Question

Terri Spiro, an experienced budget analyst at Martin Manufacturing Company, has been charged with assessing the firms financial performance during 2012 and its financial position

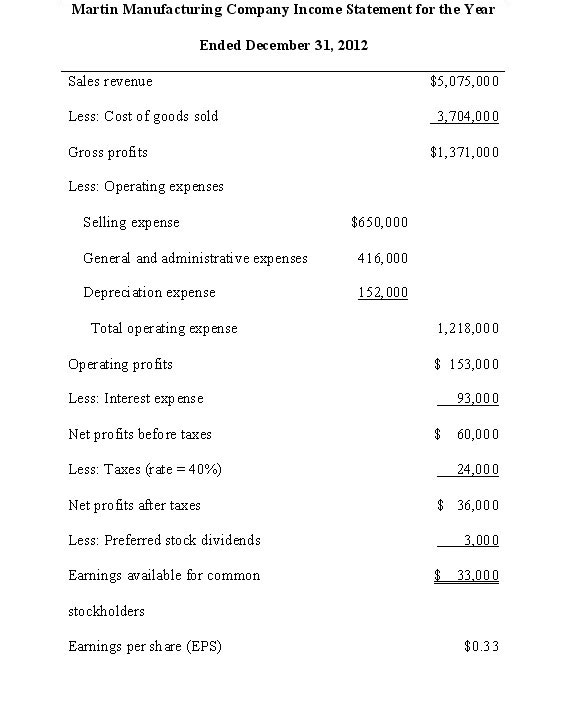

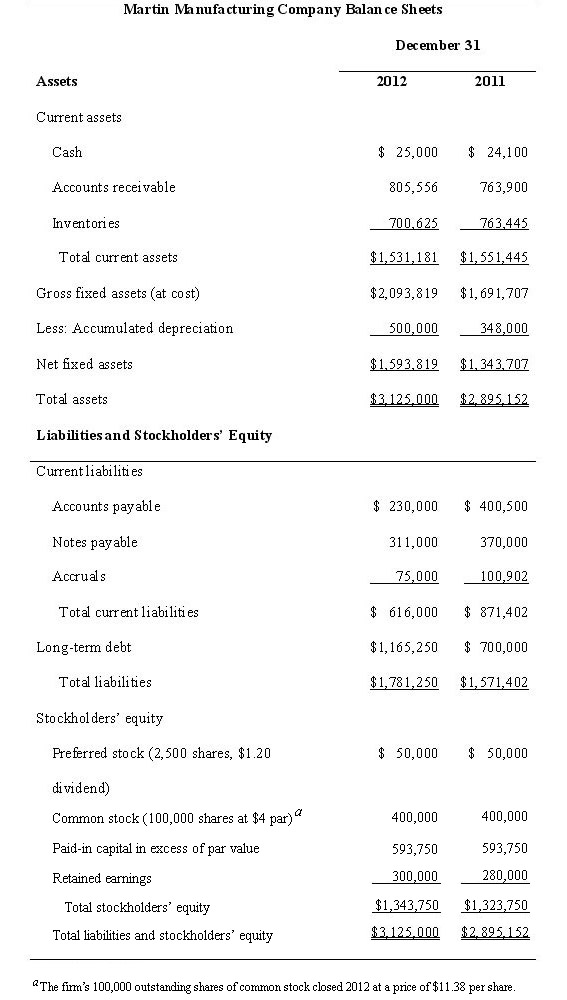

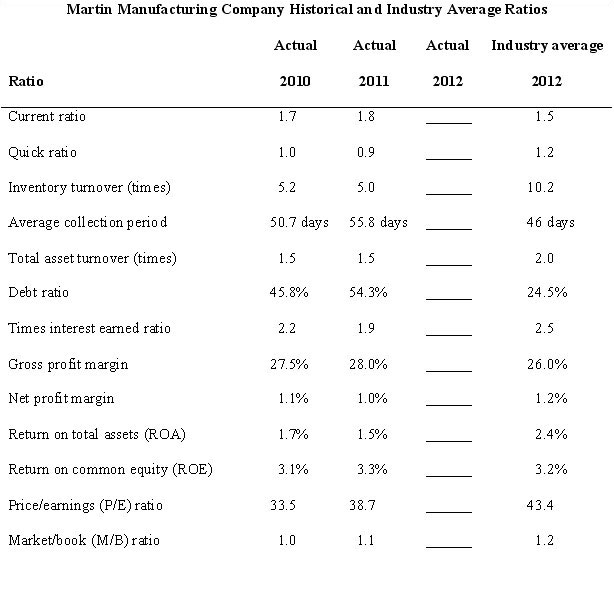

Terri Spiro, an experienced budget analyst at Martin Manufacturing Company, has been charged with assessing the firms financial performance during 2012 and its financial position at year-end 2012. To complete this assignment, she gathered the firms 2012 financial statements (see below). In addition, Terri obtained the firms ratio values for 2010 and 2011, along with the 2012 industry average ratios (also applicable to 2010 and 2011). These are presented in the table on historical and industry average ratios below.

To Do:

1. Calculate the firms 2012 financial ratios, and then fill in the preceding table. (Assume a 365-day year.)

2. Analyze the firms current financial position. Break your analysis into evaluations of the firms liquidity, activity, debt, profitability, and market.

3. Summarize the firms overall financial position on the basis of your findings in part b.

Martin Manufacturing Company Income Statement for the Y ear Ended December 31, 2012 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses $5,075,000 3,704,000 $1,371,000 Selling exp ense General and administrative expenses Depreciation expense $650,000 416,000 152,000 Total operating exp ense Oper ating profits Less: Interest exp ense Net profits before taxes Less: Taxes (rate = 40%) Net profits after taxes Less: Preferred stock dividends Eanings available for commorn stockholders Eamings per sh are (EPS) 1,218,000 153,000 93,000 60,000 24,000 $ 36,000 33.000 $0.33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started