Answered step by step

Verified Expert Solution

Question

1 Approved Answer

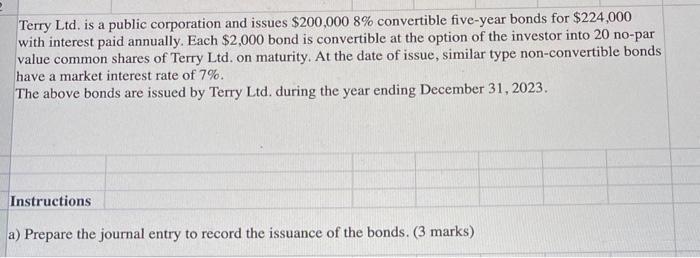

Terry Ltd. is a public corporation and issues $200,000 8% convertible five-year bonds for $224,000 with interest paid annually. Each $2,000 bond is convertible

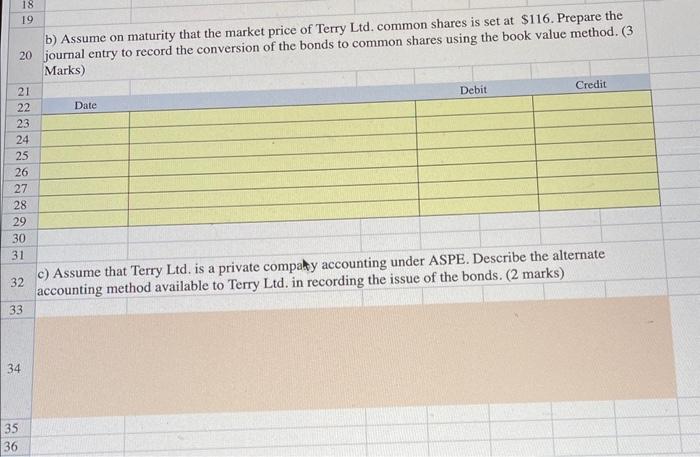

Terry Ltd. is a public corporation and issues $200,000 8% convertible five-year bonds for $224,000 with interest paid annually. Each $2,000 bond is convertible at the option of the investor into 20 no-par value common shares of Terry Ltd. on maturity. At the date of issue, similar type non-convertible bonds have a market interest rate of 7%. The above bonds are issued by Terry Ltd. during the year ending December 31, 2023. Instructions a) Prepare the journal entry to record the issuance of the bonds. (3 marks) 18 19 b) Assume on maturity that the market price of Terry Ltd. common shares is set at $116. Prepare the 20 journal entry to record the conversion of the bonds to common shares using the book value method. (3 Marks) 21 22 23 24 25 26 27 28 29 30 31 33 34 35 36 Date 32 c) Assume that Terry Ltd. is a private company accounting under ASPE. Describe the alternate accounting method available to Terry Ltd. in recording the issue of the bonds. (2 marks) Debit Credit

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Terry Ltd Convertible Bond Transactions a Journal Entry for Bond Issuance December 31 2023 Date Acco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started