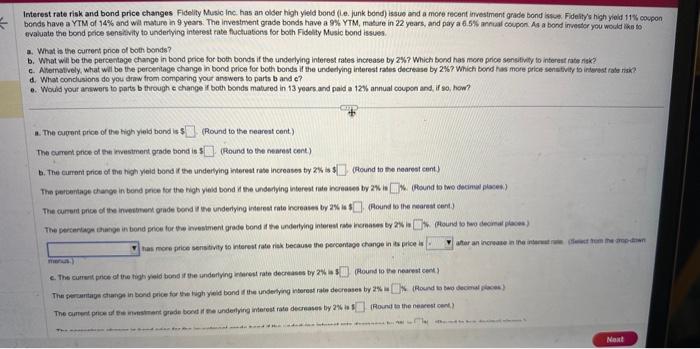

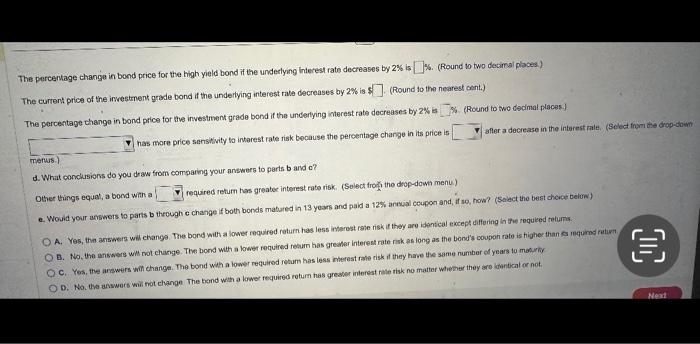

terest rate risk and bond price changes Fidelity Music inc. has an olber high yield bond (i.e. junk bond) issue and a more recent imvestment grade bond issoe. Fideitys high yiold 11% coupon onds have a YTM of 14% and wil mature in 9 years. The investment grade bonds have a 9% YTM, makure in 22 years, and poy a 6.5% anrual coupon. As a bond inveiter you would ion to valuate the bond price wensitivity to undertying interest rate fluctuations for both Fidolty Music bond issues. What is the current pnoe of both bends? b. What will be the percertage change in bond price for both bonds if the undertying interest rates increase by 2% ? Which bond has more price sensitivily to intereat rate risk? c. Aternatvely, What wil be the peroentage change in bond price for both bonds if the undedying interest rates decrease by 2 W? Which bord has more price senstivaty to irteneat rade risk? d. What condusions do you draw from oomparing your answers to parts b and c ? e. Would your anawers to parts b through e change if both bonds matured in 13 yoars and paid a 12% annual coupon and, if so, hom? a. The cuvent price of the high yleld bond is (Round to the nearest cent) The cument phice of twe mestment grade bond is (Round to the nearest cent) 6. The current price of the high yleid bond if the underying interest rase incroases by 2% is $ (Fhound to the noarest cent) The perceriage thatge in bond proce for te invesiment grade bond it the undedying interest rabe habeces by 2Th ia (Alound bo tev decinw places) (Houns to te nearest cent) (Rownt the themest cent) The percentage change in bond price for the high yield bond if the underlying interest rate decreases by 2% is 6. (Round to two decimal ploces.) The curtent price of the investment grade bond if the underlying interest rale decreases by 2% is $ (Round to the nearest cent.) The percentage chango in bond price for the investment grade bond if the undertying interest rate decreases by 2% (Round to two dedimal places) has more price sanstivity to interest rate risk because the percentage change in its price is merwis: d. What conclusions do you draw from comparing your answers to parts b and o ? Other things equat, a bood with a required retum hes greatec interest rate risk. (Solect frodi the deop-down menu.) e. Wouid your answers to parts b theough e change if both bonds matured in 13 yoars and paid a 12% anmial coupon and, if so, how? (Salect the best cheice beluen) A. Yes, the answers wim change. The bond with a lower required return has less interest rese risk it they aro identcal except differing in tiene requied toturms. B. No, the answers wil not change. The bond with a lower required reaum has greaker interest rate risk as long as the bond's coupon rate is highe than ia mequmd rativer c. Yos, the answers win change. The bond whin a lower required retum has less merest rase rigk it they have the same numbar of years to mainif