Question

Telecom services is an industry under rapid transformation because telephone, Internet, and tele-vision services are being brought together under a common technology. In fall 2006,

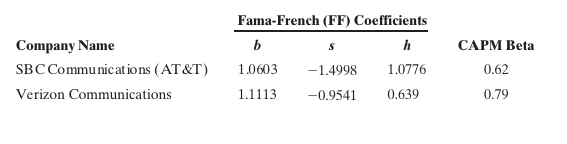

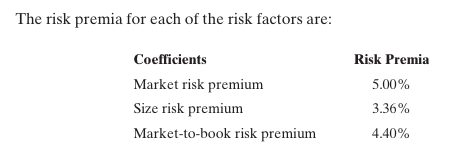

Telecom services is an industry under rapid transformation because telephone, Internet, and tele-vision services are being brought together under a common technology. In fall 2006, the telecom analyst for HML Capital, a private investment company, was trying to evaluate the cost of equity for two giants in the telecom industry: SBC Communications (AT&T) and Verizon Communications. Specifically, he wanted to look at two alternative methods for making the estimate: the CAPM and Fama-French three-factor model. The CAPM utilizes only one risk premium for the market as a whole, whereas the Fama-French model uses three (one for each of three factors). The factors are (1) a market risk pre-mium, (2) a risk premium related to firm size, and (3) a market-to-book risk premium. Data for the risk premium sensitivities ( b, s, and h ) as well as the beta coefficient for the CAPM are listed in the following table

a. If the risk-free rate of interest is 3%, what is the estimated cost of equity for the two firms using the CAPM?

b. What is the estimated cost of equity capital for the two firms using the Fama- French three-factor model? Interpret the meaning of the signs 1 { 2 attached to each of the factors (i.e., b, s, and h ).

Fama-French (FF) Coefficients Company Name SBC Communications (AT&T 1.0603 1.4998 1.0776 Verizon Communications 1.1113 -0.9541 0.639 CAPM Beta 0.62 0.79Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started