Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ten items that may or may not be involved in the bank reconciliation process for April are listed in the table shown below: Complete

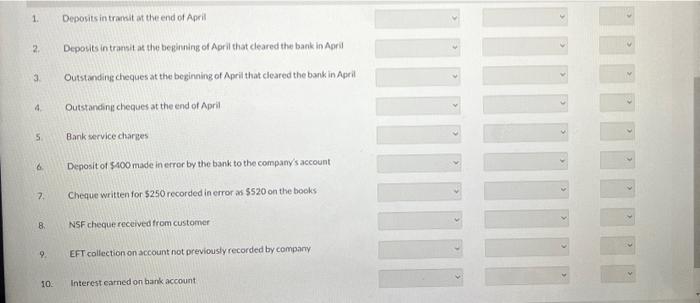

Ten items that may or may not be involved in the bank reconciliation process for April are listed in the table shown below: Complete the table shown below, identifying where each item should be included on a bank reconciliation prepared for the month of April. Indicate whether the item should be added to, or deducted from, the bank or the books. If the item should not be included in the bank reconciliation, indicate "Not Applicable" in each of the bank and books column. In addition, if an item only affects the bank, insert Not Applicable in the books column. Likewise, if it only affects the books, insert Not Applicable in the bank column. Finally, indicate whether the item will require a journal entry on the company books by indicating "yes" or "no" in the last column. 1. Deposits in transit at the end of April 2. Deposits in transit at the beginning of April that cleared the bank in April 3. Outstanding cheques at the beginning of April that cleared the bank in April M 4. Outstanding cheques at the end of April 5. Bank service charges 6 Deposit of $400 made in error by the bank to the company's account 7. Cheque written for $250 recorded in error as $520 on the books 8. NSF cheque received from customer 9. EFT collection on account not previously recorded by company 00 10: Interest earned on bank account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started