Answered step by step

Verified Expert Solution

Question

1 Approved Answer

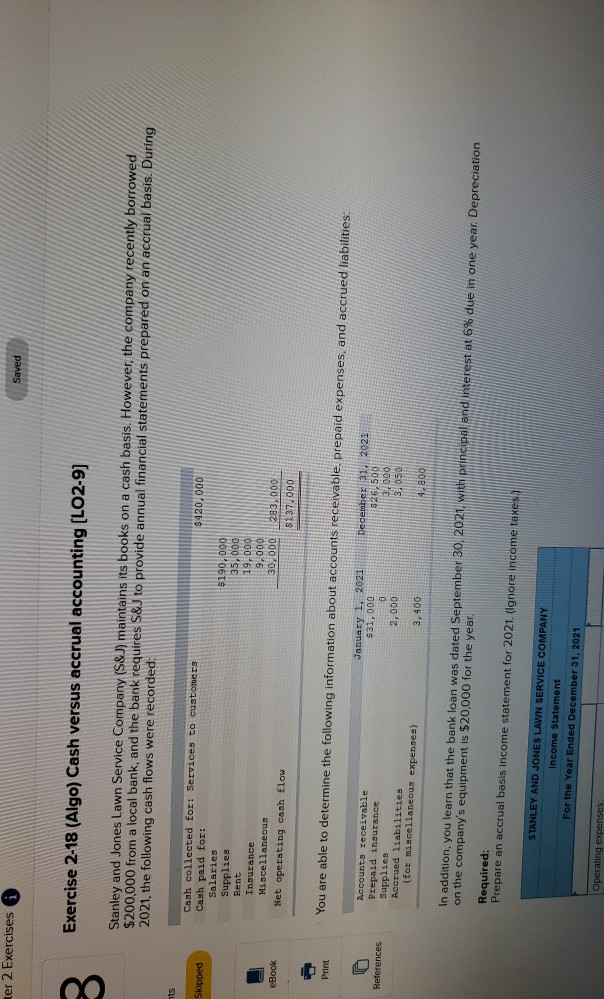

ter 2 Exercises Saved 3 Exercise 2-18 (Algo) Cash versus accrual accounting (LO2-9) Stanley and Jones Lawn Service Company (S&J) maintains its books on a

ter 2 Exercises Saved 3 Exercise 2-18 (Algo) Cash versus accrual accounting (LO2-9) Stanley and Jones Lawn Service Company (S&J) maintains its books on a cash basis. However, the company recently borrowed $200.000 from a local bank, and the bank requires S&J to provide annual financial statements prepared on an accrual basis. During 2021, the following cash flows were recorded: 15 Skipped $420,000 Cash collected for: Services to customers Cash paid for: Salaries Supplies Rent Insurance Miscellaneous Net operating cash flow $190,000 35,000 19,000 9,000 30.000 283,000 $137.000 eBook Print You are able to determine the following information about accounts receivable prepaid expenses, and accrued liabilities: January 1, 2021 $31,000 References accounts receivable Prepaid insurance Supplies Accrued liabilities (for miscellaneous expenses) December 31, 2021 $25,500 3,000 3,050 2,000 3,400 4.800 In addition, you learn that the bank loan was dated September 30, 2021 with principal and interest at 6% due in one year. Depreciation on the company's equipment is $20,000 for the year. Required: Prepare an accrual basis income statement for 2021. (Ignore income taxes STANLEY AND JONES LAWN SERVICE COMPANY Income Statement For the Year Ended December 31, 2021 Operating expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started