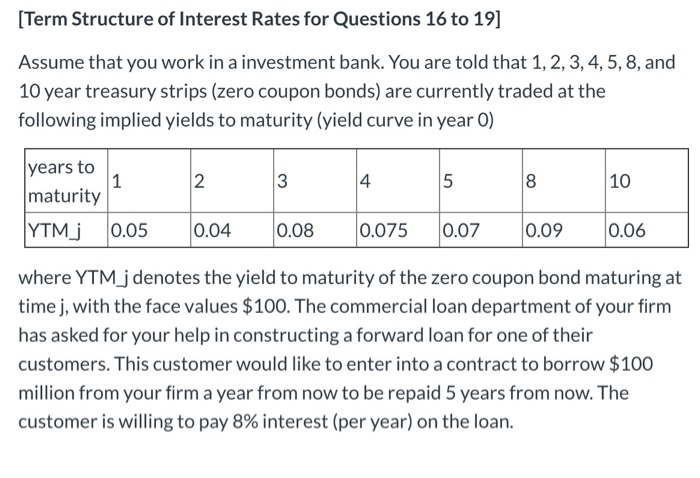

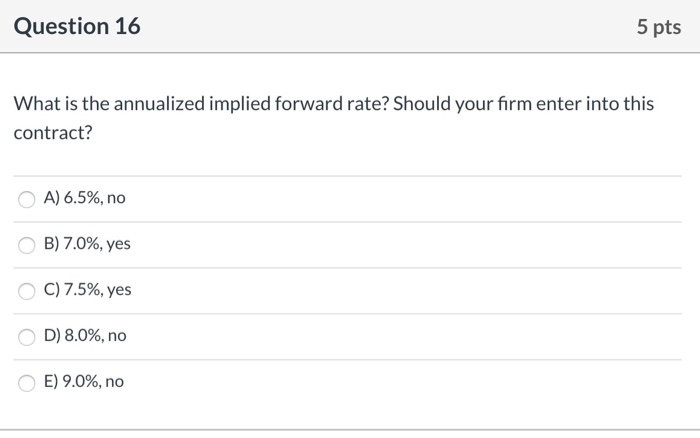

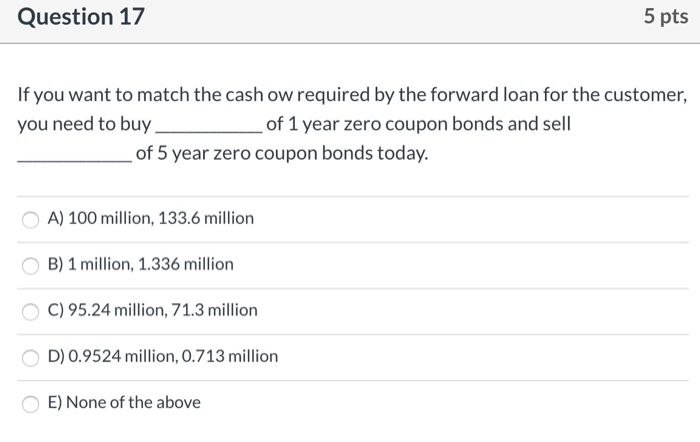

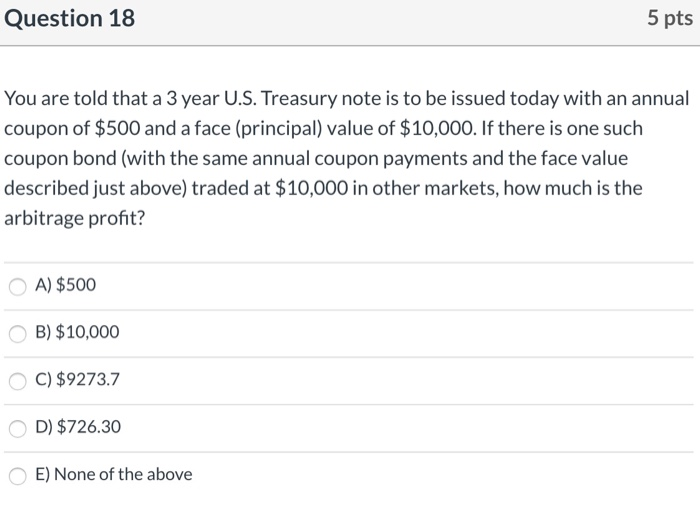

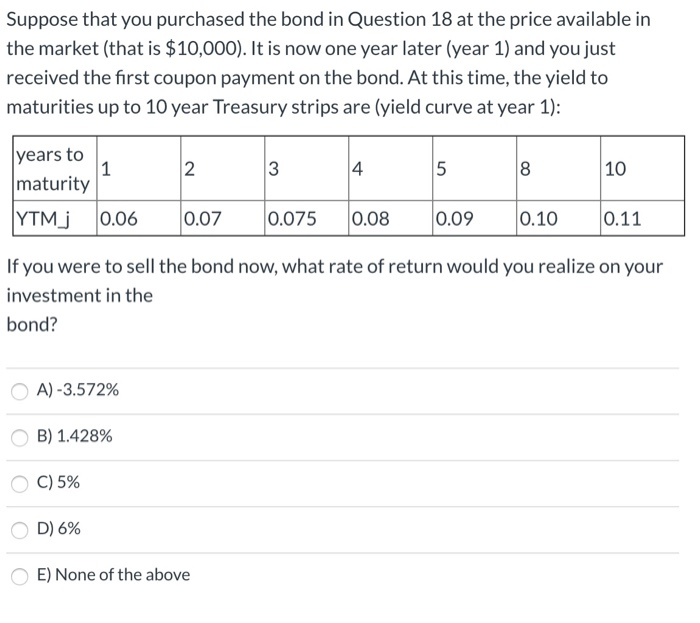

[Term Structure of Interest Rates for Questions 16 to 19] Assume that you work in a investment bank. You are told that 1,2,3,4,5,8, and 10 year treasury strips (zero coupon bonds) are currently traded at the following implied yields to maturity (yield curve in year 0) 3 8 10 years to maturity YTMj 0.05 0.04 0.08 0.075 0.07 0.09 0.06 where YTM j denotes the yield to maturity of the zero coupon bond maturing at time j, with the face values $100. The commercial loan department of your firm has asked for your help in constructing a forward loan for one of their customers. This customer would like to enter into a contract to borrow $100 million from your firm a year from now to be repaid 5 years from now. The customer is willing to pay 8% interest (per year) on the loan. Question 16 5 pts What is the annualized implied forward rate? Should your firm enter into this contract? OA) 6.5%, no OB) 7.0%, yes C) 7.5%, yes D) 8.0%, no E) 9.0%, no Question 17 5 pts If you want to match the cash ow required by the forward loan for the customer, you need to buy of 1 year zero coupon bonds and sell _ of 5 year zero coupon bonds today. A) 100 million, 133.6 million OB) 1 million, 1.336 million OC) 95.24 million, 71.3 million D) 0.9524 million, 0.713 million E) None of the above Question 18 5 pts You are told that a 3 year U.S. Treasury note is to be issued today with an annual coupon of $500 and a face (principal) value of $10,000. If there is one such coupon bond (with the same annual coupon payments and the face value described just above) traded at $10,000 in other markets, how much is the arbitrage profit? OA) $500 B) $10,000 OC) $9273.7 OD) $726.30 E) None of the above Suppose that you purchased the bond in Question 18 at the price available in the market (that is $10,000). It is now one year later (year 1) and you just received the first coupon payment on the bond. At this time, the yield to maturities up to 10 year Treasury strips are (yield curve at year 1): years to maturity YTMJ 0.06 5 0.09 8 0.10 10 0.11 0.07 0.075 0.08 If you were to sell the bond now, what rate of return would you realize on your investment in the bond? A) -3.572% OB) 1.428% OC) 5% OD) 6% E) None of the above