Answered step by step

Verified Expert Solution

Question

1 Approved Answer

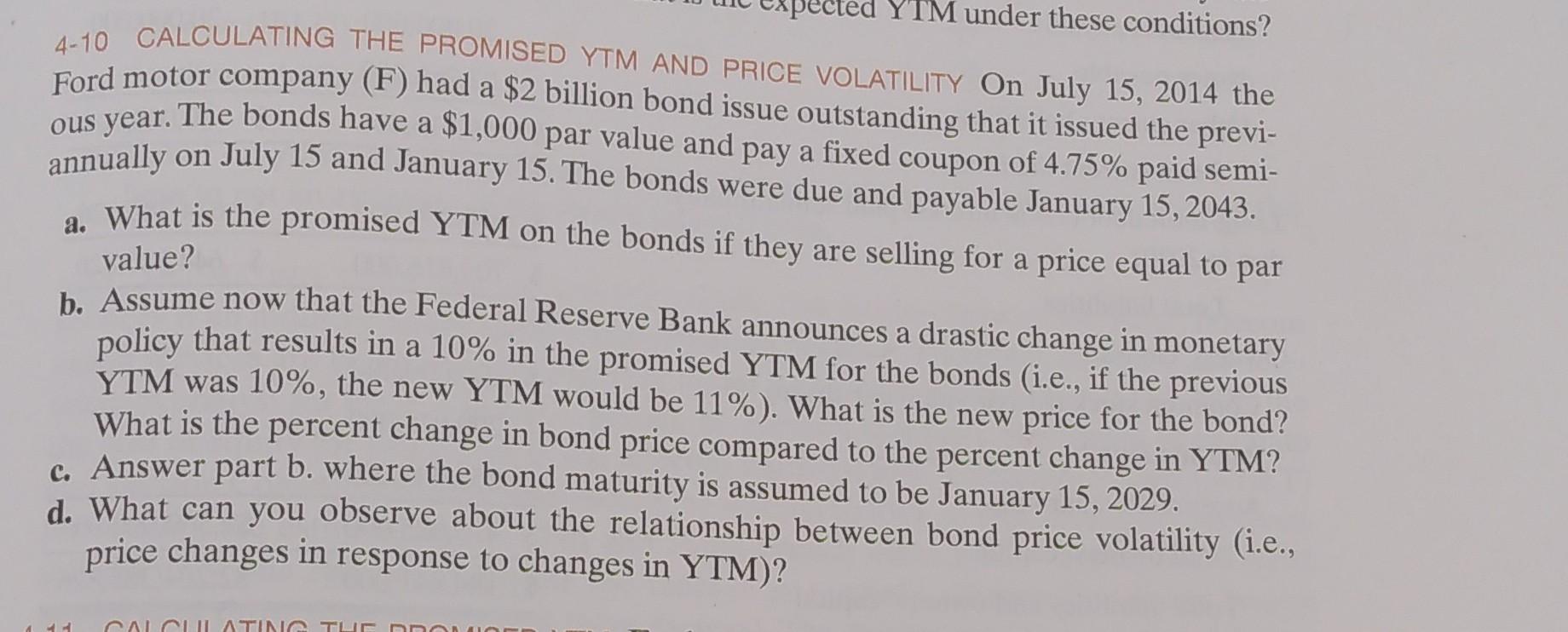

ted YTM under these conditions? 4-10 CALCULATING THE PROMISED YTM AND PRICE VOLATILITY On July 15, 2014 the Ford motor company (F) had a $2

ted YTM under these conditions? 4-10 CALCULATING THE PROMISED YTM AND PRICE VOLATILITY On July 15, 2014 the Ford motor company (F) had a $2 billion bond issue outstanding that it issued the previ- ous year. The bonds have a $1,000 par value and pay a fixed coupon of 4.75% paid semi- annually on July 15 and January 15. The bonds were due and payable January 15,2043. a. What is the promised YTM on the bonds if they are selling for a price equal to par value? b. Assume now that the Federal Reserve Bank announces a drastic change in monetary policy that results in a 10% in the promised YTM for the bonds (i.e., if the previous YTM was 10%, the new YTM would be 11%). What is the new price for the bond? What is the percent change in bond price compared to the percent change in YTM? c. Answer part b. where the bond maturity is assumed to be January 15, 2029. d. What can you observe about the relationship between bond price volatility (i.e., price changes in response to changes in YTM)? CALCULATING TUF mmoor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started