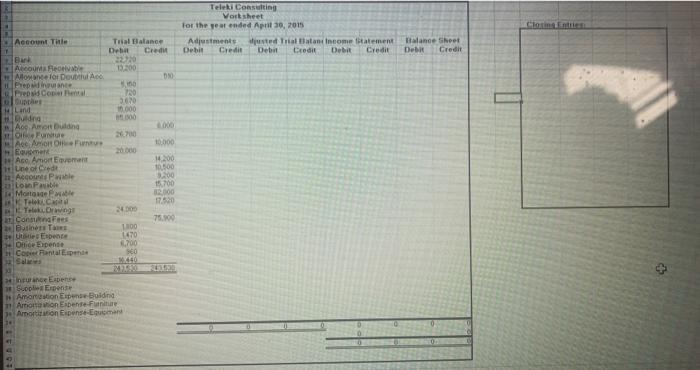

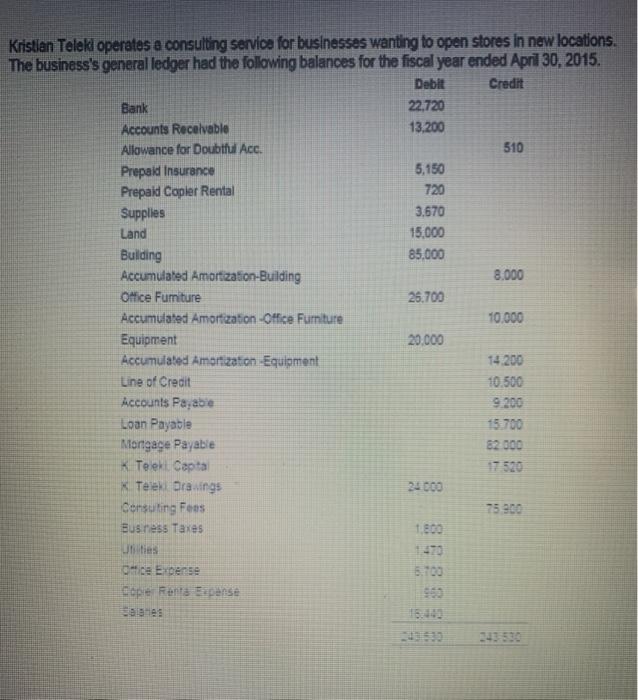

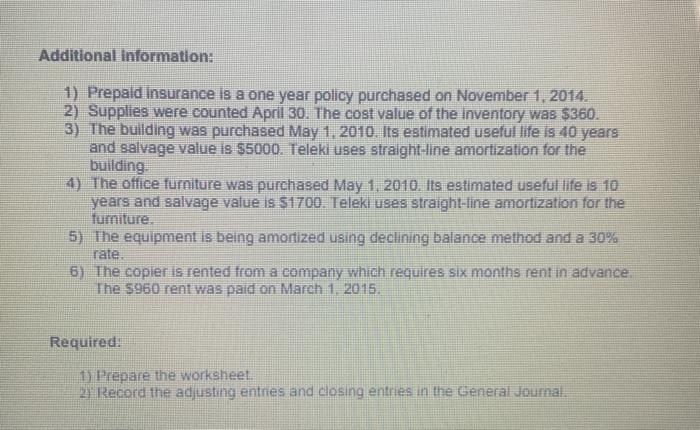

Teleki Consulting Vorksheet For the year ended April 19, 2015 Adjustments usted Tristatant Income tatement Debit Credit Debit Credit Deb Credit Account Title Trial Balance Deba Credit Balance Sheet Deb 730 360 1000 700 20 000 Alco Fonte Mlowance for Dout Aco Pepe olur (Lond udang A Amortuin Home A Amortit Home Aco Amor Eren Account Pwable Lounas Motone TCM Telekung Consund Fees 2 Business ette Exence Oto Erpente Co Fantale 4200 10.500 3200 15.700 RO 2400 75.50 1100 1470 700 SCO XO Insurance Expert 1 spense Amortion Espen Buidid Amortion Esbense Fun Amortisation Expense-Egan Kristian Teleki operates a consulting service for businesses wanting to open stores in new locations. The business's general ledger had the following balances for the fiscal year ended April 30, 2015. Debit Credit Bank 22.720 Accounts Receivable 13,200 Allowance for Doubtful Acc. 510 Prepaid Insurance 5,150 Prepaid Copler Rental 720 Supplies 3,670 Land 15.000 Building 85.000 Accumulated Amortization-Building 8.000 Office Fumiture 26.700 Accumulated Amortization Office Furniture 10.000 Equipment 20.000 Accumulated Amortization -Equipment 14.200 Line of Credit 10.500 Accounts Payable 9.200 Loan Payable 15700 Mortgage Payable 82000 K Teekl Captal 17 520 x Teel Drawings 24 000 Consuting Fees 75.900 Business Taxes 1.800 Us 0108 Expense alanes Additional Information: 1) Prepaid Insurance is a one year policy purchased on November 1, 2014. 2) Supplies were counted April 30. The cost value of the inventory was $360. 3) The building was purchased May 1, 2010. Its estimated useful life is 40 years and salvage value is $5000. Teleki uses straight-line amortization for the building 4) The office furniture was purchased May 1, 2010. Its estimated useful life is 10 years and salvage value is $1700. Teleki uses straight-line amortization for the fumiture. 5) The equipment is being amortized using declining balance method and a 30% rate. 6) The copier is rented from a company which requires six months rent in advance. The 5960 rent was paid on March 1, 2015. Required: 1) Prepare the worksheet 2. Record the adjusting entries and closing entries in the General Journal