Answered step by step

Verified Expert Solution

Question

1 Approved Answer

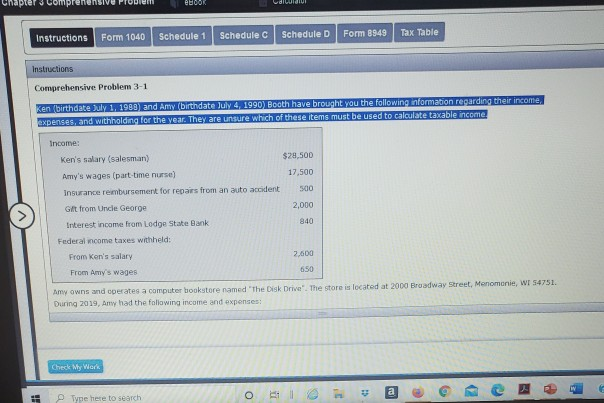

teru compr BOOK ww Instructions Form 1040 Schedule 1 Schedule C Schedule D Form 1949 Tax Table Instructions Comprehensive Problem 3-1 Ken birthdate July 1,

teru compr BOOK ww Instructions Form 1040 Schedule 1 Schedule C Schedule D Form 1949 Tax Table Instructions Comprehensive Problem 3-1 Ken birthdate July 1, 1988 and Amy (birthdate July 4, 1990) Booth have brought you the following information regarding their income expenses, and withholding for the vear. They are unsure which of these items must be used to calculate taxable income Income: Ken's salary (salesman) $29,500 Amy's wages (part-time nurse) 17,500 insurance reimbursement for repairs from an auto accident 500 Git from Uncle George 2,000 Interest income from Lodge State Bank 840 Federal come taxes withheld: 2.600 From Ken's salary From Amy's wages 650 Amy owns and operates a computer bookstore named "The Disk Drive. The store is located at 2000 Broadway Street, Menomonie, WI 54751. During 2019, Any had the following income and expenses: Check My Work o a . e 31 Type here to search teru compr BOOK ww Instructions Form 1040 Schedule 1 Schedule C Schedule D Form 1949 Tax Table Instructions Comprehensive Problem 3-1 Ken birthdate July 1, 1988 and Amy (birthdate July 4, 1990) Booth have brought you the following information regarding their income expenses, and withholding for the vear. They are unsure which of these items must be used to calculate taxable income Income: Ken's salary (salesman) $29,500 Amy's wages (part-time nurse) 17,500 insurance reimbursement for repairs from an auto accident 500 Git from Uncle George 2,000 Interest income from Lodge State Bank 840 Federal come taxes withheld: 2.600 From Ken's salary From Amy's wages 650 Amy owns and operates a computer bookstore named "The Disk Drive. The store is located at 2000 Broadway Street, Menomonie, WI 54751. During 2019, Any had the following income and expenses: Check My Work o a . e 31 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started