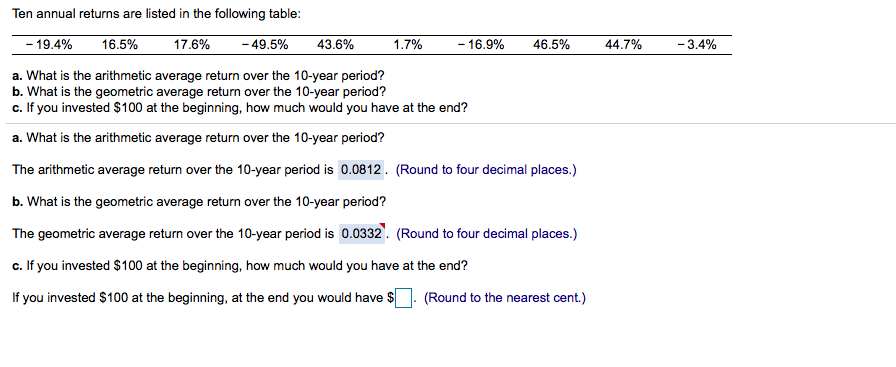

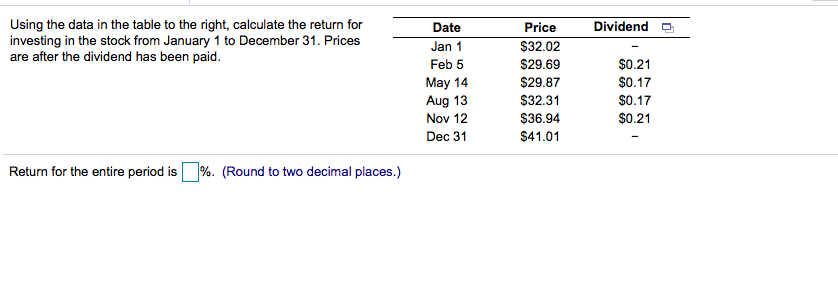

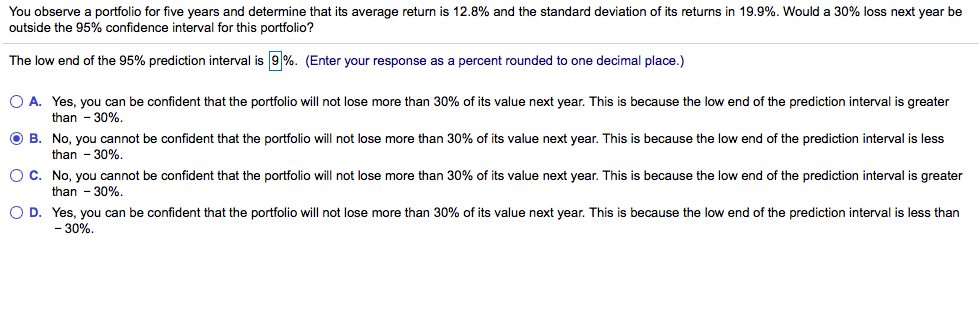

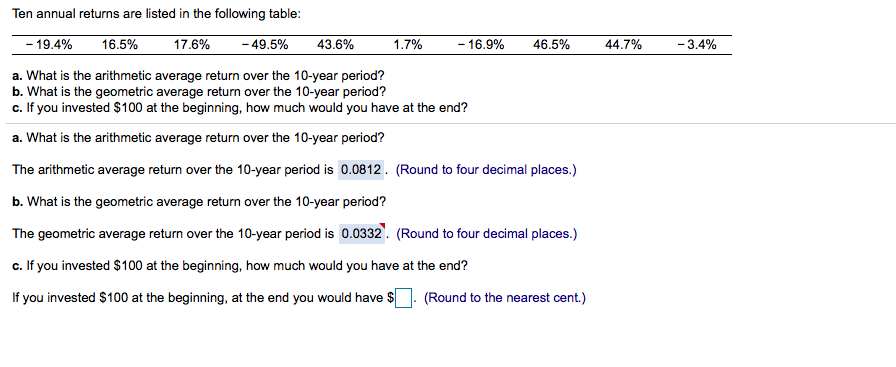

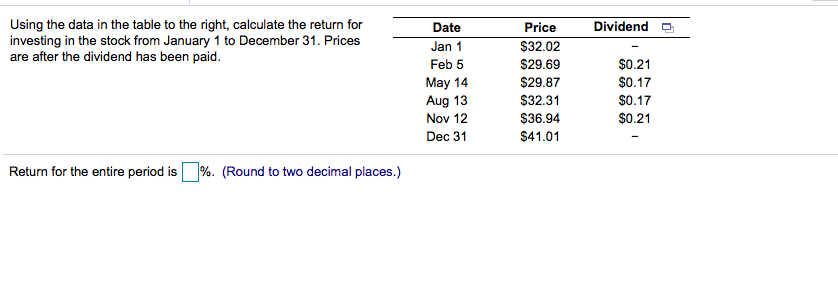

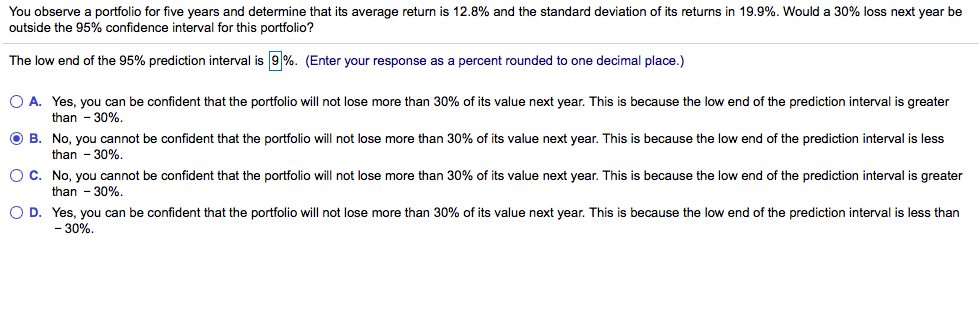

Ten annual returns are listed in the following table -19.4% 16.5% 17 .6% -49.5% 43.6% 1.7% -16.9% 46.5% 44.1% -3.4% a. What is the arithmetic average return over the 10-year period? b. What is the geometric average return over the 10-year period? c. If you invested $100 at the beginning, how much would you have at the end? a. What is the arithmetic average return over the 10-year period? The arithmetic average return over the 10-year period is 0.0812. (Round to four decimal places.) b. What is the geometric average return over the 10-year period? The geometric average return over the 10-year period is 0.0332. (Round to four decimal places.) c. If you invested $100 at the beginning, how much would you have at the end? If you invested $100 at the beginning, at the end you would have S(Round to the nearest cent) Using the data in the table to the right, calculate the return for investing in the stock from January 1 to December 31. Prices are after the dividend has been paid Date Dividend Feb 5 May 14 Aug 13 Nov 12 Dec 31 Price S32.02 $29.69 S29.87 $32.31 $36.94 $41.01 $0.21 $0.17 $0.17 $0.21 Return for the entire period is %. (Round to two decimal places.) You observe a portfolio for five years and determine that its average return is 12.8% and the standard deviation of its returns in 19.9%. Would a 30% loss next year be outside the 95% confidence interval for this portfolio? The low end of the 95% prediction interval is 19%. (Enter your response as a percent rounded to one decimal place.) o A Yes, you can be confident that the portfolio will not lose more than 30% of its value next year. This is because the low end of the prediction interval is greater (O B. No, you cannot be confident that the portfolio will not lose more than 30% of its value next year. This is because the low end of the prediction interval is less O C. No, you cannot be confident that the portfolio will not lose more than 30% of its value next year. This is because the low end of the prediction interval is greater O D. Yes, you can be confident that the portfolio will not lose more than 30% of its value next year. This is because the low end of the prediction interval is less than than-30%. than-30%. than-30%. -30%