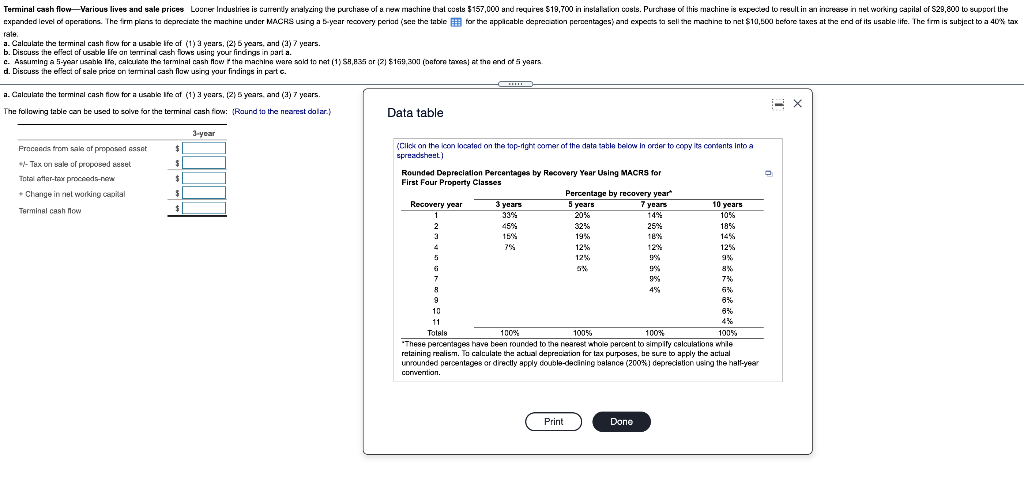

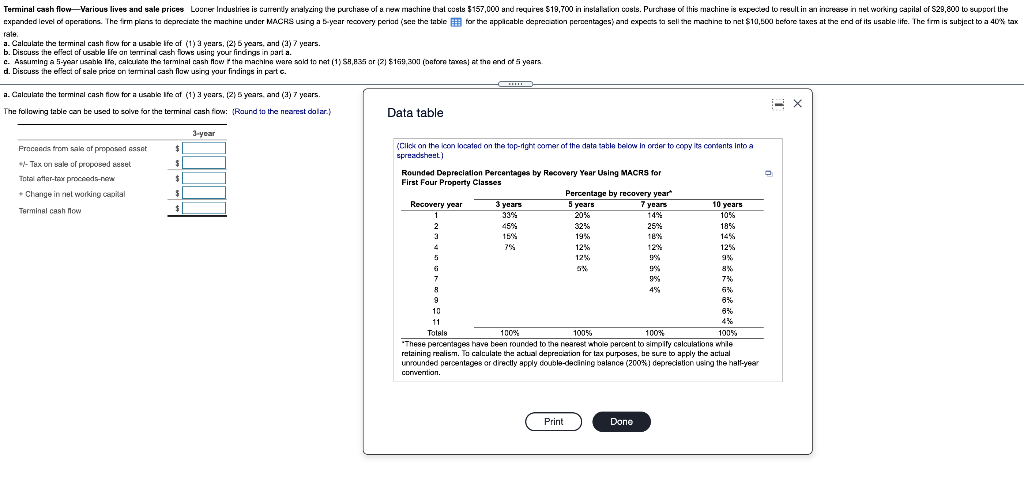

Terminal cash flow-Various lives and sale prices Lourer Industriee is currendy analyzing the purchase of a new machine that costs $157,000 and requires $19,700 in installation costs. Purchase of this machine is expected to result in an increase in networking capital of S28,800 to support the expanded level of operations. The firm plans to depreciate the machine under MACRS using a 5-year recovery period (see the table for the applicable depreciation perontages) and expects to sell the machine to net $10,500 bctore taxes at the end at its usable life. The frm is subject to a 40% tax rale, a. Calculate the terminal cash flow for a usable life of (1) 3 years, 12 years, and (2) 7 years. b. Discuss the effect of usable Ife on terminal cash flows using your firdings in aria. C. Assuming a 5-year usahle Ite, calculate the terminal cash flow the machine were sold to nat (1) $8,835 or 12) $169,300 (betore temes) At the end of years d. Discuss the effect of sale price in terminal cash flow using your findings in part c. 1. Calculate the terminal cash now for a usable ite af (1) 3 years, (2) 5 years, and (a) 7 years. The following table can be used to solve for the terminal cash flow: (Round to the nearest dolar. Data table 3-year $ Fracred from sale at proposed Asset - Tax on sale of proposed wwel Total after-tax proceeds new Change in net working capital Terminal cash flow $ $1 $ 10 years (Click on the con located on the top-right comer of the date table below in order to copy its contents into a spreadsheet) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 1 1 33% 20% 14% 1056 2 45% 32% 25% 1856 3 15% 19% 1B'N 18% 14% 12% 12 1256 5 12%. 9% G 5% 9% 8 7 995 7 8 4% 9 8% 10 8% 11 Totale 100% 100% 1009 100% 'These percentages have been rounded to the nearest whole percent to simply calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply couple declining balance (200%) depreciation using the half-year convention. Print Done