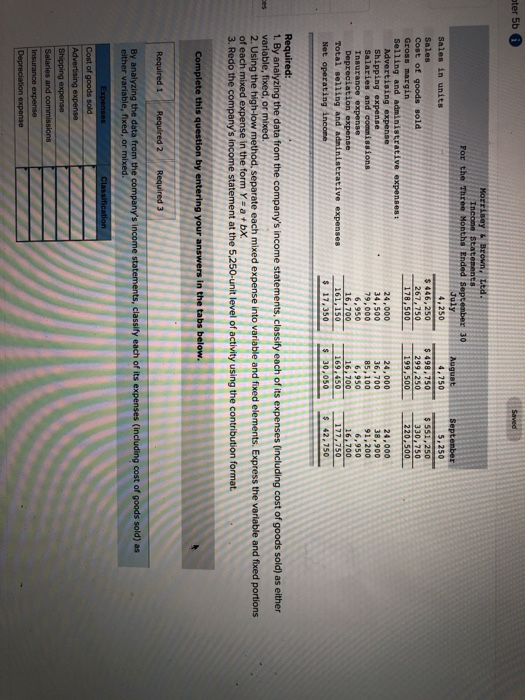

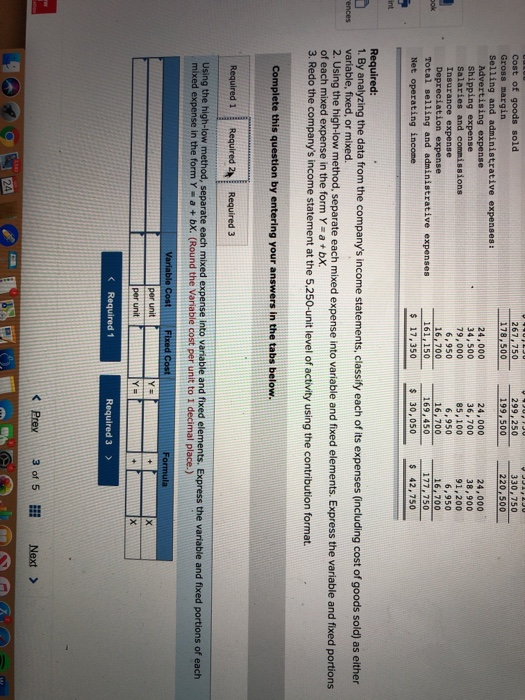

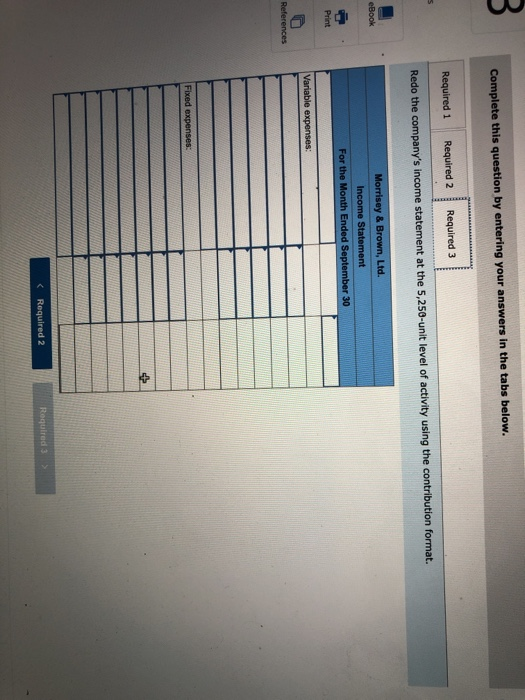

ter 5b Saved Morrisey & Brown, Ltd. Income Statements For the Three Months Ended September 30 July Sales in units 4,250 Sales $ 446,250 Cost of goods sold 267,750 Gross margin 178,500 Selling and administrative expenses Advertising expense 24,000 Shipping expense 34,500 Salaries and commissions 79,000 Insurance expense 6,950 Depreciation expense 16.700 Total selling and administrative expenses 161, 150 Net operating income $ 17,350 August 4,750 $ 498,750 299,250 199,500 September 5,250 $ 551,250 330, 750 220.500 24,000 36,700 85,100 6,950 16.700 169.450 $ 30,050 24,000 38,900 91,200 6,950 16,700 177,750 $ 42,750 ces Required: 1. By analyzing the data from the company's income statements, classify each of its expenses (including cost of goods sold) as either variable, fixed, or mixed. 2. Using the high-low method, separate each mixed expense into variable and fixed elements. Express the variable and fixed portions of each mixed expense in the form Y = a + bx 3. Redo the company's income statement at the 5,250-unit level of activity using the contribution format Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 By analyzing the data from the company's income statements, classify each of its expenses (including cost of goods sold) as either variable, fixed, or mixed. Classification Expenses Cost of goods sold Advertising expense Shipping expense Salaries and commissions Insurance expense Depreciation expense 267, 750 178,500 299, 250 199,500 330, 750 220,500 Cost of goods sold Gross margin Selling and administrative expenses : Advertising expense Shipping expense Salaries and commissions Insurance expense Depreciation expense Total selling and administrative expenses Net operating income 24.000 34,500 79,000 6,950 16,700 161,150 $ 17,350 24,000 36,700 85,100 6,950 16,700 169,450 $ 30,050 24.000 38,900 91,200 6,950 16,700 177,750 $ 42,750 bok int rences Required: 1. By analyzing the data from the company's income statements, classify each of its expenses (including cost of goods sold) as either variable, fixed, or mixed. 2. Using the high-low method, separate each mixed expense into variable and fixed elements. Express the variable and fixed portions of each mixed expense in the form Y = a + bx. 3. Redo the company's income statement at the 5,250-unit level of activity using the contribution format. Complete this question by entering your answers in the tabs below. Required 1 Required Required 3 Using the high-low method, separate each mixed expense into variable and fixed elements. Express the variable and fixed portions of each mixed expense in the form Y = a +bX. (Round the Variable cost per unit to 1 decimal place.) Formula Variable Cost per unit per unit Fixed Cost Y Y = X 24 B Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Redo the company's income statement at the 5,250-unit level of activity using the contribution format. eBook Morrisey & Brown, Ltd. Income Statement For the Month Ended September 30 Print Variable expenses: References Fixed expenses