Question

TEK wishes to hedge a EUR4,000,000 account receivable arising from a sale to Olivetti (Italy). Payment from Olivetti is due in three months. TEKs Italian

TEK wishes to hedge a EUR4,000,000 account receivable arising from a sale to Olivetti (Italy). Payment from Olivetti is due in three months. TEKs Italian unit does not have ready access to local currency borrowing, eliminating the money market hedge alternative. Citibank has offered TEK the following quotes:

| Spot rate | USD1.2000/EUR |

| 3 month forward rate | USD1.2180/EUR |

| Three month euro interest rate | 4.2% per year |

| 3 month put option on euros at strike price of USD1.0800/EUR | 3.4% |

| TEKs weighted average cost of capital | 9.8% |

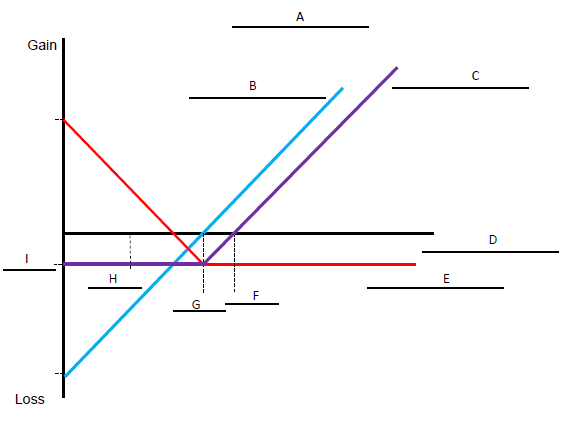

In the context of this information, match the following graph with the appropriate labels (note there are fewer blanks than available responses):

| What is the label for line A? | Choose...Forward Maket HedgeUSD1.0800/EUR1Premium of USD146,880Long PutLong ReceivablePremium of USD136,000Put Option HedgeUSD1.0400/EUR1USD1.1140/EUR1S(USD/EUR)90 daysUSD1.2180/EUR1Hedged Receivable |

| What is the label for line B? | Choose...Forward Maket HedgeUSD1.0800/EUR1Premium of USD146,880Long PutLong ReceivablePremium of USD136,000Put Option HedgeUSD1.0400/EUR1USD1.1140/EUR1S(USD/EUR)90 daysUSD1.2180/EUR1Hedged Receivable |

| What is the label for line C? | Choose...Forward Maket HedgeUSD1.0800/EUR1Premium of USD146,880Long PutLong ReceivablePremium of USD136,000Put Option HedgeUSD1.0400/EUR1USD1.1140/EUR1S(USD/EUR)90 daysUSD1.2180/EUR1Hedged Receivable |

| What is the label for line D? | Choose...Forward Maket HedgeUSD1.0800/EUR1Premium of USD146,880Long PutLong ReceivablePremium of USD136,000Put Option HedgeUSD1.0400/EUR1USD1.1140/EUR1S(USD/EUR)90 daysUSD1.2180/EUR1Hedged Receivable |

| What is the label for line E? | Choose...Forward Maket HedgeUSD1.0800/EUR1Premium of USD146,880Long PutLong ReceivablePremium of USD136,000Put Option HedgeUSD1.0400/EUR1USD1.1140/EUR1S(USD/EUR)90 daysUSD1.2180/EUR1Hedged Receivable |

| What is the label for line F? | Choose...Forward Maket HedgeUSD1.0800/EUR1Premium of USD146,880Long PutLong ReceivablePremium of USD136,000Put Option HedgeUSD1.0400/EUR1USD1.1140/EUR1S(USD/EUR)90 daysUSD1.2180/EUR1Hedged Receivable |

| What is the label for line G? | Choose...Forward Maket HedgeUSD1.0800/EUR1Premium of USD146,880Long PutLong ReceivablePremium of USD136,000Put Option HedgeUSD1.0400/EUR1USD1.1140/EUR1S(USD/EUR)90 daysUSD1.2180/EUR1Hedged Receivable |

| What is the label for line H? | Choose...Forward Maket HedgeUSD1.0800/EUR1Premium of USD146,880Long PutLong ReceivablePremium of USD136,000Put Option HedgeUSD1.0400/EUR1USD1.1140/EUR1S(USD/EUR)90 daysUSD1.2180/EUR1Hedged Receivable |

| What is the label for line I? | Choose...Forward Maket HedgeUSD1.0800/EUR1Premium of USD146,880Long PutLong ReceivablePremium of USD136,000Put Option HedgeUSD1.0400/EUR1USD1.1140/EUR1S(USD/EUR)90 daysUSD1.2180/EUR1Hedged Receivable |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started