Answered step by step

Verified Expert Solution

Question

1 Approved Answer

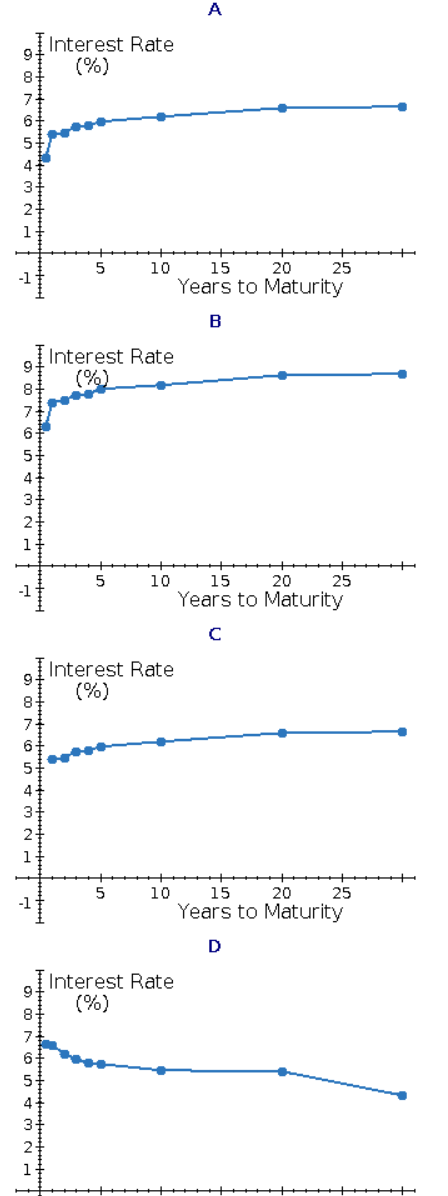

TERM RATE 6 months 4.34% 1 year 5.43 2 years 5.52 3 years 5.78 4 years 5.84 5 years 6.02 10 years 6.24 20 years

| TERM | RATE |

| 6 months | 4.34% |

| 1 year | 5.43 |

| 2 years | 5.52 |

| 3 years | 5.78 |

| 4 years | 5.84 |

| 5 years | 6.02 |

| 10 years | 6.24 |

| 20 years | 6.65 |

| 30 years | 6.71 |

9 Interest Rate (%) 8 5 4 3 1 5 -1 10 15 20 25 Years to Maturity B Interest Rate 9 (%) 8 7 5 4 3 2 1 5 -1 10 15 20 25 Years to Maturity 9 8 Interest Rate (%) 6 5 4 3 2 1 5 -1 10 15 20 25 Years to Maturity D Interest Rate (%) 8 7 6 5 4 3 2 1 The correct yield curve is -Select- b. What type of yield curve is shown? -Select- c. What information does this graph tell you? -Select- d. Based on this yield curve, if you needed to borrow money for longer than 1 year, would it make sense for you to borrow short term and renew the loan or borrow long term? Explain. I. Even though the borrower reinvests in increasing short-term rates, those rates are still below the long-term rate, but what makes the higher long-term rate attractive is the rollover risk that may possibly occur if the short-term rates go even higher than the long-term rate and that could be for a long time!). II. Generally, it would make sense to borrow short-term because each year the loan is renewed the interest rate would be higher. III. Generally, it would make sense to borrow short-term because each year the loan is renewed the interest rate would be lower. IV. Generally, it would make sense to borrow long-term because each year the loan is renewed the interest rate would be lower. V. Differences in yields that may exist between the short-term and long-term cannot be explained by the forces of supply and demand in each market. -Select

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started