Answered step by step

Verified Expert Solution

Question

1 Approved Answer

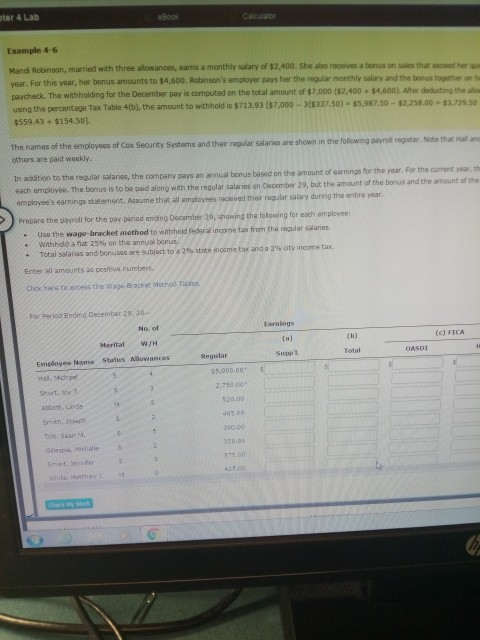

ter 4 Lab eBooi Example 46 Mand Robinson, married with three allowances, earns a monthly salary of $2,400. She also receves a bonus on sales

ter 4 Lab eBooi Example 46 Mand Robinson, married with three allowances, earns a monthly salary of $2,400. She also receves a bonus on sales that exceed her a year Far this vear, her bonus amounts to $4,600. Rabinson's engioyer oays her the reglar monthly salary and the benus together on paycheck. The withholding for the December pay is computed on the total amount of $7,000 (52,400+14,000, Ater deducting the alo using the centage Tax Table 4(b), the amount to withhold is $713.93 ts7,000-3($337.50)-$5,987 $559.43 + $154.50. The names of the employsss of Cox Security Systems and their reqular salariss are shown in the folowing others are paid weekly payrol register. Note that Hall and in addition to the regular salaries, the company pays an annual bonus ba each employee. The bonus i ed on the amount of earnings for the year. For the current year, th s to be paid along with the regular salaries on Oscomber 29, but the amount of the bonus and the amount of the s earmings statement. Assume that all employees rsceived their regular salary during the entire year Prepars the pavroll for the pay pericd ending Dscamber 29, showing the folowing fer each employee Use the waga-bracket method to wthhcld federal income tax from the rapular saanes . withhold a nat 25% on the annual bonus. . Total salanes and bonuses are subject to a 2% state mecme tax and a 2% oty income tar Enter all amourts as pestive rumbers. Click hers to access the Wags-Bracker Method Tables For Period Enoimg December 29.20- No. of Earnings {a) (c) FICA Merital W/H Regular Suppl Employee Name Statius Allowances Hol, Michael Short, ov T bbott.Lids 5,000.00 2,7500 520.00 463.00 380.00 Tole, sean M. Smart, Jennlar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started