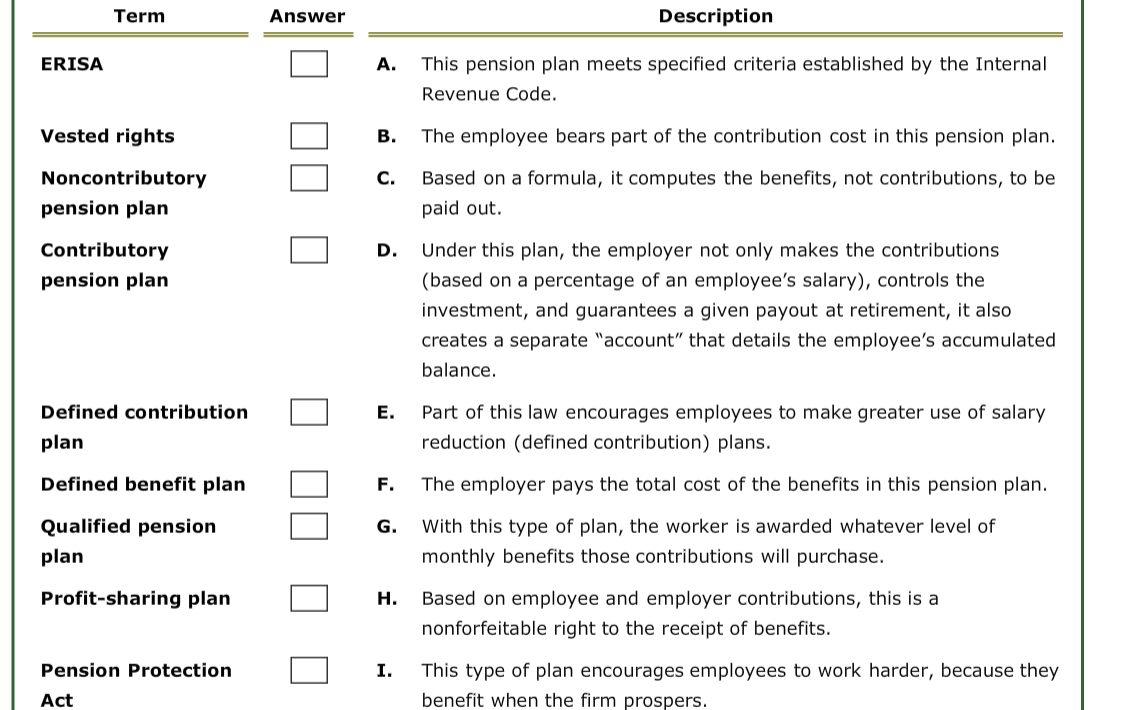

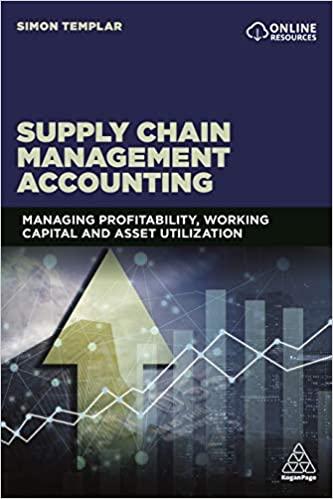

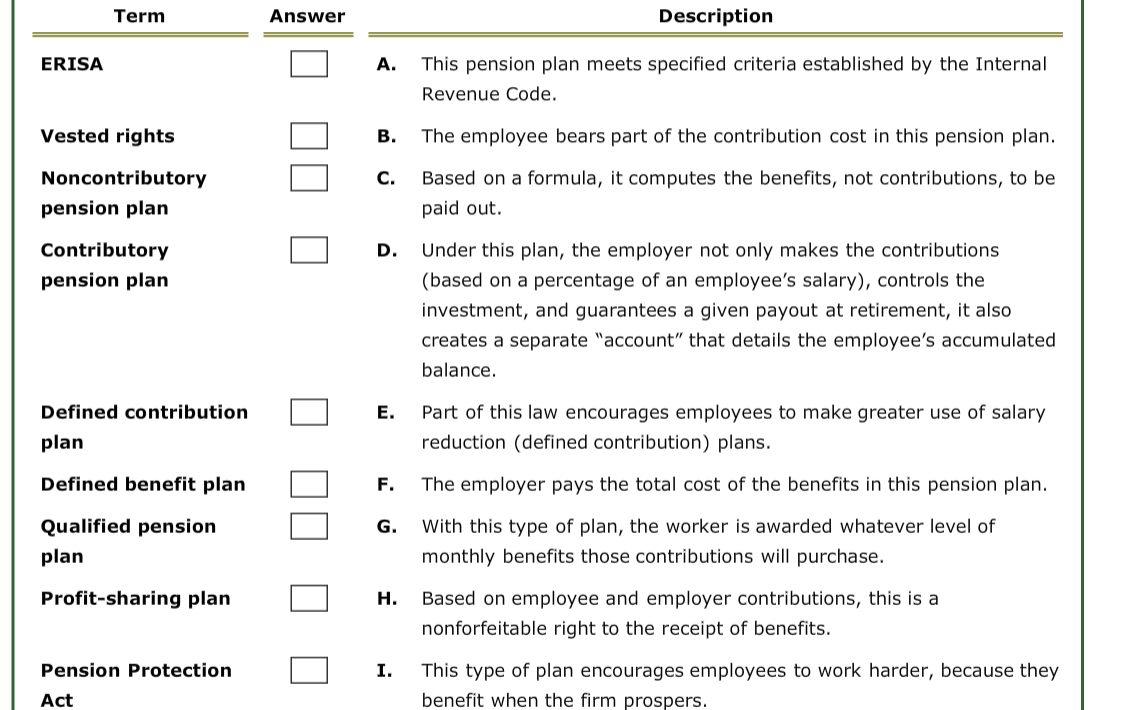

Term Answer Description ERISA A. This pension plan meets specified criteria established by the Internal Revenue Code. Vested rights B. The employee bears part of the contribution cost in this pension plan. c. Noncontributory pension plan Based on a formula, it computes the benefits, not contributions, to be paid out. Contributory pension plan D. Under this plan, the employer not only makes the contributions (based on a percentage of an employee's salary), controls the investment, and guarantees a given payout at retirement, it also creates a separate "account" that details the employee's accumulated balance. E. Defined contribution plan Part of this law encourages employees to make greater use of salary reduction (defined contribution) plans. 0 0 Defined benefit plan F. Qualified pension plan The employer pays the total cost of the benefits in this pension plan. With this type of plan, the worker is awarded whatever level of monthly benefits those contributions will purchase. Profit-sharing plan H. 0 0 Based on employee and employer contributions, this is a nonforfeitable right to the receipt of benefits. Pension Protection Act This type of plan encourages employees to work harder, because they benefit when the firm prospers. Cash-balance plan D J . This law passed in 1974 ensures that workers eligible for pensions actually receive such benefits. Term Answer Description ERISA A. This pension plan meets specified criteria established by the Internal Revenue Code. Vested rights B. The employee bears part of the contribution cost in this pension plan. c. Noncontributory pension plan Based on a formula, it computes the benefits, not contributions, to be paid out. Contributory pension plan D. Under this plan, the employer not only makes the contributions (based on a percentage of an employee's salary), controls the investment, and guarantees a given payout at retirement, it also creates a separate "account" that details the employee's accumulated balance. E. Defined contribution plan Part of this law encourages employees to make greater use of salary reduction (defined contribution) plans. 0 0 Defined benefit plan F. Qualified pension plan The employer pays the total cost of the benefits in this pension plan. With this type of plan, the worker is awarded whatever level of monthly benefits those contributions will purchase. Profit-sharing plan H. 0 0 Based on employee and employer contributions, this is a nonforfeitable right to the receipt of benefits. Pension Protection Act This type of plan encourages employees to work harder, because they benefit when the firm prospers. Cash-balance plan D J . This law passed in 1974 ensures that workers eligible for pensions actually receive such benefits