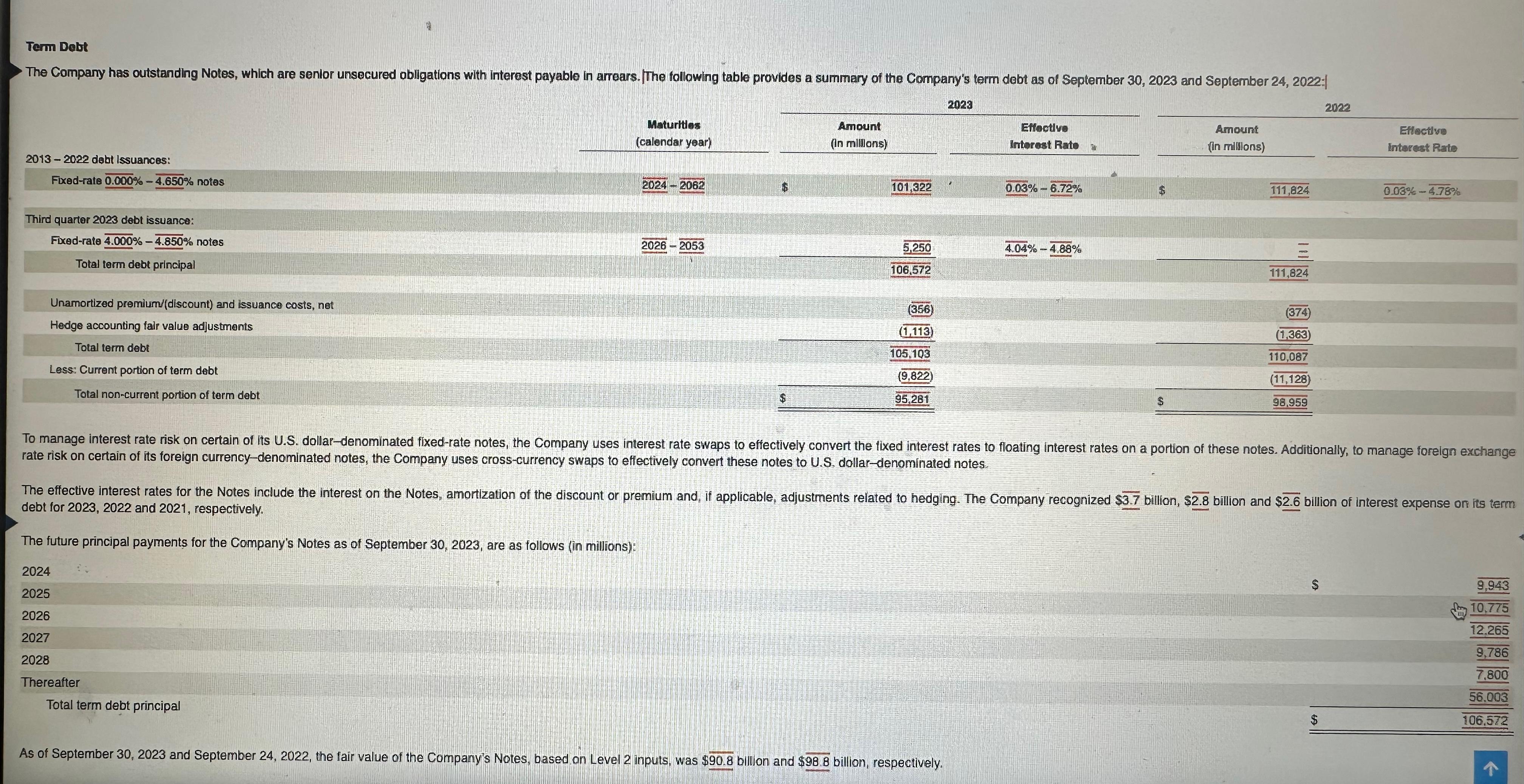

Term Debt The Company has outstanding Notes, which are senior unsecured obligations with interest payable in arrears. The following table provides a summary of

Term Debt The Company has outstanding Notes, which are senior unsecured obligations with interest payable in arrears. The following table provides a summary of the Company's term debt as of September 30, 2023 and September 24, 2022: 2013-2022 debt Issuances: Fixed-rate 0.000%-4.650% notes Third quarter 2023 debt issuance: Fixed-rate 4.000% -4.850% notes Total term debt principal Unamortized premium/(discount) and issuance costs, net Hedge accounting fair value adjustments Total term debt Less: Current portion of term debt Total non-current portion of term debt Maturities (calendar year) 2024-2062 Amount (in millions) 2023 Effective Interest Rate 101,322 0.03% -6.72% Amount (in millions) 2022 Effective Interest Rate 111,824 0.03%-4.78% 2026-2053 5,250 106,572 4.04% -4.88% 111,824 (356) (1,113) 105,103 (9,822) 95,281 $ (374) (1,363) 110,087 (11,128) 98,959 To manage interest rate risk on certain of its U.S. dollar-denominated fixed-rate notes, the Company uses interest rate swaps to effectively convert the fixed interest rates to floating interest rates on a portion of these notes. Additionally, to manage foreign exchange rate risk on certain of its foreign currency-denominated notes, the Company uses cross-currency swaps to effectively convert these notes to U.S. dollar-denominated notes. The effective interest rates for the Notes include the interest on the Notes, amortization of the discount or premium and, if applicable, adjustments related to hedging. The Company recognized $3.7 billion, $2.8 billion and $2.6 billion of interest expense on its term debt for 2023, 2022 and 2021, respectively. The future principal payments for the Company's Notes as of September 30, 2023, are as follows (in millions): 2024 2025 2026 2027 2028 Thereafter Total term debt principal As of September 30, 2023 and September 24, 2022, the fair value of the Company's Notes, based on Level 2 inputs, was $90.8 billion and $98.8 billion, respectively. 9,943 10,775 12.265 9,786 7,800 56.003 EA $ 106,572

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image you sent appears to be a table outlining the job costing for a specific job Job 371 along with additional information to help understand the calculations behind the allocated overhead Job co...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started