Question

Tenacle Acres Company and Subsidiaries Income Statement for 2018 (000 dollars) Sales $94,001 Cost of Goods Sold 46,623 Gross Profit 47,378 Selling and Administrative Expenses

| Tenacle Acres Company and Subsidiaries Income Statement for 2018 (000 dollars) | ||

| Sales | $94,001 | |

| Cost of Goods Sold | 46,623 | |

| Gross Profit | 47,378 | |

| Selling and Administrative Expenses | 28,685 | |

| Depreciation and R&D Expense (both tax deductibles) | 5,752 | |

| EBIT or Operating Income | 12,941 | |

| Interest Expense | 48 | |

| Interest Income | 427 | |

| Earnings Before Taxes (EBT) | 13,320 | |

| Income Taxes | 4,700 | |

| Net Income (NI) | 8,620 | |

| Earnings per Share | 1.72 | |

| Tenacle Acres Company and Subsidiaries Balance Sheet as of End of 2018 (000 dollars) | ||

| Cash | 5,534 | |

| Marketable Securities | 952 | |

| Accounts Receivable (gross) | 14,956 | |

| Less Allowance for Bad Debts | 211 | |

| Accounts Receivable (net) | 14,745 | |

| Inventory | 10,733 | |

| Prepaid Expenses | 3,234 | |

| Plant and Equipment (gross) Less: accumulated depreciation Plant and Equipment (net) | 57,340 29,080 28,260 | |

| Land | 1,010 | |

| Long-Term Investments | 2,503 | |

| Total Assets: | 66,971 | |

| Liabilities | ||

| Accounts Payable | 3,253 | |

| Notes Payable | ------ | |

| Accrued Expenses | 6,821 | |

| Bonds Payable | 2,389 | |

| Stockholders' Equity | ||

| Common Stock | 8,549 | |

| Retained Earnings | 45,959 | |

| Total Liabilities and Equity | 66,971 | |

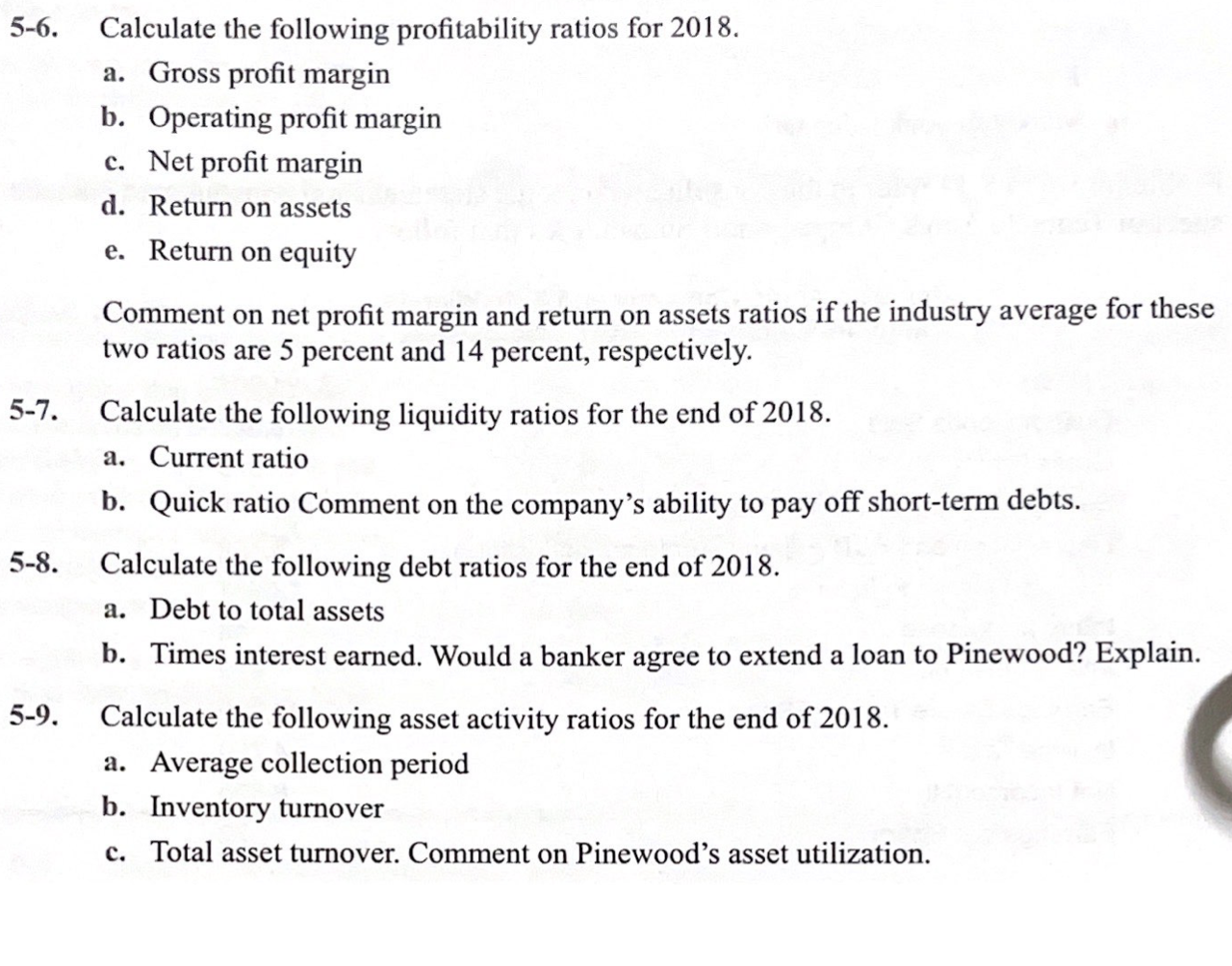

Please answer the following questions and show work!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started