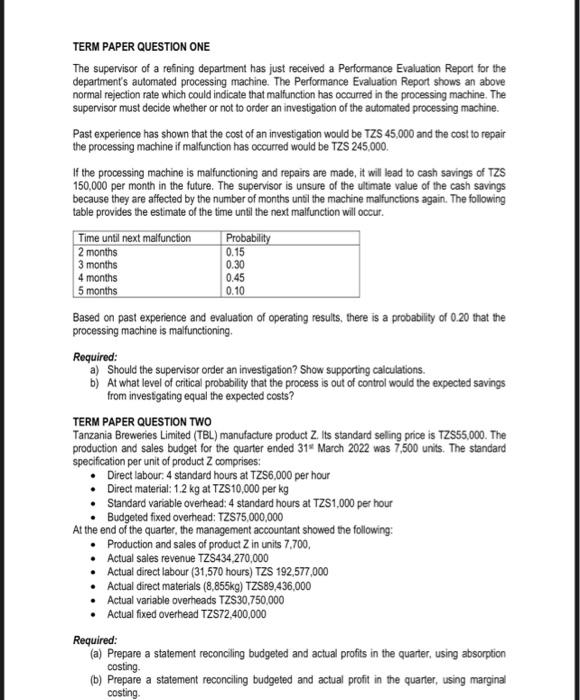

TERM PAPER QUESTION ONE The supervisor of a refining department has just received a Performance Evaluation Report for the department's automated processing machine. The Perlormance Evaluation Report shows an above normal rejection rate which could indicate that malfunction has occurred in the processing machine. The supervisor must decide whether or not to order an investigation of the automated processing machine. Past experience has shown that the cost of an investigation would be TZS 45,000 and the cost to repair the processing machine if malfunction has occurred would be TZS 245,000 . If the processing machine is malfunctioning and repairs are made, it will lead to cash savings of TZS 150,000 per month in the future. The supervisor is unsure of the ultimate value of the cash savings because they are affected by the number of months until the machine malfunctions again. The following table provides the estimate of the time until the next malfunction will occur. Based on past experience and evaluation of operating results, there is a probability of 0.20 that the processing machine is malfunctioning. Required: a) Should the supervisor order an investigation? Show supporting calculations. b) At what level of critical probability that the process is out of control would the expected savings from investgating equal the expected costs? TERM PAPER QUESTION TWO Tanzania Breweries Limited (TBL) manufacture product Z. Its standard seling price is TZS55,000. The production and sales budget for the quarter ended 31 March 2022 was 7,500 units. The standard specification per unit of product Z comprises: - Direct labour. 4 standard hours at TZS6,000 per hour - Direct material: 1.2kg at TZS10,000 per kg - Standard variable overhead: 4 standard hours at TZS1,000 per hour - Budgeted fixed overhead: TZS75,000,000 At the end of the quarter, the management accountant showed the following: - Production and sales of product Z in units 7,700, - Actual sales revenue TZS434,270,000 - Actual direct labour ( 31,570 hours) TZS 192,577,000 - Actual direct materials (8,855kg) TZS 89,436,000 - Actual variable overheads TZ $30,750,000 - Actual fixed overhead TZS72,400,000 Required: (a) Prepare a statement reconciling budgeted and actual profits in the quarter, using absorption costing. (b) Prepare a statement reconciling budgeted and actual profit in the quarter, using marginal costing