Question

Tektek Industries wants to determine whether it would be advisable for it to replace an existing, fully depreciated machine with a new one. The new

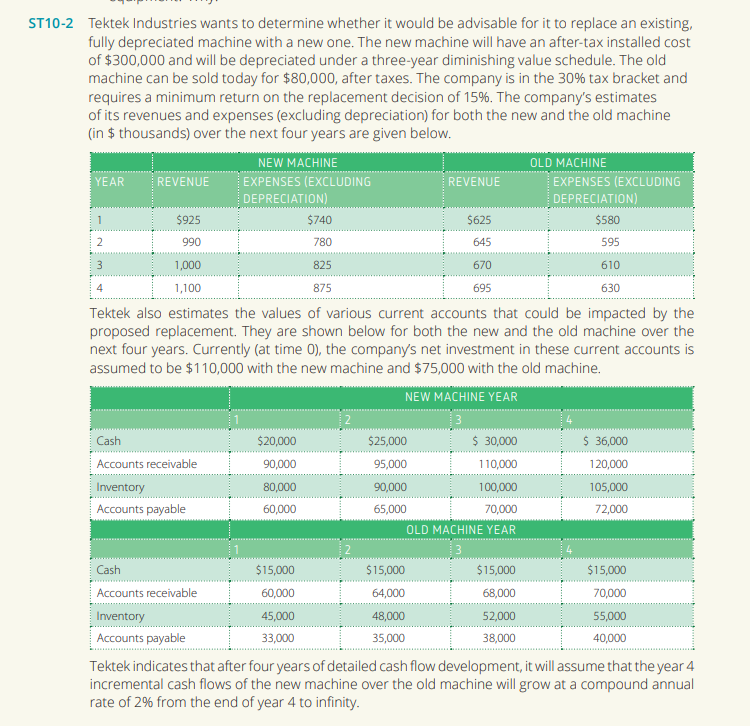

Tektek Industries wants to determine whether it would be advisable for it to replace an existing, fully depreciated machine with a new one. The new machine will have an after-tax installed cost of $300,000 and will be depreciated under a three-year diminishing value schedule. The old machine can be sold today for $80,000, after taxes. The company is in the 30% tax bracket and requires a minimum return on the replacement decision of 15%. The companys estimates of its revenues and expenses (excluding depreciation) for both the new and the old machine (in $ thousands) over the next four years are given below. NEW MACHINE OLD MACHINE YEAR REVENUE EXPENSES (EXCLUDING DEPRECIATION) REVENUE EXPENSES (EXCLUDING DEPRECIATION) 1 $925 $740 $625 $580 2 990 780 645 595 3 1,000 825 670 610 4 1,100 875 695 630 Tektek also estimates the values of various current accounts that could be impacted by the proposed replacement. They are shown below for both the new and the old machine over the next four years. Currently (at time 0), the companys net investment in these current accounts is assumed to be $110,000 with the new machine and $75,000 with the old machine. NEW MACHINE YEAR 1 2 3 4 Cash $20,000 $25,000 $ 30,000 $ 36,000 Accounts receivable 90,000 95,000 110,000 120,000 Inventory 80,000 90,000 100,000 105,000 Accounts payable 60,000 65,000 70,000 72,000 OLD MACHINE YEAR 1 2 3 4 Cash $15,000 $15,000 $15,000 $15,000 Accounts receivable 60,000 64,000 68,000 70,000 Inventory 45,000 48,000 52,000 55,000 Accounts payable 33,000 35,000 38,000 40,000 Tektek indicates that after four years of detailed cash flow development, it will assume that the year 4 incremental cash flows of the new machine over the old machine will grow at a compound annual rate of 2% from the end of year 4 to infinity. Find the incremental operating cash flows (including any working capital investment) for years 1 to 4 for Tekteks proposed machine-replacement decision. b Calculate the terminal value of Tekteks proposed machine replacement at the end of year 4. c Show the cash flows (initial outlay, operating cash flows and terminal cash flow) for years 1 to 4 for Tekteks proposed machine replacement. d Using the cash flows from part (c), find the NPV and IRR for Tekteks proposed machine replacement. e Based on your findings in part (d), what recommendation would you make to Tektek regarding its proposed machine replacement? Kindly explain step by step solution and also explained how you find the cash flows for every year with depreciation rate how you calculate them?

Tektek Industries wants to determine whether it would be advisable for it to replace an existing, fully depreciated machine with a new one. The new machine will have an after-tax installed cost of $300,000 and will be depreciated under a three-year diminishing value schedule. The old machine can be sold today for $80,000, after taxes. The company is in the 30% tax bracket and requires a minimum return on the replacement decision of 15%. The companys estimates of its revenues and expenses (excluding depreciation) for both the new and the old machine (in $ thousands) over the next four years are given below. NEW MACHINE OLD MACHINE YEAR REVENUE EXPENSES (EXCLUDING DEPRECIATION) REVENUE EXPENSES (EXCLUDING DEPRECIATION) 1 $925 $740 $625 $580 2 990 780 645 595 3 1,000 825 670 610 4 1,100 875 695 630 Tektek also estimates the values of various current accounts that could be impacted by the proposed replacement. They are shown below for both the new and the old machine over the next four years. Currently (at time 0), the companys net investment in these current accounts is assumed to be $110,000 with the new machine and $75,000 with the old machine. NEW MACHINE YEAR 1 2 3 4 Cash $20,000 $25,000 $ 30,000 $ 36,000 Accounts receivable 90,000 95,000 110,000 120,000 Inventory 80,000 90,000 100,000 105,000 Accounts payable 60,000 65,000 70,000 72,000 OLD MACHINE YEAR 1 2 3 4 Cash $15,000 $15,000 $15,000 $15,000 Accounts receivable 60,000 64,000 68,000 70,000 Inventory 45,000 48,000 52,000 55,000 Accounts payable 33,000 35,000 38,000 40,000 Tektek indicates that after four years of detailed cash flow development, it will assume that the year 4 incremental cash flows of the new machine over the old machine will grow at a compound annual rate of 2% from the end of year 4 to infinity. Find the incremental operating cash flows (including any working capital investment) for years 1 to 4 for Tekteks proposed machine-replacement decision. b Calculate the terminal value of Tekteks proposed machine replacement at the end of year 4. c Show the cash flows (initial outlay, operating cash flows and terminal cash flow) for years 1 to 4 for Tekteks proposed machine replacement. d Using the cash flows from part (c), find the NPV and IRR for Tekteks proposed machine replacement. e Based on your findings in part (d), what recommendation would you make to Tektek regarding its proposed machine replacement? Kindly explain step by step solution and also explained how you find the cash flows for every year with depreciation rate how you calculate them?

Tektek Industries wants to determine whether it would be advisable for it to replace an existing, fully depreciated machine with a new one. The new machine will have an after-tax installed cost of $300,000 and will be depreciated under a three-year diminishing value schedule. The old machine can be sold today for $80,000, after taxes. The company is in the 30% tax bracket and requires a minimum return on the replacement decision of 15%. The company's estimates of its revenues and expenses (excluding depreciation) for both the new and the old machine (in \$ thousands) over the next four years are given below. Tektek also estimates the values of various current accounts that could be impacted by the proposed replacement. They are shown below for both the new and the old machine over the next four years. Currently (at time 0), the companys net investment in these current accounts is assumed to be $110,000 with the new machine and $75,000 with the old machine. Tektek indicates that after four years of detailed cash flow development, it will assume that the year 4 incremental cash flows of the new machine over the old machine will grow at a compound annual rate of 2% from the end of year 4 to infinity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started