Answered step by step

Verified Expert Solution

Question

1 Approved Answer

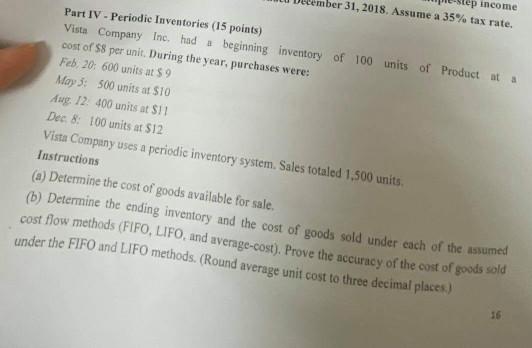

tep income nber 31, 2018. Assume a 35% tax rate. Part IV - Periodic Inventories (15 points) Vista Company Inc. had a beginning inventory of

tep income nber 31, 2018. Assume a 35% tax rate. Part IV - Periodic Inventories (15 points) Vista Company Inc. had a beginning inventory of 100 units of Product at a cost of S8 per unit. During the year, purchases were: Feb 20: 600 units at $9 May 3: 500 units at $10 Awg. 12: 400 units at $!! Dec 8: 100 units at 512 Vista Company uses a periodic inventory system. Sales totaled 1.500 units. Instructions (a) Determine the cost of goods available for sale. (b) Determine the ending inventory and the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average-cost). Prove the accuracy of the cost of goods sold under the FIFO and LIFO methods. (Round average unit cost to three decimal places) 16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started