Question

Terence, a credit approval manager in ABZ Bank, is assessing mortgage loan application submitted by Tommy who just bought a new flat in Kai Tak.

Terence, a credit approval manager in ABZ Bank, is assessing mortgage loan application submitted by Tommy who just bought a new flat in Kai Tak. The following information is provided by the applicant:

| Monthly gross income | $120,000 |

| Annual property taxes | $4,000 |

| Annual homeowners insurance | $800 |

| Monthly repayment on the major credit card (paid by bank autopay) | $1,500 |

| Purchase price of flat | $8,000,000 |

| Market value of flat | $8,300,000 |

| Mortgage interest rate | HIBOR + 1% (Capped at P-2%) |

| Down payment | 30% |

| Loan repayment period | 25 years |

| 1-month HIBOR | 4% |

| Prime rate (P) | 7.5% |

-

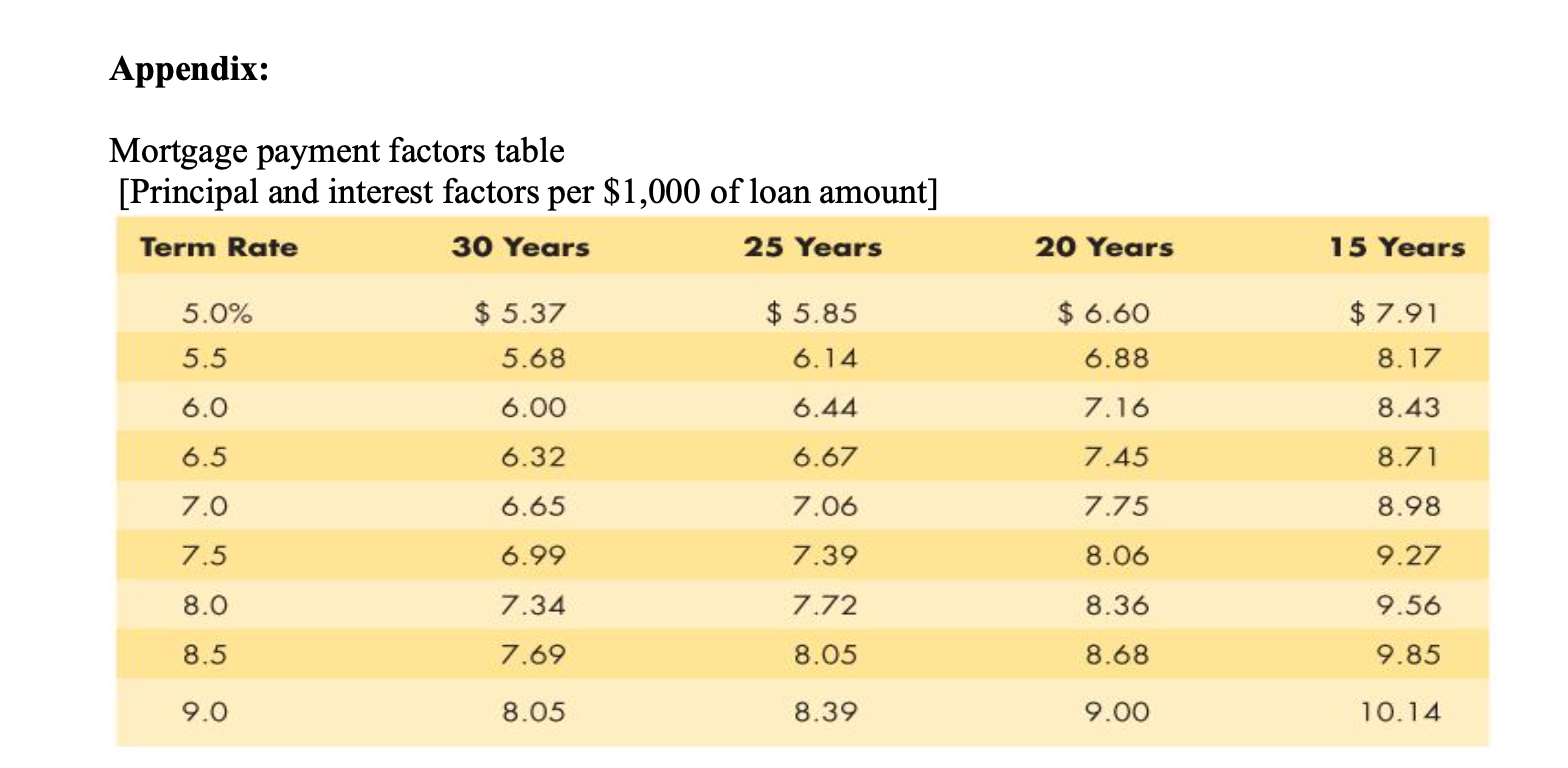

(a) Calculate the (1) monthly mortgage payment and (2) total interest expenses of the mortgage paid by Tommy, using mortgage payment factors table. (5 marks)

-

(b) Calculate Gross Debt Service ratio (GDS) and Total Debt Service Ratio (TDS) of

Tommy. (4 marks)

(c) Identify and explain briefly TWO factors (other than those mentioned above) that affect approval decision of the mortgage application. (4 marks)

(d) From viewpoint of ABZ Bank,

-

(i) explain the trade-off of imposing interest rate cap for mortgage loan. (5 marks)

-

(ii) explain TWO reasons why mortgage loan is more preferred than credit card loans. (4 marks)

-

(iii) explain the trade-off for expanding mortgage refinancing. (4 marks)

-

(iv) identify and explain briefly TWO common weaknesses of ratio analysis and Altman-Z score in assessing credit risk of commercial & industrial loans. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started