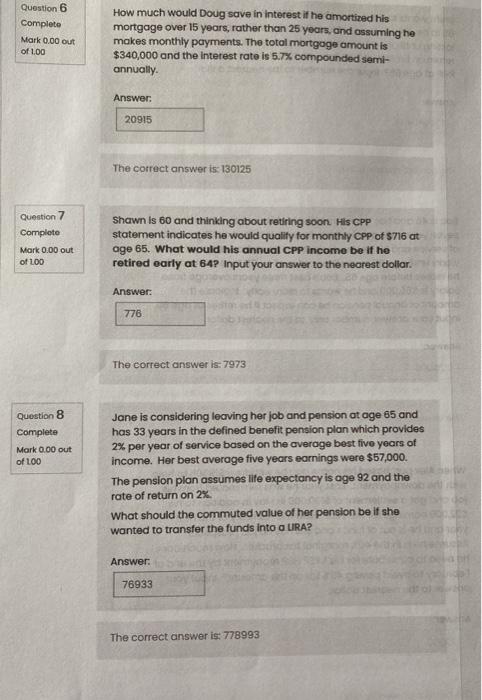

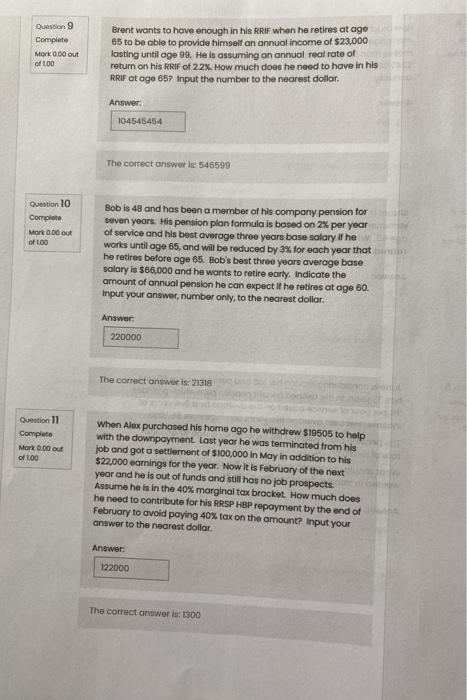

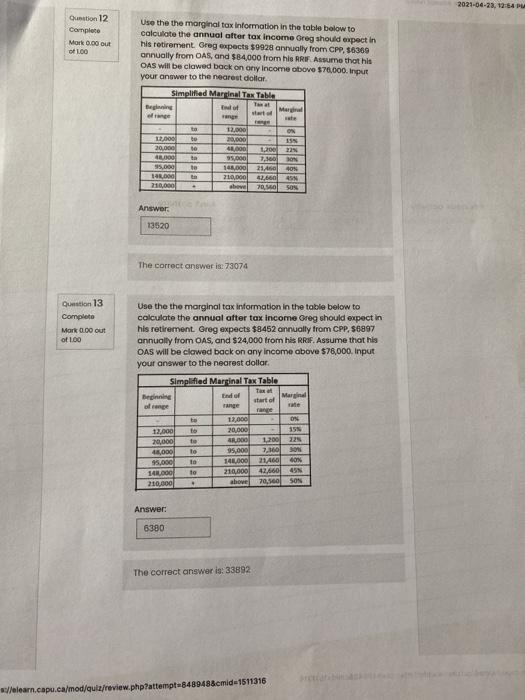

ted on Friday, 23 April 2021, 12:53 PM taken 2 hours 8 mins 101 Ben has a $10,000 face bond, with a 5.8% semi annual coupon, and 16 years to maturity. If interest rates today for a bond with 150 the same characteristics are 4.2% what should the value of his bond be today? Input your answer to two decimal places (include pennies). 8/4 = 2 c/4=2 FV 10,000 Answer: n = 1682. = 32 10402.97 The correct answer is: 11850.47 ut Hannah has $27,000 saved already and wants to have enough DO to buy a business worth $530,000 in 19 years. How much does she need to save each month to accumulate 530,000 and be able to buy the business according to her goal? Assume she will able to get a 3.2% annual rate of return on her savings. Input your answer to the nearest dollar. Answer: 878 The correct answer is: 1543 503,000 If she starts now, how much does Sally need to save each month for the next 9 years to accumulate $90,000 to be able to buy her dream vocation property. Assume she will be able to get a 6.1% annual rate of return on the savings. Input your answer to the nearest dollar ut Answer: 627 The correct answer is: 632 Alesha is wondering what she will be owing on her mortgage at the end of the five year term. She has a $663,000 mortgage with a semi-annual interest rate of 3.3%, amortized over 25 years. If she continues paying the same payment based on the 25 year amortization, what will she owe at the end of the five year term Input your answer to the nearest dollar with no minus or s sign Answer: 1425 The correct answer is: 569925 Souzan's financial institution has confirmed that based on her TDSR of 40% and GDSR of 30%, the maximum monthly mortgage payment she qualities for is $2442. The qualifying interest rate for mortgages is 5% semi-annual and assume a 25 year amortization. Based on this, what is the largest mortgage she would be able to qualify for? Input your answer to the nearest dollar with no minus or $ sign. Answer: 705716.68 The correct answer is: 419873 Question 6 Complete Mark 0.00 out of 100 How much would Doug save in interest if he amortized his mortgage over 15 years, rather than 25 years, and assuming he makes monthly payments. The total mortgage amount is $340,000 and the Interest rate is 5.7% compounded semi- annually Answer: 20915 The correct answer is: 130125 Question 7 Completo Mark 0.00 out of 100 Shawn is 60 and thinking about retiring soon. His CPP statement indicates he would quality for monthly CPP of $716 at age 65. What would his annual CPP income be if he retired early at 64P Input your answer to the nearest dollar. Answer: 776 The correct answer is: 7973 Question 8 Complete Mark 0.00 out of 100 Jane is considering leaving her job and pension at age 65 and has 33 years in the defined benefit pension plan which provides 2% per year of service based on the average best five years of income. Her best average five years earnings were $57,000. The pension plon assumes life expectancy is age 92 and the rate