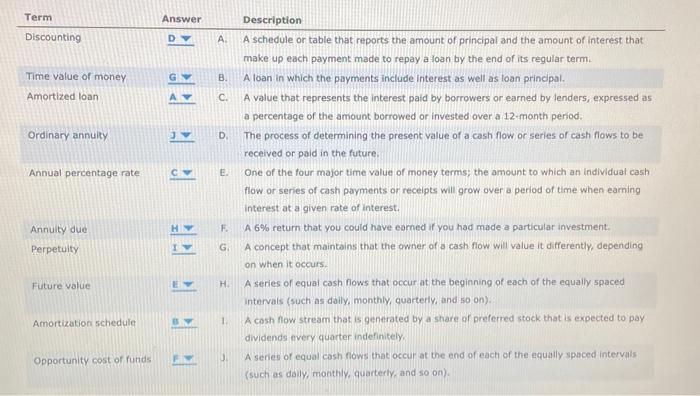

Term Answer Description Discounting Time value of money Amortized loan Ordinary annuity Annual percentage rate Annulty due Perpetulty Future value Amortization schedule Opportunity cost of funds D G A 3 C v H 1 E s > A. A schedule or table that reports the amount of principal and the amount of interest that make up each payment made to repay a loan by the end of its regular term. B. A loan in which the payments include interest as well as loan principal. C. A value that represents the interest paid by borrowers or earned by lenders, expressed as a percentage of the amount borrowed or invested over a 12-month period. D. The process of determining the present value of a cash flow or series of cash flows to be received or paid in the future. E. One of the four major time value of money terms; the amount to which an individual cash flow or series of cash payments or receipts will grow over a period of time when earning interest at a given rate of interest. F. A 6% return that you could have earned if you had made a particular investment. G. A concept that maintains that the owner of a cash flow will value it differently, depending on when it occurs. H. A series of equal cash flows that occur at the beginning of each of the equally spaced intervals (such as daily, monthly, quarterly, and 50 on). 1. A cosh flow stream that is generated by a share of preferred stock that is expected to pay dividends every quarter indefinitely, 3. A series of equal cash flows that occur at the end of each of the equally spaced intervals (such as dally, monthly, quarterly, and so on). Term Answer Description Discounting Time value of money Amortized loan Ordinary annuity Annual percentage rate Annulty due Perpetulty Future value Amortization schedule Opportunity cost of funds D G A 3 C v H 1 E s > A. A schedule or table that reports the amount of principal and the amount of interest that make up each payment made to repay a loan by the end of its regular term. B. A loan in which the payments include interest as well as loan principal. C. A value that represents the interest paid by borrowers or earned by lenders, expressed as a percentage of the amount borrowed or invested over a 12-month period. D. The process of determining the present value of a cash flow or series of cash flows to be received or paid in the future. E. One of the four major time value of money terms; the amount to which an individual cash flow or series of cash payments or receipts will grow over a period of time when earning interest at a given rate of interest. F. A 6% return that you could have earned if you had made a particular investment. G. A concept that maintains that the owner of a cash flow will value it differently, depending on when it occurs. H. A series of equal cash flows that occur at the beginning of each of the equally spaced intervals (such as daily, monthly, quarterly, and 50 on). 1. A cosh flow stream that is generated by a share of preferred stock that is expected to pay dividends every quarter indefinitely, 3. A series of equal cash flows that occur at the end of each of the equally spaced intervals (such as dally, monthly, quarterly, and so on)