of return on 2% What should the commuted value of her pension be if she wanted to transfer the funds into a LIRA? Answer: 76933 The correct answer is: 778993 Question 9 Complete Mork 0.00 out of 100 Brent wants to have enough in his RRIF when he retires at ago 65 to be able to provide himself an annual income of $23,000 lasting until age 99. He is assuming an annual real rate of return on his RRIF of 2.2%. How much does he need to have in his RRIF at age 657 Input the number to the nearest dollar Answer: 104545454 The correct answer is: 546599 Question 10 Complete Mort 0.00 out of LOO Bob is 48 and has been a member of his company pension for seven years. His pension plan formula is based on 2% per year of service and his best average three years base salary if he works until age 65, and will be reduced by 3% for each year that he retires before age 65. Bob's best three years average base salary is $66,000 and he wants to retire early. Indicate the amount of annual pension he can expect if he retires at age 60 Input your answer, number only, to the nearest dollar. Answer: 220000 The correct answer is: 21318 Question 11 Completo Mark 0.00 out of 100 When Alex purchased his home ago he withdrew $19505 to help with the downpayment last year he was terminated from his job and got a settlement of $100,000 in May in addition to his $22,000 earnings for the year. Now it is February of the next year and he is out of funds and still hos no job prospects. Assure he is in the 40% marginal tax brocket. How much does he need to contribute for his RRSP HBP repayment by the end of February to avoid paying 40% tax on the amount? Input your answer to the nearest dollar Answer: 122000 The correct answer is: 1300 2021-04-23, 12:54 PM Question 12 Complete work out of 100 Use the the marginal tax information in the table below to calculate the annual after tax income Greg should expect in his retirement Greg expects $9928 annually from CPP, 56369 annually from OAS, and $84,000 from his RRIF Assume that his OAS will be clowed back on ony Income above $70,000. Input your answer to the nearest dollar Simplified Martinal Tax Table Taal Beginning Tot Merged ge wart ng ta 12.000 ON 12.000 to 20.000 15 20.000 to 40,000 1,200 225 40 ta 95.000 1,500 SON 95,000 te 145,000 21.4160 40% 14.000 210,000 43,66 AN 210,000 show 70,90 SO Answer: 13520 The correct answer is: 73074 Question 13 Completo Mark 0.00 out of 1.00 Tax Use the tho marginal tax information in the table below to calculate the annual after tax income Greg should expect in his retirement Greg expects $8452 annually from CPP. 56897 annually from OAS, and $24,000 from his RRIF. Assume that his OAS will be clowed back on any income above $76,000. Input your answer to the nearest dollar Simplified Marginal Tax Table Beginning End of start of Marginal onge range ane 12,000 ON 12.000 20,000 155 20,000 4,00 1200 48,000 95.000 7,360 son 95,000 140,000 21460 40 141.000 to 210,000 42.460 210,000 above 70,500 SON 201212 to Answer: 6380 The correct answer is: 33892 //elearn.capu.ca/mod/quiz/review.php?attempt848948&cmid-1511316